Bitcoin and equities have closed out the third quarter of 2024 with strong performances, defying forecasts and avoiding the typical September downturns. The S&P 500 has climbed 5.1% for the quarter, its best performance since 1997.

Bitcoin has surged over 7% this month, one of its strongest September performances ever. This signals solid sentiment, even as concerns linger in the broader market.

Goldman Sachs reports that hedge funds are actively placing three times more bets on increasing IT stocks than short positions.

Crypto Market Outlook: Can Bitcoin Sustain Momentum?

Market analysts expect the equity rally to face challenges as Q3 earnings reports begin in mid-October. High values in both equities and Bitcoin may be tested.

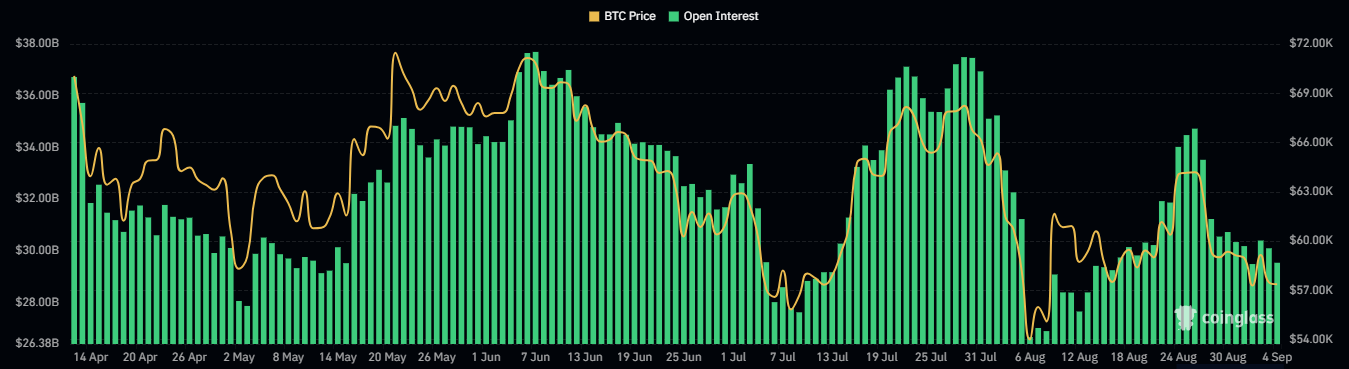

However, Bitcoin could benefit from any dip in equities due to its nature as a risk-on asset, particularly in the overall financial easing. Additionally, in the medium term, many market observers remain optimistic. A breakout above $70,000 could create further bullish momentum, positioning Bitcoin for additional gains in the months ahead.

Current Market Conditions and Technical Analysis

As of press time, Bitcoin was trading at $63,826.43, recording a decline of 2.91% in the last 24 hours, moreover, it reflected a slight pullback after a recent uptrend that peaked around $67,500.

From a technical analysis, the MACD indicator shows a bearish crossover, with the signal line falling below the orange line, suggesting a weakening in bullish momentum. The MACD histogram is also declining, indicating a bearish sentiment.

Moreover, the RSI stands at 62.26, showing a bullish condition but signaling a potential overbought scenario.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com