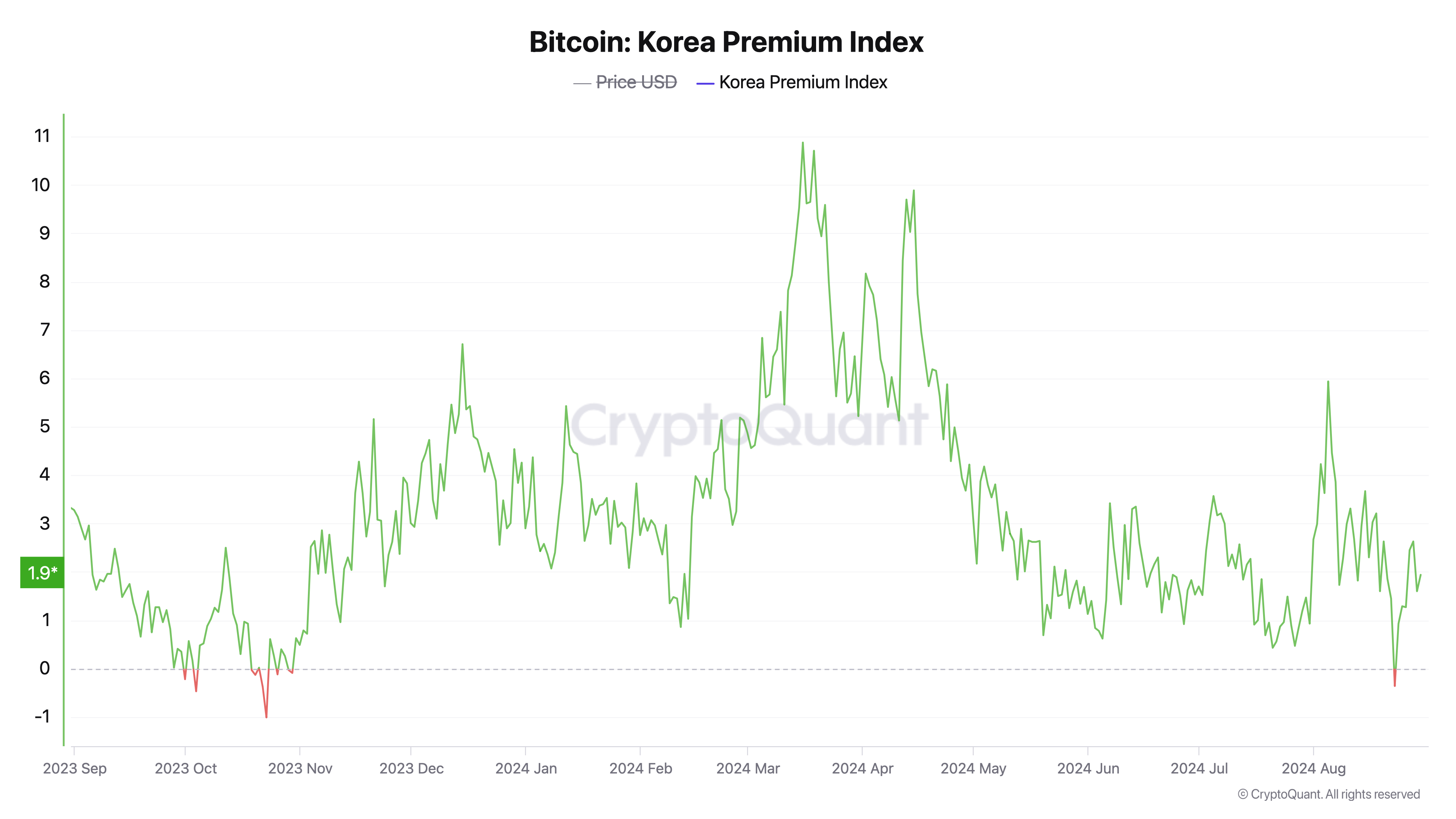

Despite recent turbulence in the crypto market, bitcoin’s price continues to carry a premium in South Korea. As of 4 p.m. EDT, bitcoin is trading at $59,002 per unit, but in South Korea, the exchange rate hits $59,900, reflecting a 1.52% premium.

Despite First Negative Dip Since Oct. 2023, South Korea’s Bitcoin Premium Continues

Interestingly, bitcoin (BTC) has consistently traded at a premium in South Korea since Oct. 30, 2023, dipping into the negative just once on Aug. 22, 2024. According to cryptoquant.com, BTC was priced at around $60,500 per coin on that day, and within two days, it climbed to $64,000. Although the price momentarily fell 0.36% below the global average in South Korea on Aug. 22, the dip was fleeting.

By Aug. 23, the premium had bounced back to nearly 1%, reaching 0.93% above BTC’s global average. The premium climbed to 2.63% on Aug. 27 and settled at 1.94% by Aug. 29. As August comes to a close, bitcoin is trading at a 1.52% premium on the South Korean crypto exchange Upbit, with prices approximately $898 higher. Ethereum (ETH) is also trading at a premium on Upbit, albeit a smaller one at 0.95%, according to the latest price data.

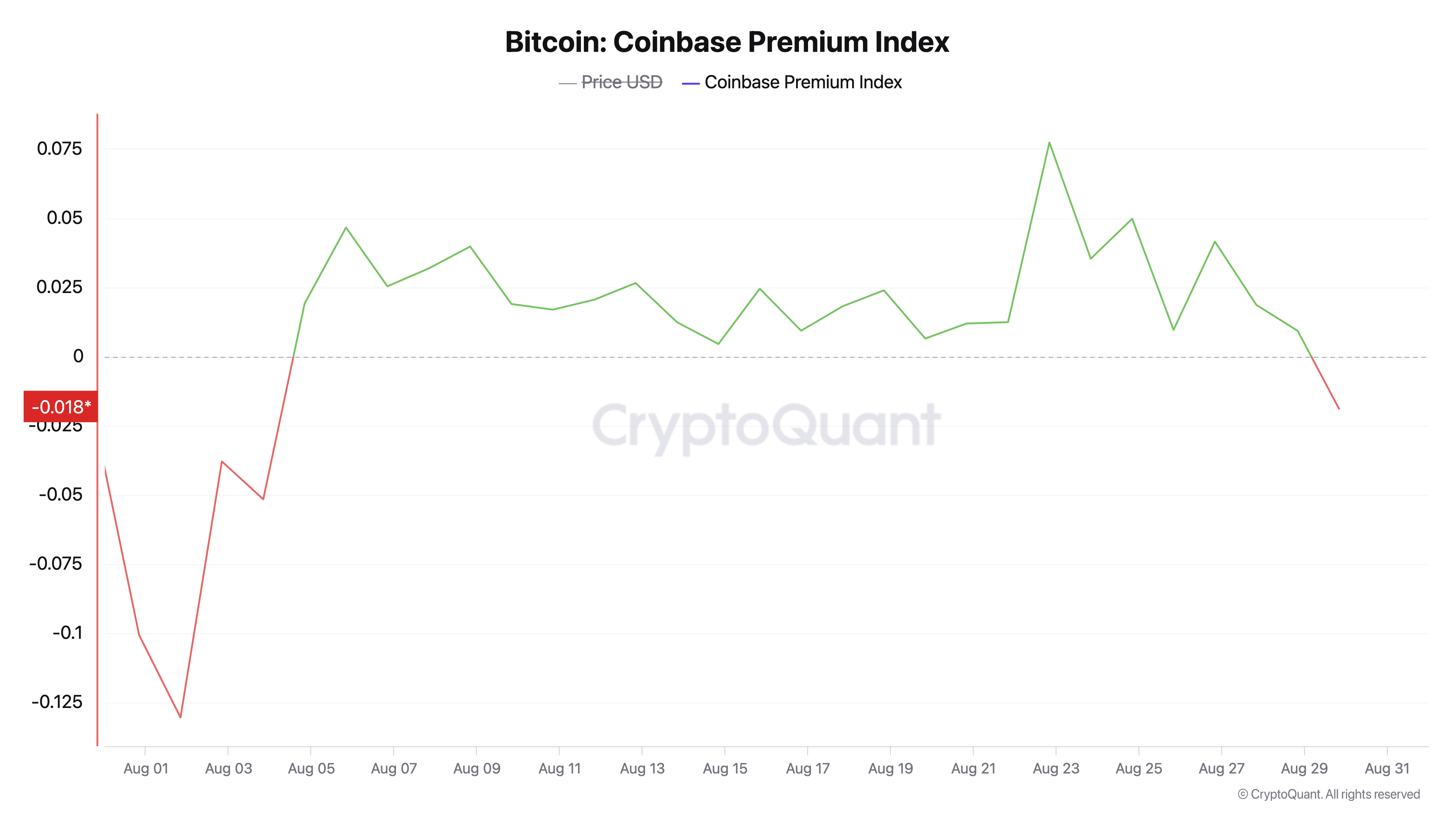

While stablecoins USDT and FDUSD are BTC’s top trading pairs, the South Korean won ranks as the second most traded fiat currency, just behind the U.S. dollar. Throughout 2024, the won has been a significant player in trade volume, second only to the greenback. Interestingly, Coinbase saw a consistent premium from Aug. 4 to Aug. 28, though it remained far below South Korea’s, peaking at just 0.07% on Aug. 22.

However, by Aug. 29, Coinbase BTC prices had slipped back into the negative after 24 days of a slight premium, according to cryptoquant.com metrics. The ongoing bitcoin premium in South Korea, contrasted with the modest premium on Coinbase, highlights a stronger and more persistent demand in the South Korean market. Nevertheless, a Coinbase Premium often reflects increased demand for bitcoin, which can drive up its price.

news.bitcoin.com

news.bitcoin.com