In a rapidly evolving cryptocurrency market, Bitcoin (BTC) finds itself at a critical juncture. The world’s leading digital asset has recently tested previous range lows, prompting speculation about its next move. As investors and traders eagerly watch for signs of direction, a prominent crypto analyst has shared insights into possible scenarios.

On Sunday, July 14, 2024, professional trader and renowned crypto analyst CrypNuevo took to X to provide an in-depth analysis of Bitcoin’s current position. The analyst highlighted two distinct scenarios that could unfold in the coming days or weeks.

As reported by CrypNuevo, Bitcoin recently reached the previous range lows. Now, the question is whether this represents a resistance retest before a further decline or if Bitcoin will reclaim its previous trading range. The leading cryptocurrency kept the last range for four months before losing it down to $53,540.

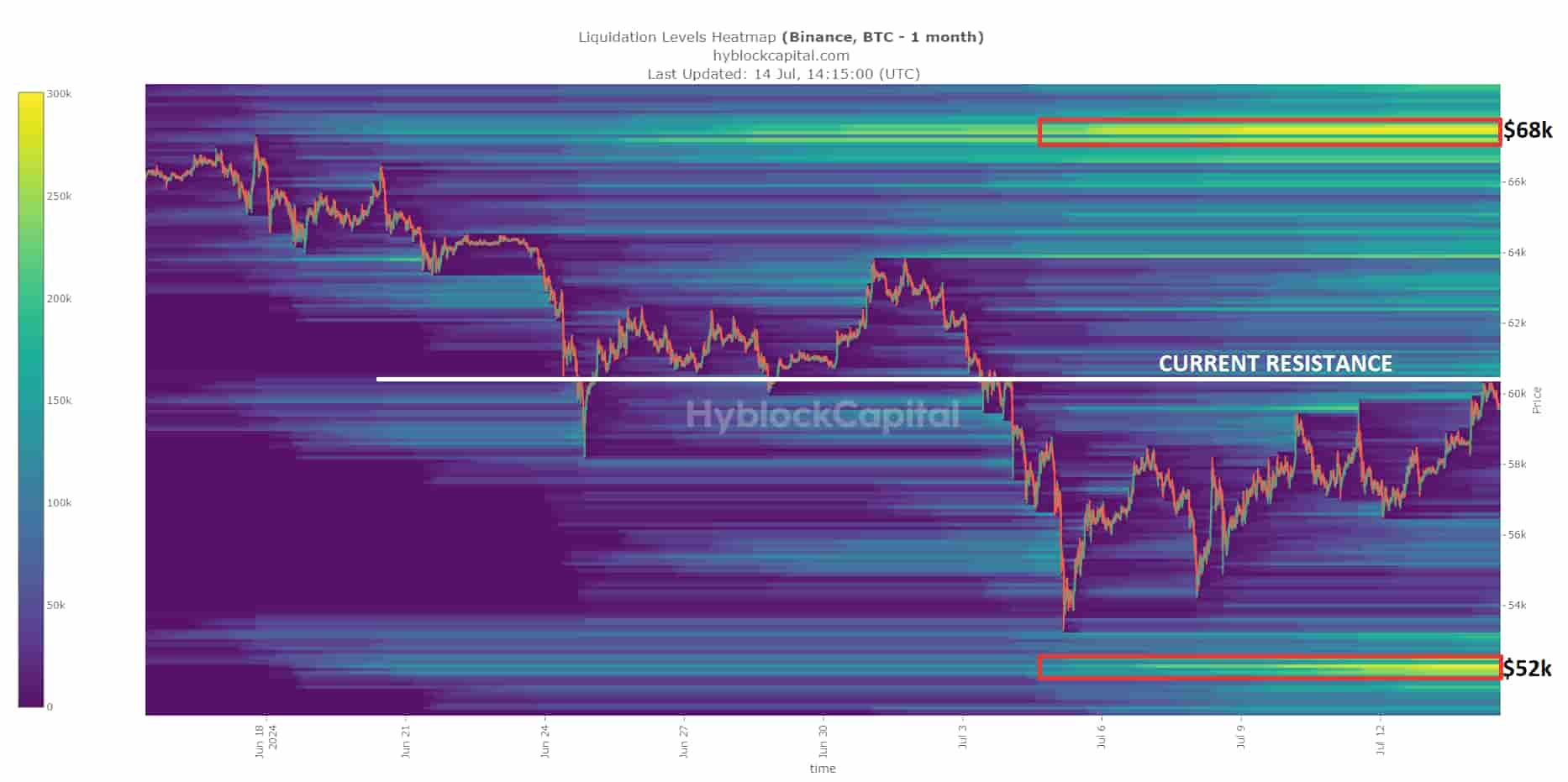

Potential liquidation zones

CrypNuevo identified two key liquidation zones that traders should keep an eye on. The first is at $68,000, where a significant number of liquidations could occur if Bitcoin reclaims its previous range. However, the analyst notes that price needs to first reclaim the range as seen in previous market behavior.

The second liquidation zone is at $52,000. This level could potentially serve as a bottom if Bitcoin hasn’t reached its lowest point yet. Interestingly, this level also aligns with the 50-week exponential moving average (EMA), adding to its significance as a potential support level.

Bitcoin long and short scenarios

In the bullish scenario, CrypNuevo suggests that if Bitcoin reclaims the range lows and tests them as support, the next logical move would be a push toward the range highs. The analyst points out an Open Interest (OI) gap between $72,000 and $73,500, describing it as an interesting liquidity area that the price has avoided visiting for some time.

Conversely, the bearish scenario would require Bitcoin to be rejected at the range lows for several days. The analyst suggests that an ideal trigger for this scenario would be a false breakout above range lows, followed by an immediate retracement below resistance.

Macroeconomic factors and external events

While technical analysis provides valuable insights, it’s crucial to consider broader economic factors and external events that could influence Bitcoin’s price. Recent Consumer Price Index (CPI) data came in 0.1% below expectations, potentially favoring a Bitcoin recovery.

Additionally, a recent assassination attempt on Donald Trump, a now-known Bitcoin supporter and confirmed speaker at the upcoming Bitcoin 2024 conference, could have unforeseen impacts on market sentiment.

As Bitcoin tests critical support levels, the cryptocurrency community remains on high alert. Whether the leading digital asset will reclaim its previous range or continue its downward trajectory remains to be seen. Traders and investors should stay informed and cautious as the market decides its next move.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com