Bitcoin price tumbled below the $64,000 mark on July 25, down 7% from the weekly timeframe peak of $68,477, on-chain analysis explores how Bitcoin miners selling into the market euphoria may have triggered the on-going price pull-back.

Bitcoin Price Decline Amid Cooling Ethereum ETF Hype

The cryptocurrency market, including Bitcoin, had been experiencing a robust uptrend since July 5, driven by favorable macroeconomic factors in the U.S. Initially, dovish NFP and CPI reports for June 2023 boosted demand for risk assets, including cryptocurrencies.

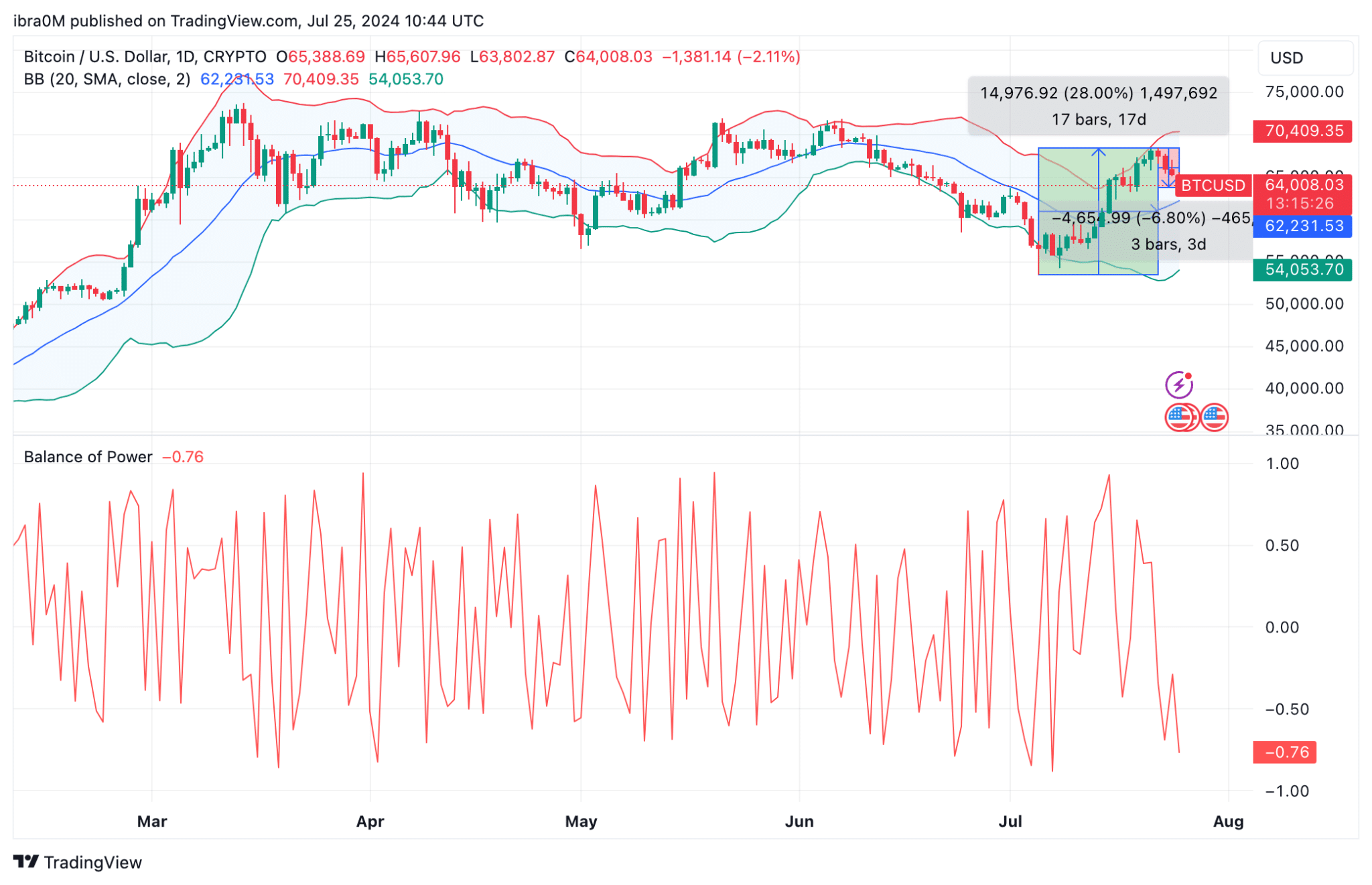

The rally intensified on July 22, propelled by the launch of Ethereum ETFs and President Biden’s withdrawal from the 2024 presidential race, positioning crypto-friendly Donald Trump as a strong contender. This glut of bullish catalysts drove Bitcoin price into a remarkable 28% in 17 days, moving from $53,540 on July 5 to $68,477 on July 22.

Notably, the $68,477 price level is Bitcoin’s highest in over 30-days, dating back to June 10, 2024. Unsurprisingly, bull traders in the derivatives mounted LONG positions worth over $1 billion in anticipation of a $70,000 breakout.

However, market events unfolding in the last 48 hours suggests the $70,000 target is now unlikely within the monthly timeframe. Look at the chart above we see that BTC price has now retraced 7% from the $68,477 peak recorded on July 22, as it tumbled as low as $63,802 on Thursday July 25.

Bitcoin Miners Have Sold 20,000 BTC in 10 Days

Firstly, there is an indication that a lot of strategic crypto traders that bought BTC in the build up to the Ethereum ETF launch are now promptly “selling-the-news” to locking some of the unrealized profits they have racked up during last few weeks.

But looking closer at recent on-chain data trends, Bitcoin miners have also been trading bearish since the market rally began, a move which is evidently pivotal to the on-going Bitcoin price correction.

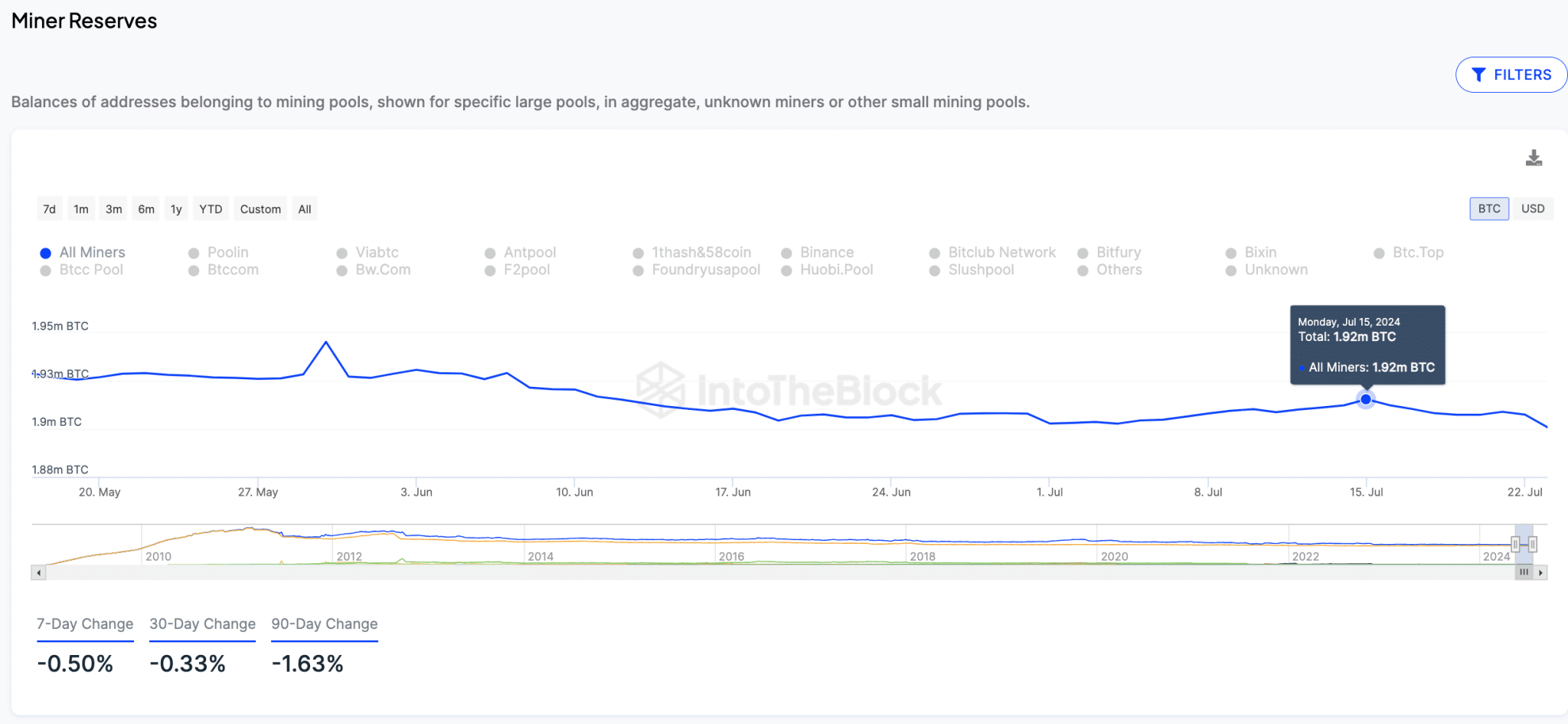

IntoTheBlock’s Miner Reserves chart below tracks the BTC holdings in control of recognized miners and mining pools. The decline in miner reserves indicates ongoing sell-off, which often impacts price negatively, and vice versa.

Bitcoin miners held a total of 1.92 million BTC at as of July 15. But as the Ethereum ETF hyped kicked in after the announcement of the July 23 launch date Bitcoin miners capitalized on the renewed investor interest to stage a large sell-off.

At the time of writing on July 25, Bitcoin miners now hold only 1.90 million BTC in their reserves, reflecting a 20,000 BTC sell-off within the last 10 days. When miners on blockchain network begin selling-off their holdings, it often triggers bearish price reaction for a number of reasons.

Firstly, the miners’ 20,000 BTC sell-off has effectively diluted the Bitcoin market supply by $1.28 billion. More so, it discourages prospective new entrants from entering the markets, wary that the miners’ ongoing billion-dollar selling trend could hurt their short-term profits.

In summary, the combination of traders locking in profits and miners selling off their holdings has contributed to Bitcoin’s recent price drop. Without a considerable shift in these bearish trends, Bitcoin may face further downward movement in the near term.

Bitcoin Price Forecast: $60k Reverse Looming

A 10-day long sell-off by miners, has seen Bitcoin’s market supply increase by $1.28 billion, deterring new investors concerned about short-term losses. In effect, BTC has recently pulled back by 7% following the Ethereum ETFs launch on July 23.

Technical indicators on the BTC/USD daily price chart also affirm this negative Bitcoin price outlook.

Currently, BTC is trading near $64,008, with the Bollinger Bands showing resistance at $70,409 and support at $54,053. The Parabolic SAR indicates a potential downward trend, while the Balance of Power is at -0.76, reinforcing the bearish sentiment.

To avoid further decline, Bitcoin needs to reclaim the $66,000 resistance level. If the bearish pressure persists, BTC may test the next key support level at $62,231. Traders should closely monitor these levels, as a breach below $60,000 could trigger additional selling pressure and further downside risks.

thecryptobasic.com

thecryptobasic.com