Bitcoin whales are actively accumulating, with a particular whale address recently withdrawing 4,500 $BTC from Binance.

As Bitcoin experiences a retracement from its recent weekly highs, whale activity has surged, indicating potential future bullish trends.

According to whale tracking platform Lookonchain, a significant whale, identified as “12QVsf,” has withdrawn a substantial amount of Bitcoin from major exchanges, likely accumulating amid an anticipation of higher prices ahead.

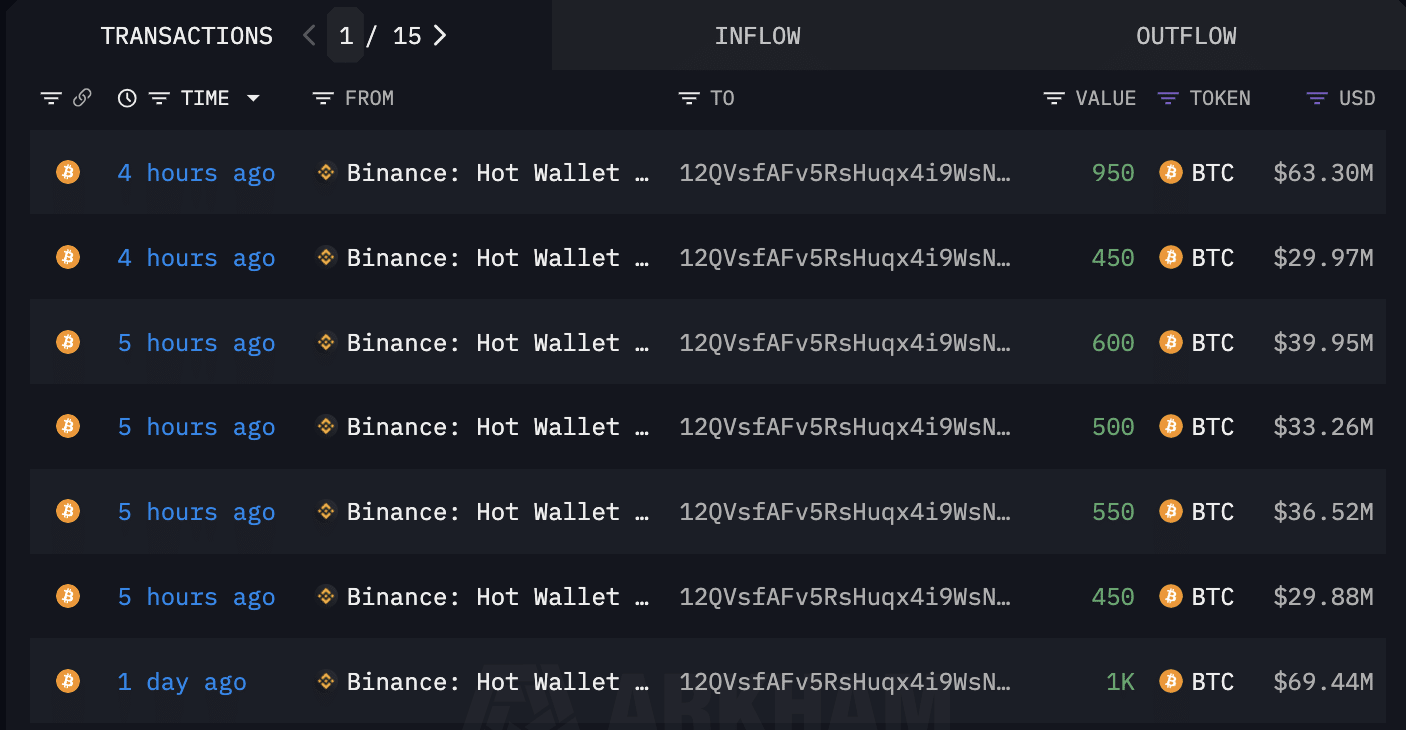

Withdrawals from Binance

Lookonchain reported that Whale “12QVsf ” withdrew a total of 4,500 $BTC, valued at approximately $302 million, from Binance within the last 22 hours. The withdrawals were conducted at an average entry price of $67,182 per $BTC, as confirmed by The Data Nerd, an on-chain sleuth.

The transactions included several large withdrawals, such as 950 $BTC, 450 $BTC, and 600 $BTC, along with additional withdrawals of 500 $BTC, 550 $BTC, and 450 $BTC. The earliest recorded withdrawal was a staggering 1,000 $BTC.

Further data from Arkham Intelligence reveals that whale “12QVsf” currently holds 4,500 $BTC with an unrealized loss of around $12.12 million.

Additionally, Lookonchain identified three wallets, potentially linked to the same whale, that withdrew a combined total of 1,400 $BTC from Bitfinex. This follows a previous withdrawal of 2,510 $BTC from Bitfinex on June 20.

Bitfinex Sees Major $BTC Outflows

The recent withdrawals from Bitfinex were carried out by three distinct wallets, each showing notable activity. Wallet 1 withdrew 700 $BTC today and had previously withdrawn 649.9 $BTC a month ago.

Wallet 2 withdrew 600 $BTC today and had a prior withdrawal of 999.9 $BTC. Wallet 3, on the other hand, withdrew 100 $BTC today after having withdrawn 859.9 $BTC a month prior.

The total value of today’s withdrawals amounted to $94.09 million, while the withdrawals on June 20 totaled $163.22 million.

This consistent pattern of large withdrawals suggests a deliberate accumulation strategy by these wallets, likely influenced by market conditions and future price expectations.

Looking at Whale Activity Indicators

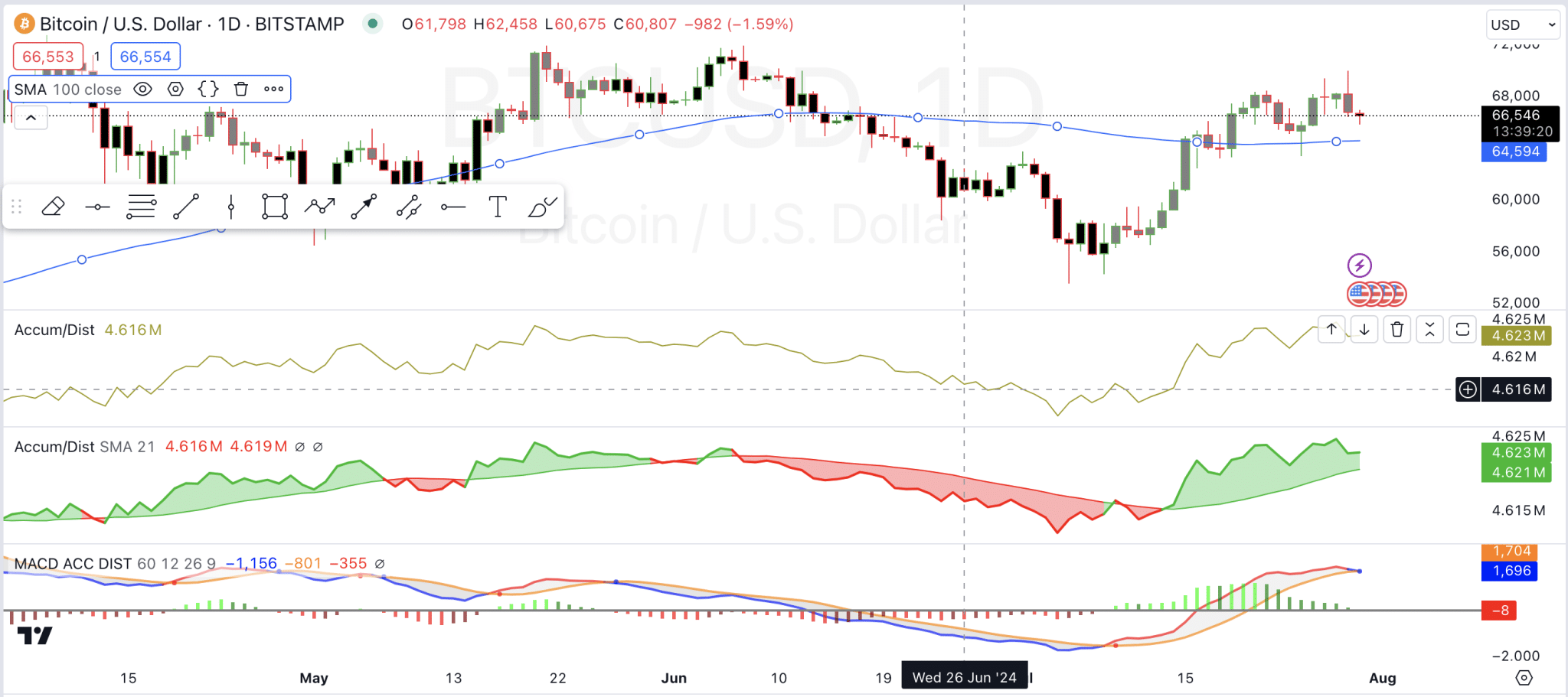

Confirming from the technical front, TradingView’s Accumulation/Distribution (Acc/Dist) line, which measures the cumulative flow of money into and out of Bitcoin, shows a consistent upward trend, despite the price volatility.

The 21-period SMA of the Acc/Dist line further confirms this upward trend, suggesting a sustained period of accumulation.

The MACD indicator also supports this accumulation trend, with positive histogram bars and a bullish crossover of the MACD lines indicating growing bullish momentum. This aligns with the observed whale activity and accumulation patterns.

thecryptobasic.com

thecryptobasic.com