- BitMEX CEO Hayes predicts Bitcoin could fall below $50,000 which reflects growing market pessimism.

- The Crypto Fear and Greed Index at 22 indicates extreme fear among traders and investors.

- Technical analysis shows Bitcoin below key levels, with potential for further decline to $53,693.

The CEO of BitMEX, Arthur Hayes, has made a negative forecast for Bitcoin by predicting its decline below $50,000. With the cryptocurrency still maintaining high levels of volatility, the market is gradually shifting to fear as participants remain cautious.

$BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I am a degen.

— Arthur Hayes (@CryptoHayes) September 6, 2024

Bitcoin is now trading at $53,770.87 with a decrease of 4.5% indicating that the bears are confident in their position.

Market Sentiment Shows Extreme Fear

The Crypto Fear and Greed Index now stands at 22, which means that traders and investors are extremely fearful. This index can be used to measure market sentiment and low value signal apprehension about further decline in price. This fear could further result in additional selling pressure for Bitcoin due to its inability to rise past key levels of resistance, hence strengthening the bearish prediction for the cryptocurrency.

Hayes shorted Bitcoin saying that the digital asset could still experience further sell-off. Other market experts like Altcoin Sherpa also give a bearish view and are expecting the $BTC to reach $45000 in the future from now.

Key Support and Technical Indicators

The market cap is continuing to lower, new support and resistance levels are being established as traders react to the current market conditions. The 24-hour trading volume is currently sitting at $50.1billion,with market cap lows of $1.2 billion, which suggests that market bears are pushing prices down to the $52,690.15 support level.

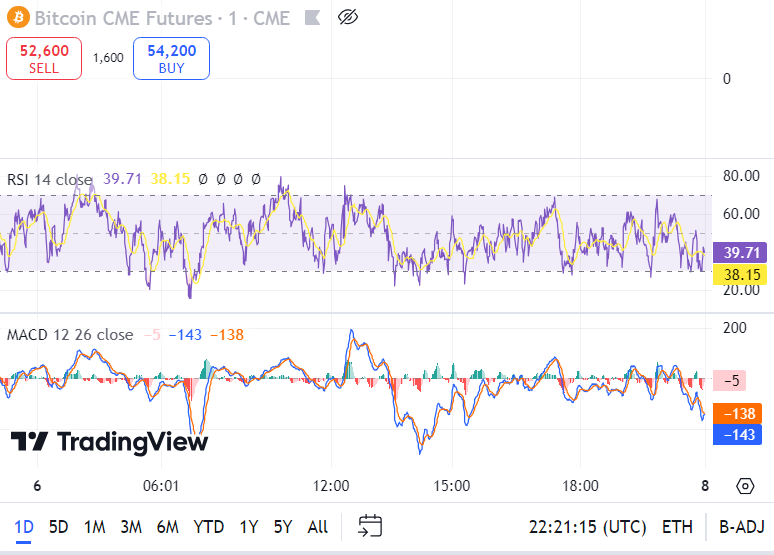

Source:Trading View

The volatility for the $BTC/USD pair has been decreasing, indicating that the market is becoming less stable. The technical indicators are showing a bear sentiment as the daily Relative Strength Index (RSI) stands at 38 which is an oversold condition.

However, the Moving Average Convergence Divergence (MACD) remains below the signal line, supporting continued bearish momentum for now.As traders assess the situation, the coming days will likely provide further clarity on Bitcoin’s trajectory.