The “September Effect” is, so far, in full force against Bitcoin ($BTC) and other cryptocurrencies, mirroring historical patterns, as Finbold reported. Yet, technical analyses indicate that this is just part of an expected shake-out before $BTC can seek higher prices.

One of these analysts is Cryptorphic, according to a recent “$BTC/USD roadmap to $93,000” he published on TradingView. At first, he urged traders and investors to “stay strong” because “things are going to improve soon.”

“Hello everyone, first off, stay strong—things are going to improve soon! Many people are confused right now and might get liquidated, eventually leaving the market and regretting it later. But not you! You have access to this information.”

– Cryptorphic

The trader shared a technical analysis of higher time frame indicators, highlighting what it would take to reach $93,000. Moreover, he mentioned key support and resistance levels to watch in the following weeks.

Bitcoin roadmap to $93,000

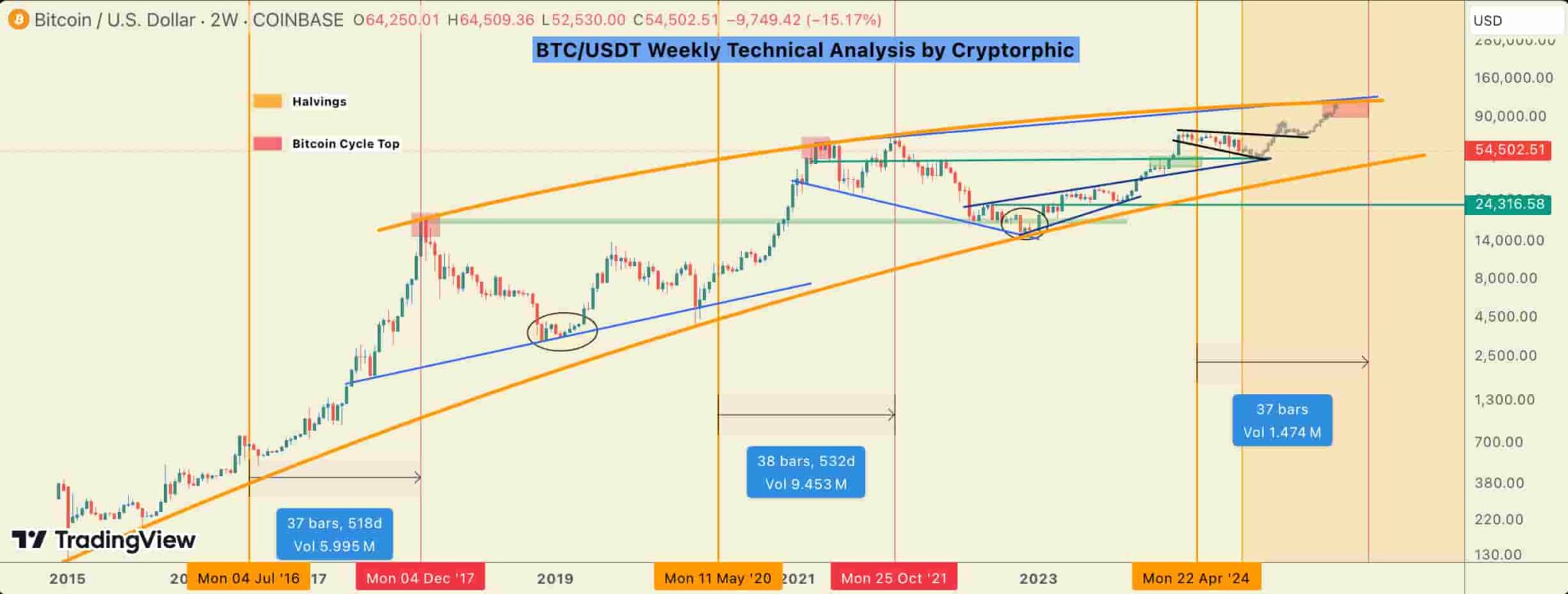

Notably, the analysis looks at the two-week $BTC/USD chart on Coinbase, tracing two high time frame (HTF) trend lines. The HTF support dates from 2015, while the resistance starts in December 2017, each making higher lows and higher highs.

Their confluence traces the overall roadmap to $93,000 per Bitcoin and beyond.

Besides that, Cryptorphic marked intermediary support levels in lower time frames, which he thinks will play an important role before Bitcoin can get back into a bull market amid the current bearish sentiment.

Bitcoin key support levels to watch before $93,000

In particular, the analyst mentioned two “high-confluence zones” that “could signal a strong bounce and an upward move” if kept.

First, an important psychological range between $50,521 and $50,901, close to the round number of $50,000. Second, between $46,216 and $46,930, although Cryptorphic believes it is less likely, considering the first level’s strength.

The trader is optimistic that, after testing these supports, Bitcoin could quickly bounce to its all-time high between $70,000 and $72,000 and even higher – between $89,000 and up to $93,000.

However, he recognizes there is relevant support between $52,550 and $53,400, which could prevent $BTC from going below. As of this writing, Bitcoin trades at around $54,500, and three other analysts believe the worst has already gone.

What other analysts have to say on $BTC/USD

Namely, CrypNuevo, The ForexX Mindset, and Credible Crypto, as Finbold has been reporting throughout the week.

CrypNuevo shared his trading plan for the week last Sunday, which played out as expected. As forecasted, Bitcoin would drop between $51,500 and $56,600 after a “liquidity run” up to $61,300.

The ForexX Mindset warned of a bear trap that could go as low as $51,188. This would be a necessary step before following a bull diamond chart pattern, leading the price above the all-time high.

Meanwhile, Credible Crypto celebrated Bitcoin reaching his “downside target” below $54,500, saying the “full bull gear” can now start.

Well, my downside target on $BTC has been hit, and the original idea shared below looks to have played out, despite us not getting any relief in between (like I was most recently expecting).

— CrediBULL Crypto (@CredibleCrypto) September 6, 2024

By skipping the "relief rally" in between and just heading straight down, we may have… https://t.co/ObW2GkgRPn

As things develop, Bitcoin traders and investors closely watch $BTC’s price action and seek insights from other analysts. If everything goes as most experts forecast, the leading cryptocurrency could soon reach and break its all-time high – heading directly to $93,000 and beyond.

Nevertheless, given the volatility, these professionals also warn of the need for caution and to avoid overexposure in high-leverage positions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com