Bitcoin could be poised for a significant breakout in September, with some analysts predicting a price surge to $86,000 based on historical patterns and macroeconomic trends.

According to popular analyst Rekt Capital, Bitcoin may enter the "Parabolic Phase" of its cycle around late September, approximately 160 days after the last halving. He noted in an Aug. 18 post to his 493,000 followers on X:

"Bitcoin tends to breakout into the Parabolic Phase of the cycle some ~160 days after the Halving. If history repeats, Bitcoin could be just over a month away from breakout."

#$BTC

— Rekt Capital (@rektcapital) August 18, 2024

Bitcoin is ~125 days after the Halving

Bitcoin tends to breakout into the Parabolic Phase of the cycle some ~160 days after the Halving

If history repeats, Bitcoin could be just over a month away from breakout

That's late September$BTC #Crypto #Bitcoin pic.twitter.com/iy7xmDjuso

The macroeconomic outlook also supports a potential breakout, with Jamie Coutts, chief crypto analyst at Real Vision, pointing to the growing global M2 money supply as a key factor. In an Aug. 13 X post, Coutts explained that Bitcoin has historically surged after global M2 bottoms out, followed by a mid-cycle correction. He described the current environment, bolstered by Bitcoin exchange-traded funds (ETFs) and increasing liquidity, as the "perfect setup" for Bitcoin.

Over the past decade, #Bitcoin has had a tendency to trough several months before the bottom in global M2. Then it rips, gets way ahead of the move in liquidity, and has a mid-cycle correction.

— Jamie Coutts CMT (@Jamie1Coutts) August 13, 2024

Now, momentum in global liquidity is starting to accelerate higher while all the… pic.twitter.com/0A9hV9m25h

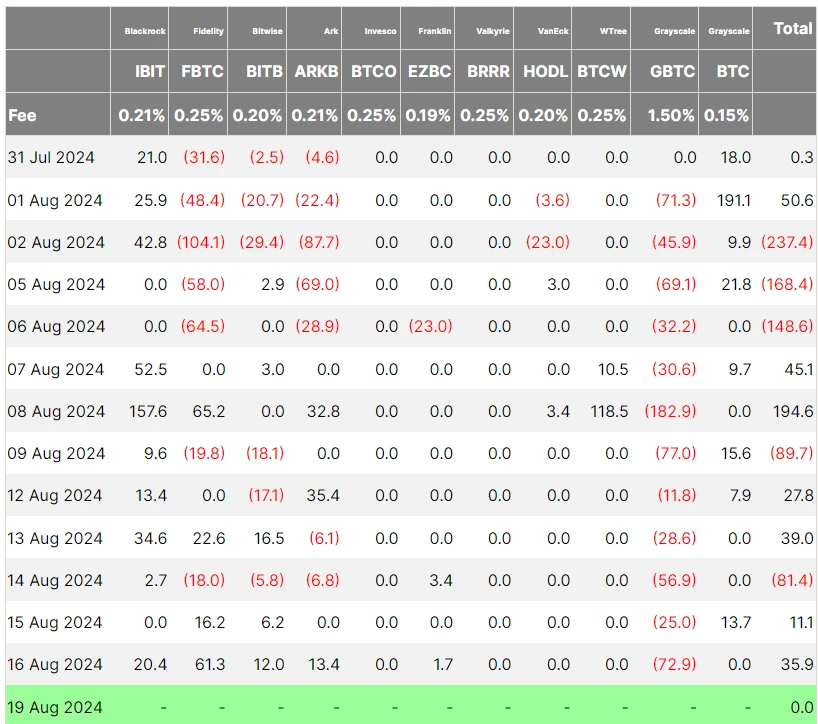

Additional positive momentum comes from Bitcoin ETF inflows, which turned positive last week with net flows of $35.9 million on Aug. 16, according to Farside Investors data. Institutional adoption of Bitcoin ETFs also saw a notable increase last quarter, with a 27% growth and 262 new firms investing.

Crypto analyst Titan of Crypto suggests that Bitcoin's next major price target could be $86,000 if it breaks out in September. He highlighted the "megaphone" chart pattern, which indicates high market volatility and could signal either a macro top or bottom.

"Bitcoin Intermediate Target: $86,000. Would you bet on this Megaphone Pattern playing out?"

Titan of Crypto wrote in an Aug. 18 post.

#Bitcoin Intermediate Target: $86,000 🎯

— Titan of Crypto (@Washigorira) August 18, 2024

Would you bet on this Megaphone Pattern 📢 playing out? pic.twitter.com/5ozrcmbjBM

However, Rekt Capital cautioned that Bitcoin needs to close above its current downtrend to confirm a bullish reversal. He added,

"The reality is that Bitcoin is going to keep downtrending until it breaks."

#$BTC

— Rekt Capital (@rektcapital) August 19, 2024

Bitcoin has failed to Daily Close above the blue Downtrend, instead upside wicking into it and rejecting from there

The reality is that Bitcoin is going to keep downtrending until it breaks

But Bitcoin is only one Daily Close above the Downtrend from turning it all… https://t.co/K53XkNCs7K pic.twitter.com/gSdexSwGI2

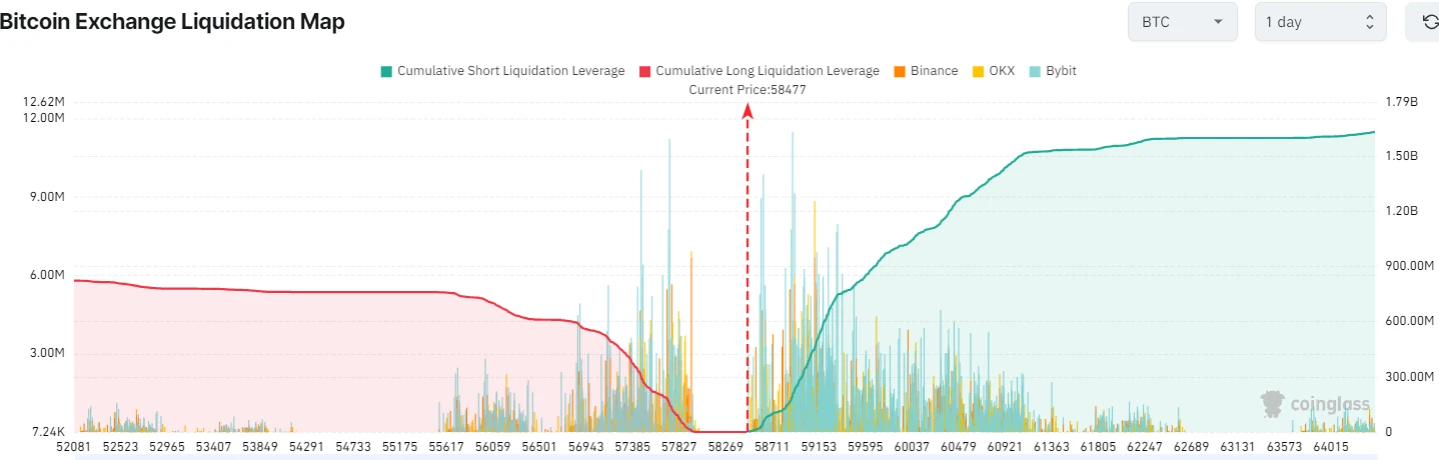

Before the potential breakout, Bitcoin may retest support levels around $54,000 and $50,000, while facing significant resistance at $59,500. A break above this level could trigger the liquidation of over $800 million in leveraged short positions, with the potential to surpass $1 billion if Bitcoin climbs above $59,900.