Demand for Bitcoin ($BTC) price to form a new all-time high has been keeping investors’ hopes alive.

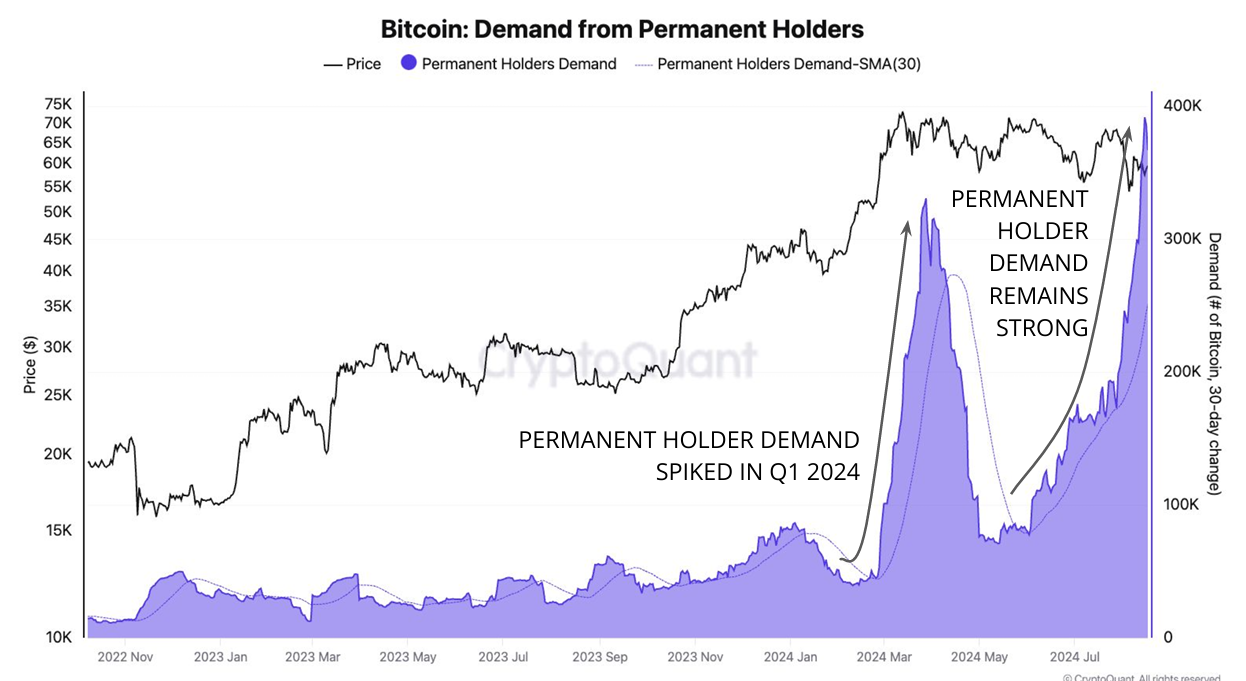

However, the actual demand for $BTC is showing a massive decline. However, there is one cohort of investors that could prevent a drawdown in price.

Bitcoin Demand Dwindles

Since the beginning of August, Bitcoin’s price has struggled to rise above $60,000. This is delaying the recovery of investors’ losses from the July crash.

While the crypto asset’s movement defines the structure of a broadening ascending wedge, the breakout from this pattern takes a lot of time. The reason behind this is the decline in demand for $BTC among investors.

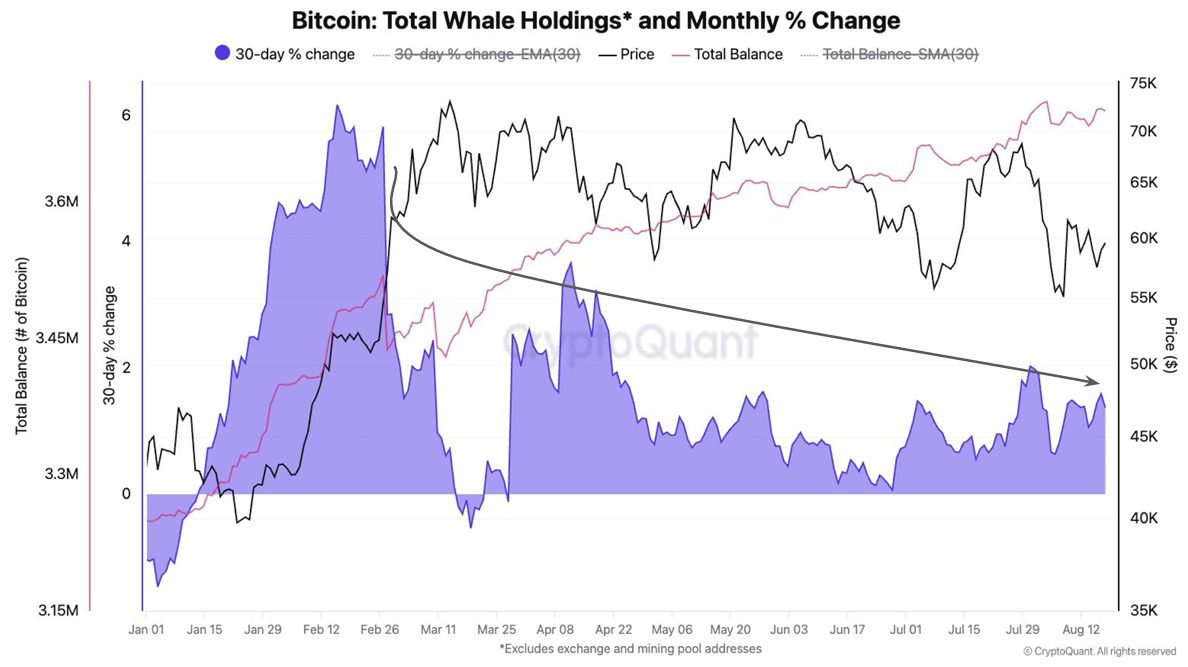

An exclusive report from CryptoQuant shared with BeInCrypto shows that large $BTC holders’ holdings have declined considerably. As noted in the report, the 30-day percentage change in whale holdings has decreased from 6% in February to just 1% currently.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, if Bitcoin’s price does manage to breach $65,000, it could break out above $71,500. This would enable a rise for $BTC, potentially rallying past the all-time high of $73,800, invalidating the bearish-neutral thesis.

beincrypto.com

beincrypto.com