On Wednesday, seasoned trader Peter Brandt shared his long-term perspective on bitcoin, predicting it could reach $135,000 by August or September 2025. This forecast comes with a key caveat: for the projection to hold, bitcoin must stay above a crucial support level of $48,000. Should it drop below this mark, Brandt suggests his current chart analysis would no longer be valid.

Bitcoin Could Climb to $135K by 2025, Says Peter Brandt

Veteran trader Peter Brandt has built a solid reputation in the crypto world for his insightful bitcoin charts and technical analysis. Back in mid-July, Brandt was feeling optimistic about BTC, noting that bears seemed to be stuck in a tough spot. Jump to Oct. 2, and Brandt offered another analysis, describing bitcoin’s price movement as the “Three Blind Mice and a Piece of Cheese” pattern. This lighthearted name refers to a continuation pattern in technical analysis.

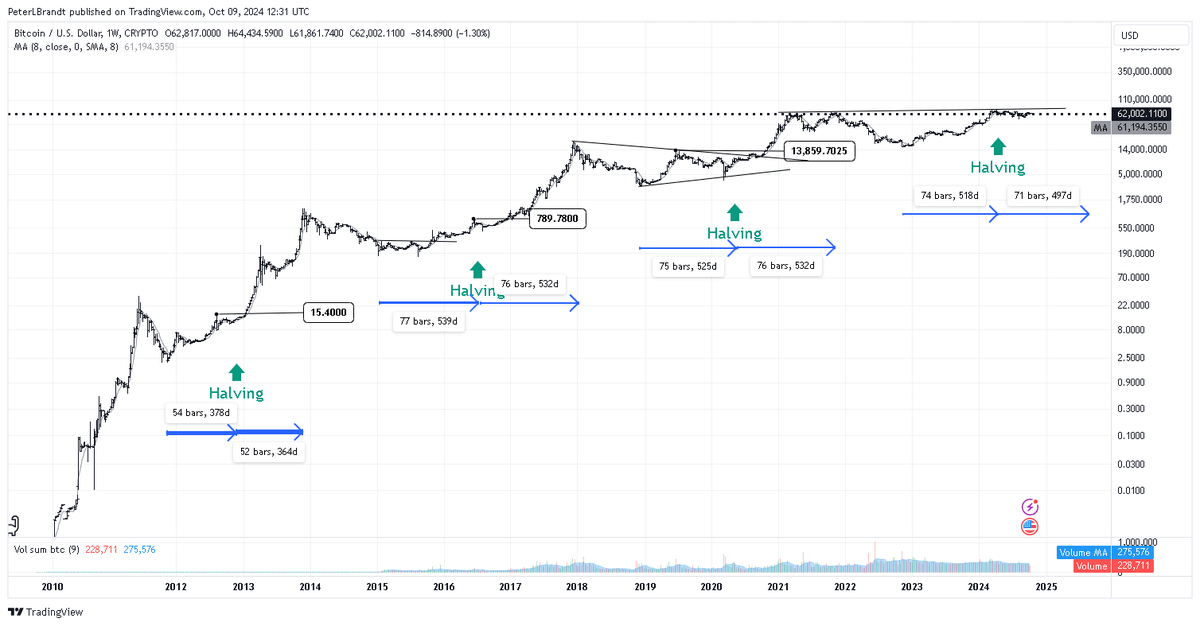

The pattern points to the likelihood that bitcoin’s price will keep moving in line with the current trend, which, at the time, had been heading downward. Just a week later, on Oct. 9, Brandt shared his broader outlook on BTC’s future. “Observations,” Brandt said. “Huge gains come in post-half of halving cycles. Period since [March] 2024 appears as insignificant, brief pause in ongoing trend. My target is $135,000 in Aug/Sep 2025. [A] close below $48K negates my chart analysis.”

Brandt’s macro outlook presents a fairly positive view, drawn from his analysis of bitcoin’s historical halving cycles. He points out that the biggest gains for bitcoin usually unfold in the latter half of these cycles, typically about a year after the halving event. With the most recent halving occurring in April 2024, Brandt seems to believe the real price increases will likely happen after this point, driven by supply limitations and growing demand.

As for the market’s behavior after March 2024, Brandt views any periods of price consolidation or minor dips as short-lived and largely irrelevant in the grander scheme of bitcoin’s bullish trajectory. He remains confident in his long-term target of $135,000 by August or September 2025, so long as bitcoin stays above the key support level of $48,000. A drop below this threshold, in his opinion, would, in fact, invalidate his current analysis.

As Brandt’s latest projection sets the stage for bitcoin’s potential ascent to $135,000, investors are reminded of the importance of the $48,000 support level. Brandt’s emphasis on post-halving cycles offers a strategic lens through which to view bitcoin’s future trajectory, suggesting that significant gains may be on the horizon if current support levels hold. As always, the path forward hinges on market stability and investor confidence.

What do you think about Brandt’s macro outlook? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com