BlackRock CEO Larry Fink has labeled Bitcoin ($BTC) as a distinct asset class. Backing this belief, the asset management giant has launched an international campaign aimed at institutional partners to drive mainstream adoption of the cryptocurrency.

Bitcoin’s price continues its upward trajectory, surpassing the $65,000 mark on Monday.

BlackRock CEO Champions Bitcoin Adoption Campaign

Larry Fink made the remarks during the firm’s third quarter earnings report, indicating that BlackRock is engaging institutions globally about digital assets. Specifically, the discussion centers on asset allocation for Bitcoin, looking at it as an alternative to commodities such as gold.

Further, in the earnings report, Larry Fink noted that Bitcoin’s expansion is not a function of regulation or who becomes the next president of the US. Rather, liquidity and transparency are the drivers, with the former Bitcoin skeptic calling for enhanced analytics and more investor acceptance.

With these, Fink implied that Bitcoin and crypto, in general, are similar to other new financial products, which, despite stalling, ultimately reach scale.

Read More: What Is a Bitcoin ETF?

Larry Fink’s perspective on Bitcoin marks a notable transformation, considering he was an outspoken Bitcoin skeptic. Like JPMorgan CEO Jamie Dimon, the BlackRock exec has a history of dismissing $BTC as a speculative and potentially dangerous asset.

Nevertheless, Fink’s assertions may represent a general sentiment among BlackRock managers. The firm’s head of digital assets, Robbie Mitchnick, recently said that Bitcoin is a safe haven and fundamentally a risk-off asset.

Mitchnick expressed that Bitcoin is not tied to any single country’s economic health or policies, adding that its scarcity makes it immune to the usual risks of currency debasement and political turmoil.

Earlier this month, another BlackRock executive, Jay Jacobs, said there is plenty of room for Bitcoin adoption. The US Head of Thematic and Active ETFs (exchange-traded funds) estimated that Bitcoin will grow to a market of $30 trillion in the coming years.

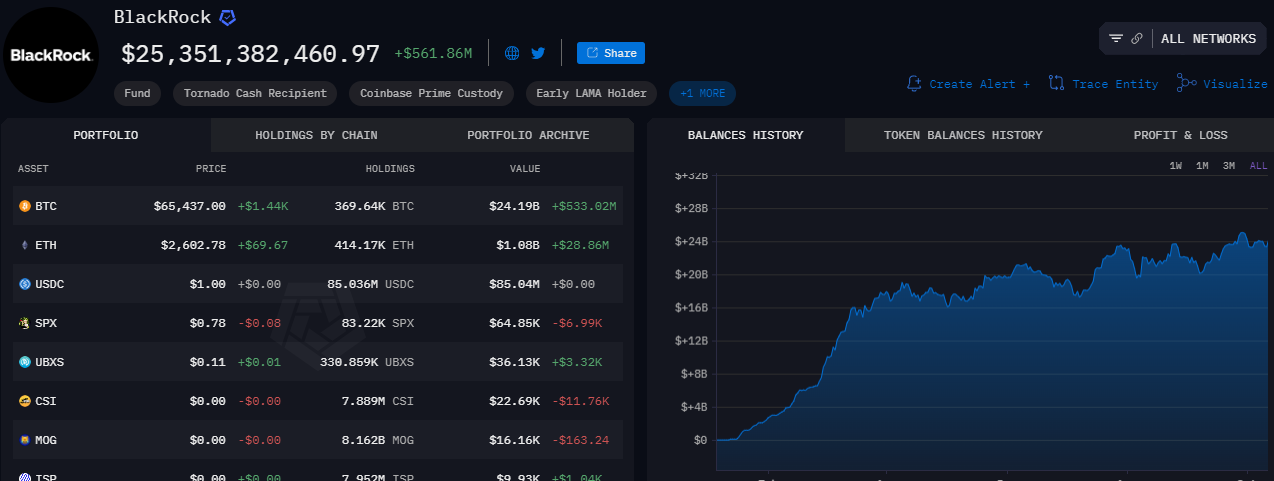

BlackRock’s Bitcoin ETF Soars to $23 Billion

During the earnings call, BlackRock CEO Larry Fink revealed that the firm’s IBIT ETF has surged to a $23 billion market in just nine months. Launched on January 11, the ETF provides institutional investors with indirect access to Bitcoin. This period has been marked by significant successes, with the fund attracting billions in investments and breaking trading volume records.

“…and we will continue to pioneer new products to make investing easier and more affordable,” Fink added.

BlackRock’s IBIT is a market leader in the Bitcoin ETF space in the US. It manages nearly 370,000 $BTC, emerging as one of the largest Bitcoin holders. IBIT has already surpassed MicroStrategy’s Bitcoin holdings and now only lags behind Satoshi Nakamoto and Binance. Data on Arkham shows BlackRock’s Bitcoin stash is worth $25.35 billion.

Read more: Who Owns the Most Bitcoin in 2024?

As BlackRock and other crypto ETF issuers continue offering institutional access to Bitcoin, concerns about custodial risks have emerged. Critics also fear that increased institutional adoption could undermine the core principles of Bitcoin.

The cryptocurrency was designed to decentralize financial power, but with institutional control growing, some worry it could shift influence back to the very entities Bitcoin was intended to bypass.

beincrypto.com

beincrypto.com