Tether ($USDT), the world’s largest stablecoin issuer, has announced a remarkable profit of $5.2 billion for the first half of the year; market indicators suggest this could be bullish for Bitcoin’s short-term price action and long-term prospects.

Tether Posts Record-Breaking H1 2024 Performance

On July 31, 2024, Tether released an official attestation reports showing a record-Breaking $5.2 billion gains for H1 2024. This remarkable H1 performance includes a substantial $1.3 billion in net operating profits generated during the second quarter alone.

In an impressive display of financial acumen, Tether’s ownership of U.S. Treasuries has surged to unprecedented levels. The firm’s exposure to US Treasuries now surpasses that of major economies including the UAE, Australia, and Germany.

With this strategic positioning, Tether has ascended to the 18th spot globally among holders of U.S. debt, trailing only behind financial powerhouses like the United Kingdom and the Cayman Islands in terms of 3-month U.S. Treasury purchase.

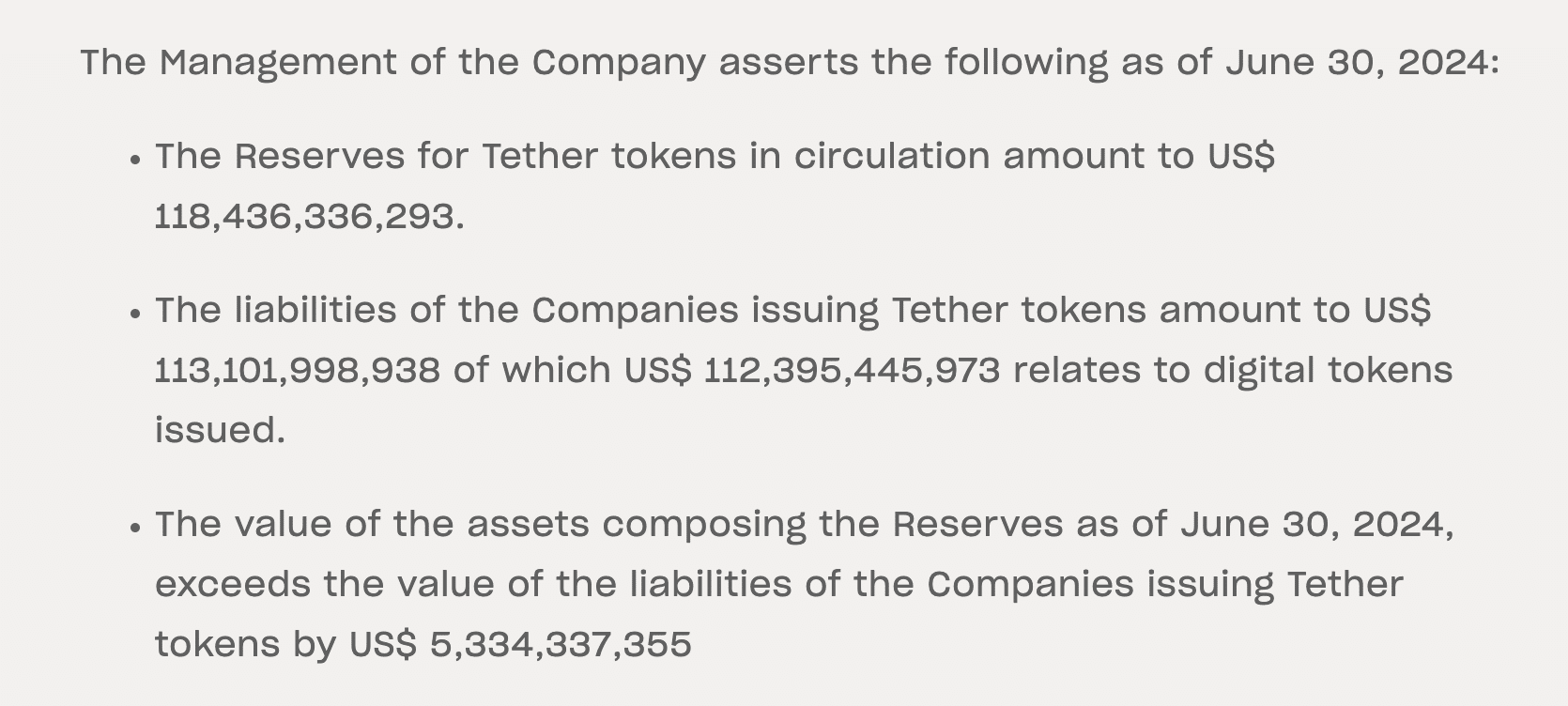

The latest quarterly attestation report from Tether reveals robust financial health, showcasing $118.3 billion in assets against $113.1 billion in liabilities at the close of the second quarter. This results in an impressive buffer of over $5 billion in excess reserves. Such a strong reserve position not only fortifies Tether’s stability but also reinforces confidence in the overall cryptocurrency market.

Tether’s H1 Peformance Could Propel Bitcoin to new ATH

This performance not only emphasizes Tether’s dominance in the Stablecoin sector, but also carries significant implications for the broader cryptocurrency ecosystem, particularly Bitcoin ($BTC).

Notably, Tether disclosed Bitcoin holdings of around 80,000 $BTC. This substantial $BTC reserve aligns with Tether’s earlier commitment to allocate 15% of its realized net operating profits towards Bitcoin investments.

This strategic move signals Tether’s bullish stance on Bitcoin, reflecting a broader market sentiment that could propel Bitcoin’s value.

These developments highlight Tether’s critical influence on the cryptocurrency landscape. It’s substantial profits, strategic investments in U.S. Treasuries, and significant Bitcoin holdings collectively suggest a bullish short-term outlook for $BTC.

As Tether continues to demonstrate financial strength and strategic foresight, these actions are like to bolster market confidence in Bitcoin, potentially driving its value upward in the coming months.

Bitcoin Price Forecast: Road to $75k in August?

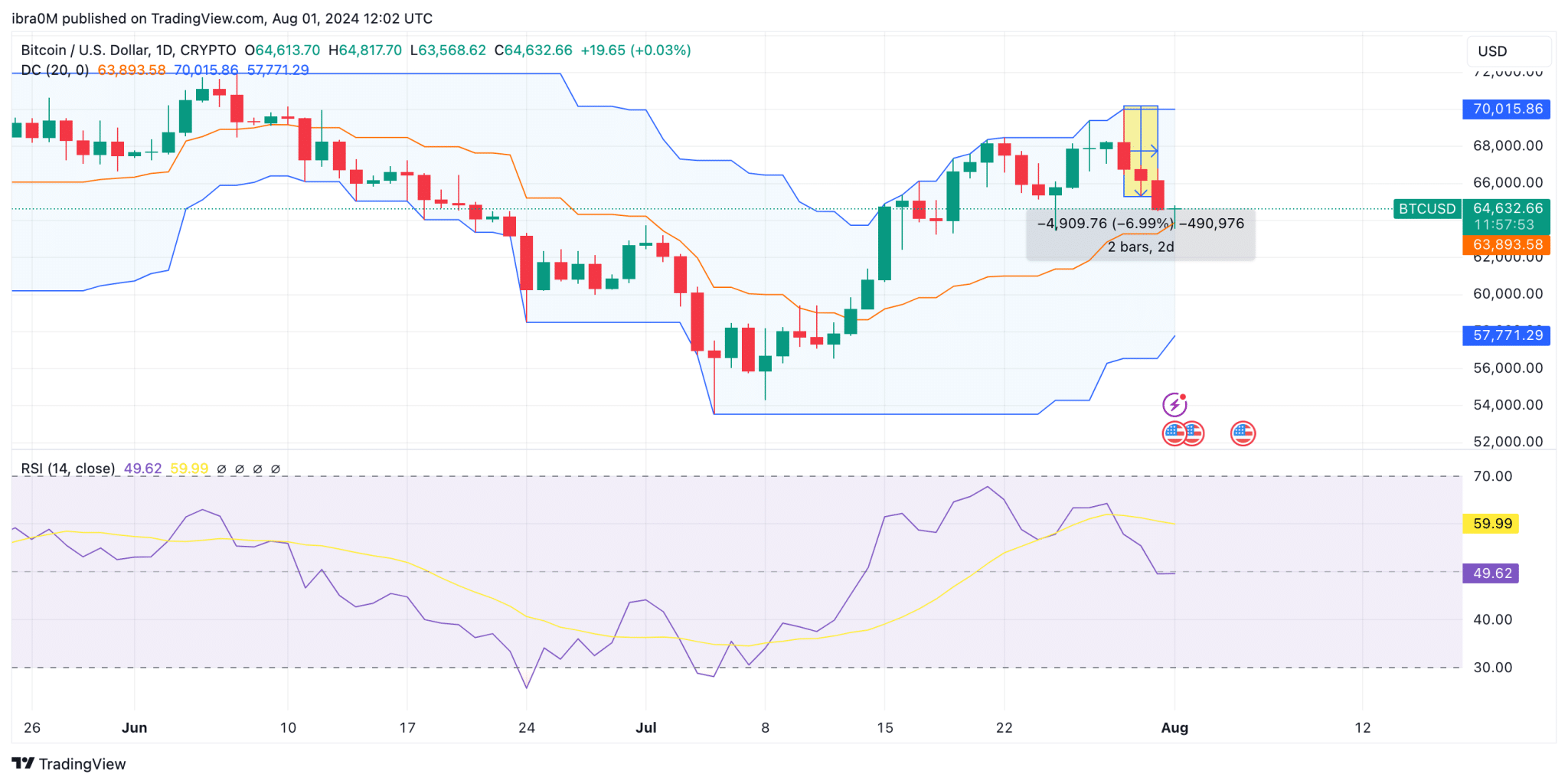

Bitcoin’s price action suggests potential bullish momentum ahead, as it currently trades at $64,632.66. The Donchian Channel indicates that Bitcoin is holding above the lower boundary of $57,771.29, suggesting a solid support level. The middle band of the Donchian Channel, around $63,893.58, is crucial, as Bitcoin’s ability to stay above this level could provide the foundation for an upward move.

The recent decline from $70,015.86 to the current level appears to be a temporary pullback. The Relative Strength Index (RSI) is at 49.62, which is just below the neutral 50 mark, indicating that Bitcoin is neither overbought nor oversold.

This neutrality provides Bitcoin with the potential to build bullish momentum if buying pressure increases. The RSI’s previous peak around 59.99 suggests that a move back above 50 could trigger renewed interest from buyers.

Immediate resistance lies at the recent high of $70,015.86. A break above this level could see Bitcoin targeting the next psychological resistance at $75,000. The consolidation around the $63,893.58 support level adds credence to the possibility of an upward surge, particularly if the price can close above the key resistance level.

In conclusion, Bitcoin’s technical indicators suggest a cautious but optimistic outlook. Maintaining support above $63,893.58 and breaking through $70,015.86 are critical steps towards reaching the $75,000 mark. Given the current technical setup, a move towards $75,000 in August remains within the realm of possibility, provided Bitcoin can garner sufficient bullish momentu

thecryptobasic.com

thecryptobasic.com