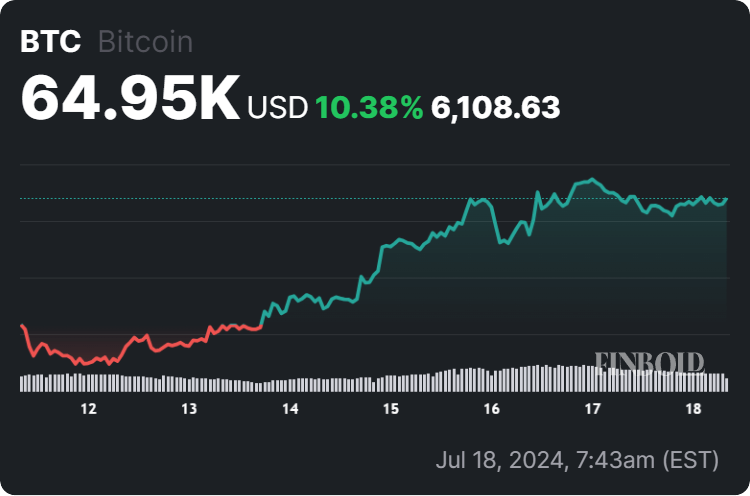

After Bitcoin (BTC) made a massive recovery that saw its price rise from the area around $55,000 to $65,000 in a matter of days, its outlook is looking positive as well, and machine learning and artificial intelligence (AI) price predicting algorithms agree.

As it happens, Bitcoin has returned to its previous levels after a failed assassination attempt on the Republican presidential candidate and former United States President Donald Trump, which has publicly endorsed cryptocurrencies, including the maiden crypto asset.

Bitcoin price prediction

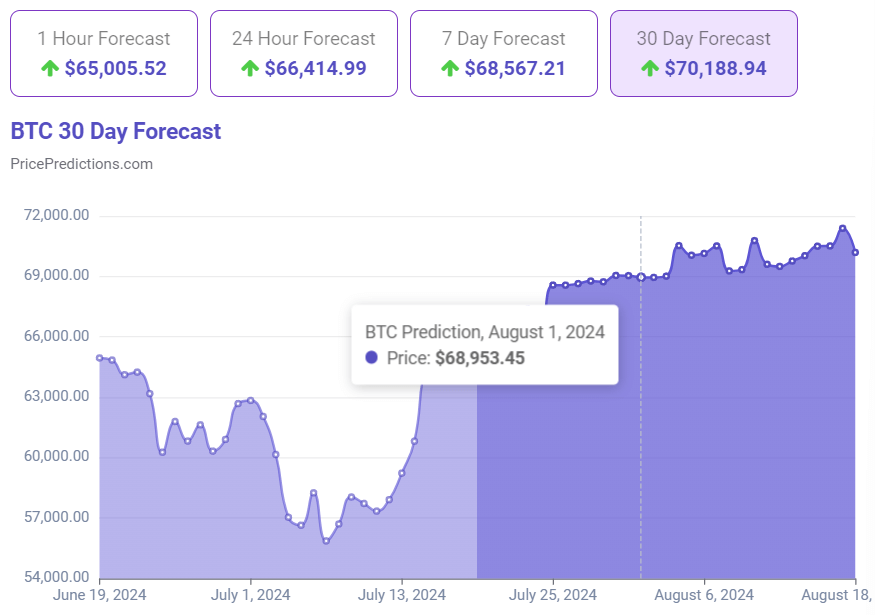

Indeed, in this context, the flagship decentralized finance (DeFi) asset might continue its upward move toward the end of this month, possibly reaching the price of $68,953.45 on August 1, 2024, as per data of the advanced AI algorithms over at the crypto analytics platform PricePredictions retrieved on July 18.

Specifically, should these projections, which rely on the interplay between various technical indicators, such as Bollinger Bands (BB), moving average convergence divergence (MACD), average true range (ATR), and others, prove correct, it would result with a 6.16% price increase for Bitcoin from its current position.

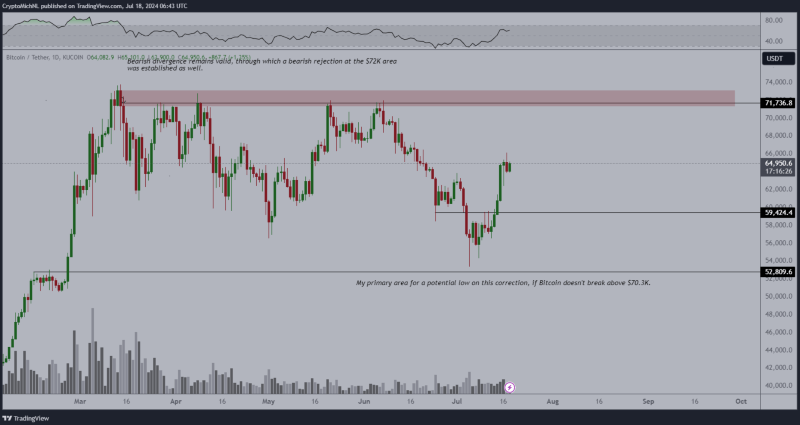

Elsewhere, renowned crypto trading expert Michaël van de Poppe has recently pointed out that Bitcoin was “nicely consolidating within the four-month range,” adding that “it’s very likely going to continue rallying upwards” as long as its price stays above $60,000.

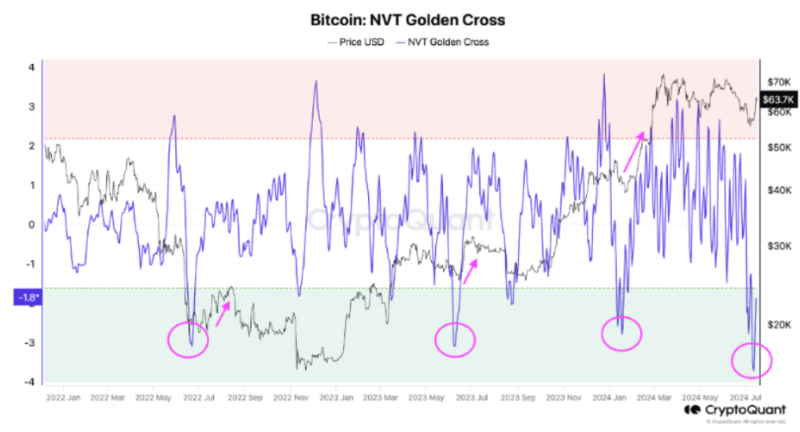

Shortly after, he observed that Bitcoin’s NVT ratio, an important indicator for the pioneer crypto, had hit its “lowest, negative number in the past 2.5 years,” suggesting that the “correction is over” and telling his followers to “buckle up,” according to his analysis in an X post on July 18.

Bitcoin price analysis

For the time being, the largest asset in the crypto sector by market capitalization is changing hands at $64,950, which indicates a 0.05% gain in the last 24 hours, an advance of 10.38% across the previous seven days, as it reduces its monthly decline to 0.38%, according to the latest charts.

Ultimately, Bitcoin is in a good position for further continuation of its bullish price action, although trends in the crypto market can sometimes make a full turn without warning, so doing one’s own research and weighing all the risks is critical when investing larger sums of money.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com