The ongoing Bitcoin post-halving decline closely reflects the patterns observed during the 2015-2017 halving bull market cycle, suggesting a similar trajectory.

Today, Bitcoin retraced to the $49,000 price channel for the first time in over seven months. This price range reappeared after Bitcoin’s value plunged from a high of $61,000 to $49,000, marking a significant correction of nearly 20% in just one day.

Significantly, the crypto market has been anticipating a new all-time high for Bitcoin since its latest halving. However, the asset has consistently experienced low values. Bitcoin traded at $65,442 on April 20, the day of the halving, but has since declined by roughly 26%.

Amid this performance, veteran market observers have noted a striking historical resemblance, suggesting potential insights into the asset’s future trajectory.

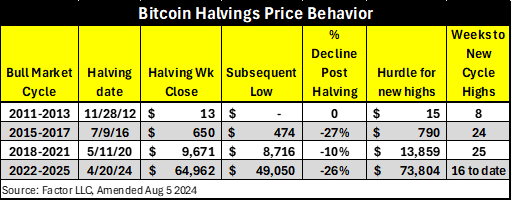

Bitcoin Historical Post-Halving Declines

In a recent update, veteran trader Peter Brandt cited market data showing that the latest Bitcoin retracement resembles the 2015 to 2017 halving bull market cycle.

The data highlighted that the second Bitcoin halving occurred on July 9, 2016. During the halving week, $BTC closed at $650. However, the premier asset dropped to a low of $470 weeks later, marking a post-halving decline of 27%.

Brandt’s graph indicated that Bitcoin faced a resistance barrier at $790, which it had to overcome to enter new price territory. It ultimately surmounted this hurdle and established a new cycle high at approximately $20K by 24 weeks a year after the having.

In the third halving cycle, Bitcoin only dropped 10% post-halving before creating a new all-time high at around $69K by 25 weeks a year after the having.

Meanwhile, Bitcoin has already tanked by 26% in the current cycle, as in 2015/2017. Bitcoin is still within its halving year and has already spent 16 weeks consolidating.

It continues to battle a significant resistance barrier at $73,800 and has failed multiple times to defend the $70K threshold once it re-entered.

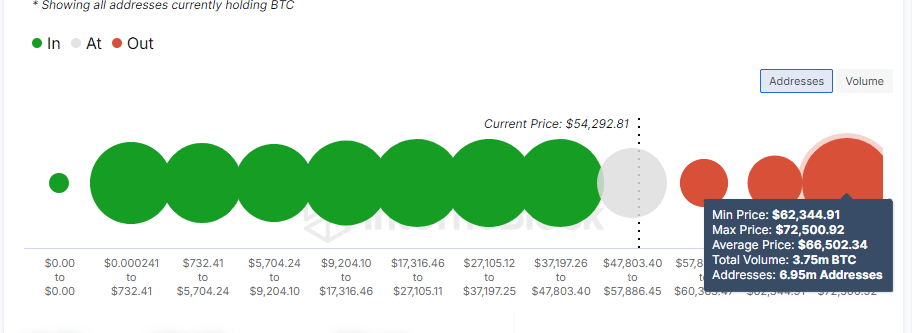

Bitcoin Resistance Barrier

Notably, 6.96 million wallets hold 3.75 million $BTC within the price range of $62,344.91 to $72,500. This range represents the largest cluster of holdings among all Bitcoin holding thresholds, making it a significant barrier.

Meanwhile, some commentators have challenged Brandt’s view. They point out several key differences, including Bitcoin reaching a new all-time high before its recent halving, which deviates from past trends.

Additionally, the current global recession indicators are cited as a unique bearish pressure for Bitcoin in this cycle.

At press time, Bitcoin has settled at around $52,023, relaxing from the intense volatility experienced earlier today.

thecryptobasic.com

thecryptobasic.com