New "BitVM2" paper from Robin Linus and a team of co-authors marks a leap forward from the initial design.

Project would rely on advanced cryptography and a novel design to facilitate a secure "bridge" for transferring bitcoins from the main network to auxiliary networks known as "rollups."

Unlike the earlier incarnation, BitVM2 is "permissionless," allowing anyone to challenge suspicious transactions, not just a fixed set of operators.

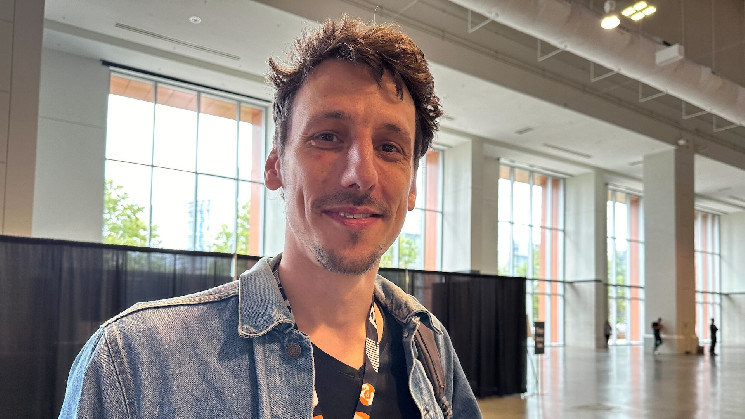

Robin Linus, the Bitcoin developer who shook up the crypto tech landscape last year with a theoretical method of making the oldest and original blockchain more programmable, is out with a second iteration called "BitVM2" – boasting dramatic improvements that could bring the concept closer to real-world implementation.

The basic setup involves using cryptography to compress programs into sub-programs that can then be executed within Bitcoin transactions, according to a white paper published Thursday by Linus along with five co-authors.

The programs are then "verified" – basically making sure nobody is trying to cheat or steal – in three on-chain transactions. In the previous version, the verification could take upwards of 70 transactions, according to one of the co-founders, Alexei Zamyatin, who separately works for a project called BOB, short for Build on Bitcoin.

A key improvement of the new version is that anyone can call into question a suspicious transaction, in a feature known as "permissionless challenging." In the original BitVM, which was published last October but never really put into any practical implementation, only a fixed set of operators could initiate challenges.

"This design gives us these major improvements," Zamyatin said in a video interview with CoinDesk. "We now have a full and comprehensive writeup of the BitVM paradigm."

Linus is a core contributor at ZeroSync Association, a Swiss non-profit organization based in the canton of Zug. The other co-authors besides Zamyatin included Lukas Aumayr, Andrea Pelosi, Zeta Avarikioti and Matteo Maffei.

Linus's project has been hailed as a breakthrough partly because it doesn't require any changes to the underlying Bitcoin code. That's crucial since Bitcoin is, more so than most subsequent blockchain projects, fully decentralized in its governance; there isn't really a guiding foundation or governing body or lead developer as there is with, say, Ethereum or Solana.

Even seemingly modest proposals like the much-discussed OP_CAT have faced difficulty getting adopted by the maintainers of the Bitcoin code, since nearly total consensus has evolved to be the de facto standard for suggested updates.

The initial application of BitVM2 would be to enable a "rollup" – essentially a separate auxiliary network atop Bitcoin that could handle faster and cheaper transactions, but with similar security guarantees.

Just the publication of Linus's original design helped to inspire a fervor for building projects on Bitcoin; as of July, CoinDesk counted at least 83 Bitcoin layer-2 projects in the works, with a variety of setups, including rollups as well as sidechains.

The new paradigm could be used to create a blockchain "bridge" that could be used to securely transfer bitcoin to the rollup, and later safely bring it back so the deposits could be withdrawn.

While Bitcoin's proof-of-work consensus mechanism – the method of confirming transactions, essentially involving data centers working nonstop to solve cryptographic puzzles, with heavy electricity consumption – has been criticized for its environmental impact, most blockchain experts agree that it is the most secure blockchain.

Such a virtue is underscored by the $1.2 trillion market value of all bitcoin outstanding – more than all other cryptocurrencies combined.

"Our new bridge design is simpler and more capital efficient," Linus told CoinDesk in a Telegram message. "The previous design caused liquidity issues both in terms of how much and for how long bridge operators had to lock collateral. Now, it requires less capital, which is locked for a shorter duration."

coindesk.com

coindesk.com