- Mt. Gox has been creditors $BTC to its previous users at a steady pace.

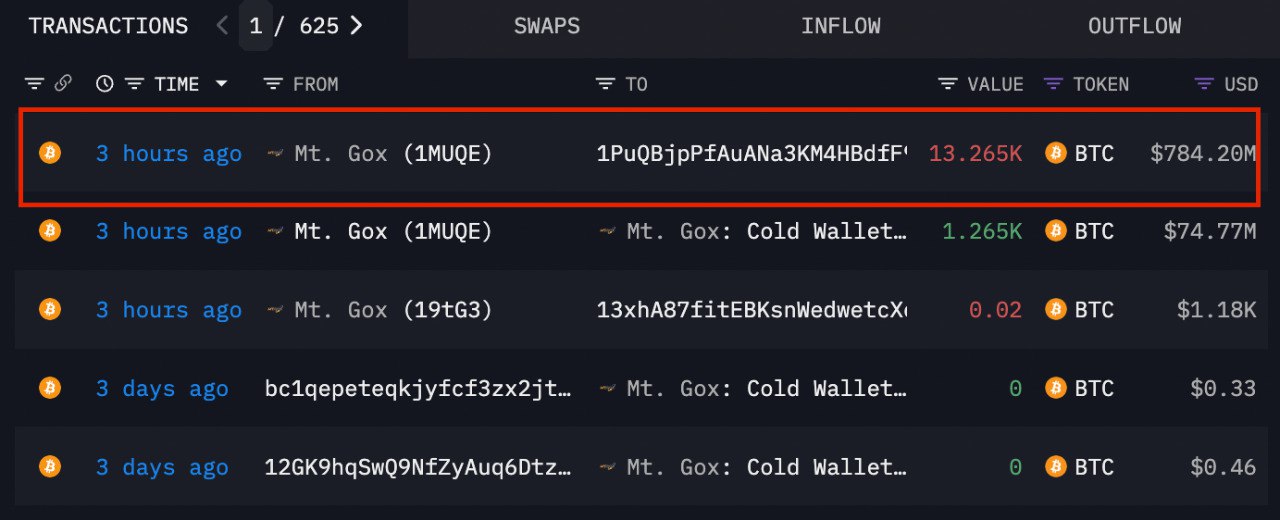

- The entity just moved 13,265 $BTC worth $783 million after about 3 weeks of no activity.

- Will this phase of credits spark a bull run or trigger another crypto market dip?

After a few days of quiet, Mt. Gox is on the move again. The entity has just shifted 13,265 $BTC worth $784 million. This is the entity’s first major move in 3 weeks. Previously, when Mt. Gox moved its $BTC there was no significant change in $BTC price as many Mt. Gox creditors chose to hold their returned $BTC.

Mt. Gox’s First Move in Weeks

According to Arkham Intelligence, Mt. Gox still has 46,164 $BTC in its possession and may just have to return all this Bitcoin ($BTC) worth around $2.74 billion at current prices to its many creditors who waited years for their $BTC to come back to them.

As any seasoned crypto community member knows, Mt. Gox suspended all trading in February 2014. Soon after this move, the website went fully offline and showcased a black page. The company became insolvent and lost 744,408 $BTC in a theft that want undetected for years.

Since then $BTC victims from the entity have waited a decade to see their Bitcoin holdings returned to them, Unfortunately, Mt. Gox cannot return their creditors the same amount as they lost but has promised to return a smaller amount.

Mt. Gox Continues to Return $BTC at a Steady Pace

Earlier this year, Mt. Gox started crediting a small but significant share to its previous users. During the first set of $BTC credit returns, the German government began to sell its large $BTC holdings. This selloff combined with Mt. Gox returns led to a huge crypto market dip with the price of $BTC crashing to significant monthly lows.

Soon after $BTC price recovered, Mt. Gox returned another set of $BTC to its creditors. This time there was no major impact on $BTC price meaning the cause of the previous dip was in large part due to the German government’s $BTC selloff.

Perhaps this set of $BTC returns and all the remaining $BTC returns from Mt. Gox will not trigger a greater $BTC selloff phase and will instead encourage the creditors to hold out to maximize their gains in the coming bull run phase of the ongoing bull cycle.