Bitcoin’s price rebounded above $65,000 on August 2 after a Fed rate pause had triggered a 15% downtrend to $62,000. On-chain analysis explores how MicroStrategy’s latest $2 billion purchase could impact $BTC prices as the month unfolds.

Bitcoin Reclaims $65k After MicroStrategy’s $2B Purchase News

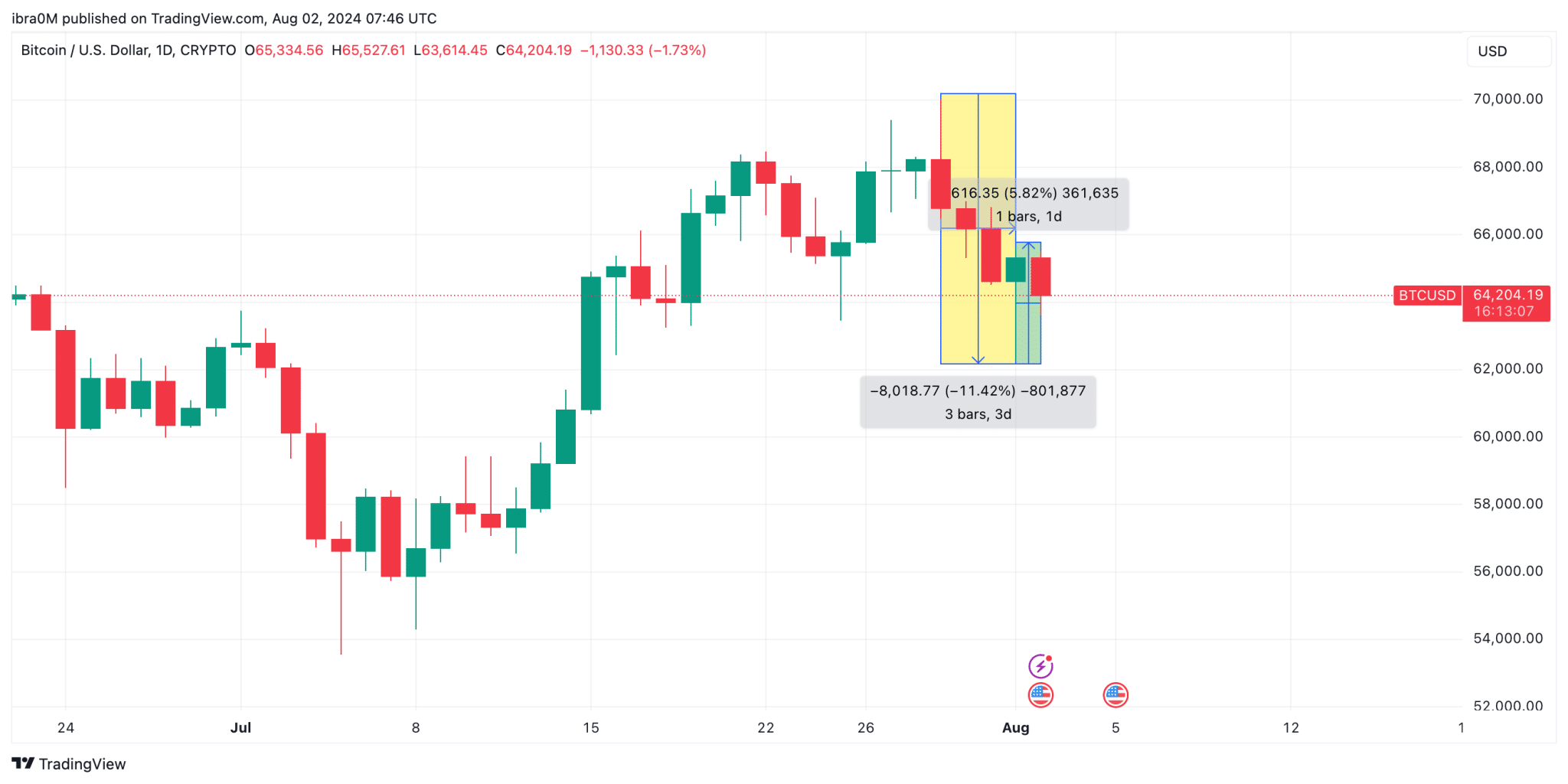

Bitcoin price action over the last 72 hours has been subject to intense volatility amid a major clash between bearish and bullish market catalysts.

The US government triggered the first phase of the bearish trend, after it followed up news of $2 billion sell-off from seized $BTC holdings, with a largely unpopular Fed Rate pause decision on July 31.

This caught highly leveraged bull traders off guard after a rollercoaster where the ETF launch and Donald Trump’s bullish comments at the Bitcoin Nashville conference had put $BTC on the brink of breaching the $70,000 territory on Monday.

Within 24 hours of the US Fed Rate pause decision on July 31, Bitcoin price rapidly tumbled to 10-day low of $62,282. But shortly after, on Aug 1, public filings showed that MicroStrategy has made strategic plans to add another $2 billion $BTC to its growing portfolio.

Instantly, $BTC price rebounded 6% briefly reclaiming $65,500 mark before retracing toward $64,200 at the time of writing on Aug 2.

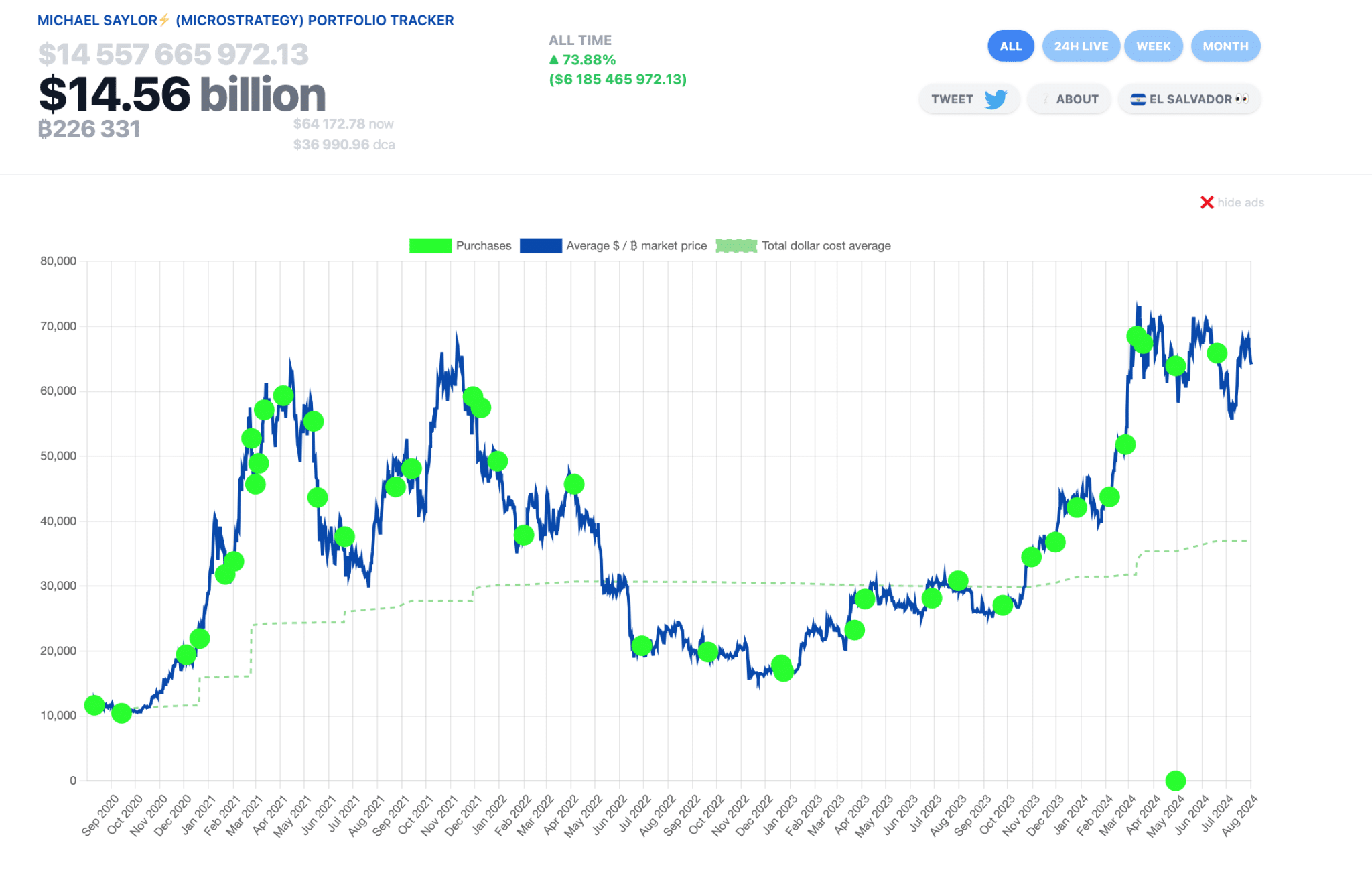

Over the years, Microstrategy has emerged as one of the biggest investors in Bitcoin. At the time of publication, the company currently holds 226,331 $BTC, valued at approximately $14.6 billion.

The latest $2 billion purchase filings comes just days after CEO and Founder Michael Saylor made an ambitious prediction that $BTC price will reach $13 million per coin by 2045, during a bullish keynote speech at the Bitcoin Nashville 2024 conference.

Evidently, this news appears to have lifted the sentiment around $BTC. However, it remains to be seen if bulls can sustain the momentum over the weekend.

More so, the US Fed has hinted at a possible rate cut in September. Hence, investors will be looking out for the Non-Farm Payrolls report scheduled to be released on Friday, Aug 2. Another round of dovish figures could raise expectations of the September cut, possibly driving $BTC above the $70,000 level.

$BTC Price Forecast: Bulls Eyeing $70k Retest

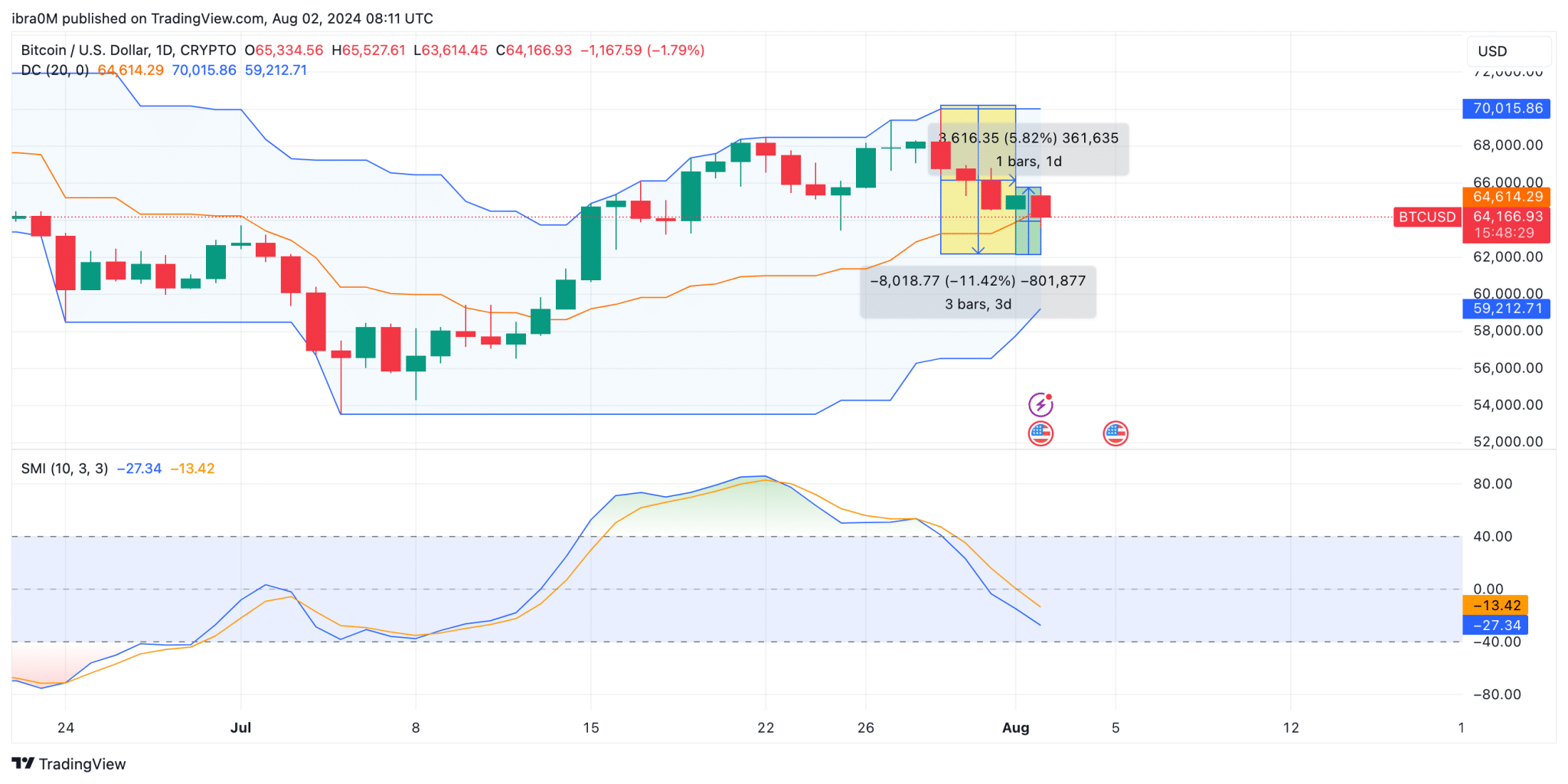

The recent price action for Bitcoin ($BTC) indicates a significant correction, with the price declining by 11.42% over the past three days. This drop has brought $BTC down to $64,166.93, slightly above the key support level of $64,614.29, which is represented by the Donchian Channel’s lower boundary.

The immediate resistance level to watch is $66,000, aligning with the upper boundary of the Donchian Channel. If $BTC can break above this level, it could open the door for a move towards the major resistance at $70,015.86.

The Stochastic Momentum Index (SMI) is currently in the oversold territory, with the %K line at -27.34 and the %D line at -13.42. This indicates that the bearish momentum might be waning, and a potential bullish reversal could be on the horizon.

Historically, oversold conditions in the SMI have often preceded strong upward movements, suggesting that the current price levels could present a buying opportunity for bulls.

In conclusion, while the short-term outlook for Bitcoin shows signs of bearishness, the longer-term trend remains positive. Traders should monitor the key support level at $59,212.71 and the resistance level at $70,015.86. A successful break above $66,000 could be the first signal of a bullish reversal, paving the way for $BTC to retest the $70k mark.

thecryptobasic.com

thecryptobasic.com