Bitcoin (BTC) has driven a bloodbath in the crypto sector while increasingly facing bearish sentiments amid uncertainty among investors regarding the next move.

With market sentiment low, crypto trading analyst Alan Santana has offered insights into what he termed the best-case scenario for Bitcoin in July. It’s worth noting that historically, July has largely been a positive month for the maiden crypto.

“The truth is clear and Bitcoin right now is red. This is only the second month and there is room for much red before the major bull-market takes place. This is normal. This is expected… This is what is happening and we adapt and accept,” he said.

In his analysis, Santana first acknowledged that Bitcoin has, for the first time since February 2024, fully traded below the $60,000 mark. This level, which had previously been a strong support since Bitcoin’s rise from $40,000 to over $60,000 in February, is now at a critical juncture.

Bitcoin’s next play

When looking at the next play for Bitcoin, Santana pointed out that should Bitcoin continue to stay below $60,000, an extended negative market condition could emerge. Referring to the massive green candle in February 2024, the expert explained that a similar but opposite reaction could occur on the bearish side, potentially driving prices down to test lower levels such as $50,000, $40,000, and even $30,000.

He suggested that while this could cause short-term turmoil, recovery within the same month could render this drop as mere “market noise” in the long-term perspective.

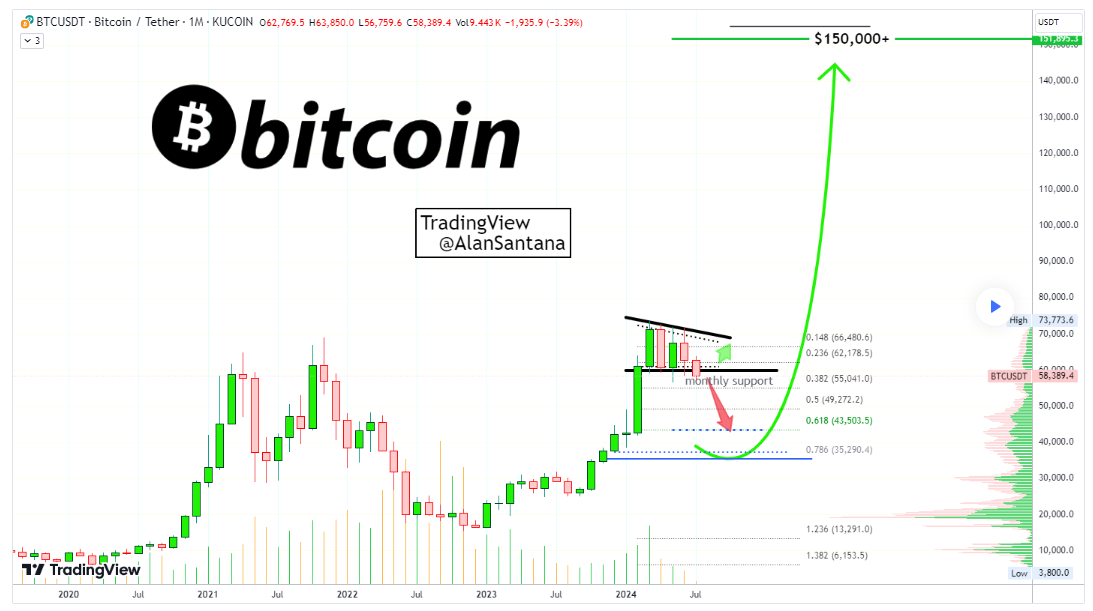

Although the market is gloomy, Santana also outlined a more optimistic scenario. If Bitcoin reverses and closes above the $60,000 support, it could signify accumulation rather than distribution, paving the way for a rise to $65,000, $70,000, $80,000, and possibly $100,000 without significant correction. While labeled as “wishful thinking” by Santana, this best-case scenario remains within the realm of possibility.

In general, the analyst maintained that Bitcoin’s potential recovery path could lead to a target of over $150,000, emphasizing the volatility and pivotal nature of the current market conditions.

Santana also pointed out external factors such as the upcoming U.S. election in 2024, historically a positive period for markets post-election. He argued that for a primary bull market in 2025 to materialize, any significant correction must occur between July and November 2024. This critical period sets the stage for sustained growth and new all-time highs in 2025.

At the moment, Bitcoin is facing increased selling pressure, coinciding with repayments to customers from the defunct Mt. Gox exchange. Notably, this pressure accelerated across the markets after Mt. Gox moved 47,228 BTC, signaling the start of their repayment process.

Bitcoin price analysis

As of press time, Bitcoin was trading at $54,490, with daily losses of over 4%. On the weekly chart, Bitcoin is down over 11%.

Overall, the most immediate goal for Bitcoin is to sustain gains above the $55,000 support zone. A further drop below this level could lead to retesting the $50,000 mark.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com