Bitcoin prices rebounded after dropping below $53,219 on July 3rd, reaching a potential local bottom according to the latest edition of the “Bitfinex Alpha” report. The initial price decline was triggered by fears of selling from the German government and Mt. Gox creditors.

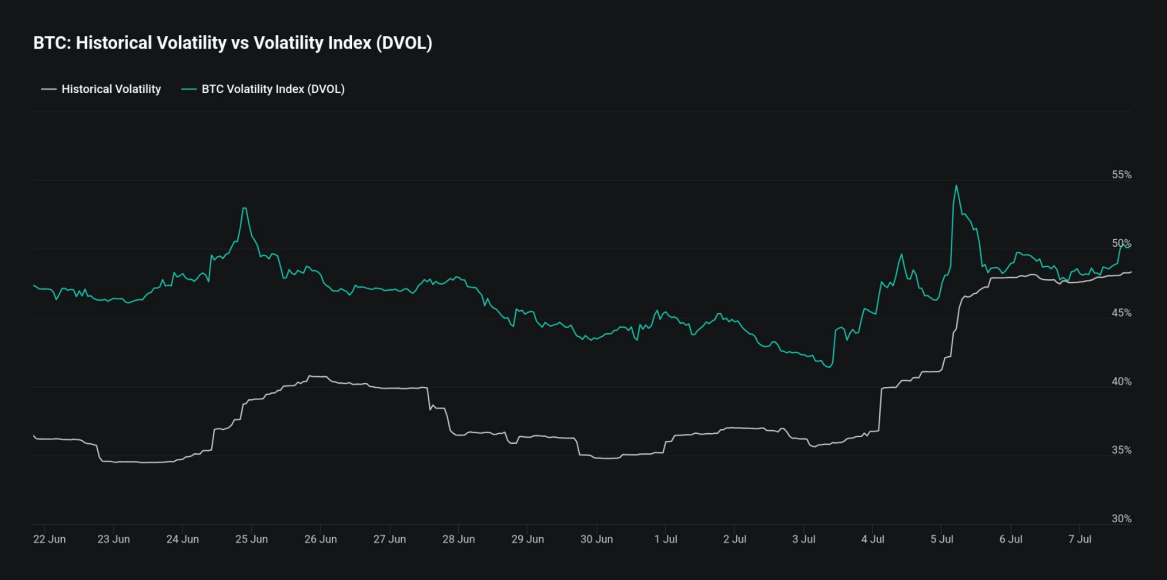

Market sentiment shifted as traders reassessed the impact of the German government’s Bitcoin transfers to exchanges, recognizing it as a relatively small proportion of total Bitcoin transactions since 2023. Additionally, volatility metrics indicate a narrowing spread between implied and historical volatility, suggesting increased market stability.

Notably, short-term holder behavior points to possible selling exhaustion, with the Spent Output Profit Ratio (SOPR) for this group at 0.97, indicating sales at a loss. Historically, such conditions have preceded price rebounds as selling pressure eases.

Funding rates for Bitcoin perpetual contracts turned negative for the first time since May 1st, potentially signaling an oversold market. When combined with low short-term SOPR values, these conditions have often marked the end of price corrections in the past.

While long-term Bitcoin holders continue to realize significant profits, the market positioning displays complacency among short sellers. This is evidenced by high numbers of short liquidations, even during the July 7th market rebound, suggesting a lack of clear directional conviction among traders.

Nevertheless, the recent US economy data suggests that an interest rate cut is unlikely in the next Fed meeting, set for July 31st. This means that Bitcoin and the broad crypto market could still be stuck in a tight range until September when Bitfinex analysts believe the first rate cut might come.

cryptobriefing.com

cryptobriefing.com