Bitcoin (BTC) recently plummeted to $54,179 on July 5, the first time the asset has traded at this price since February. This sharp decline has prompted fears of a deeper market downturn among analysts and investors.

A significant factor contributing to this decline is Mt. Gox’s substantial transfer of $2.7 billion in Bitcoin to an unknown wallet, raising concerns within the crypto community.

Additionally, U.S. spot Bitcoin ETFs reported outflows of $20.45 million, according to data from SoSoValue, exacerbating the bearish sentiment.

Despite the overall market decline, Bitcoin’s market dominance increased by 0.80%, suggesting even steeper declines in the altcoin market.

The open interest in Bitcoin has also decreased by 10%, now holding a valuation of $16 billion, according to CoinAnalyze. Bitcoin’s market capitalization currently stands at $1.07 trillion.

Critical support breakdown

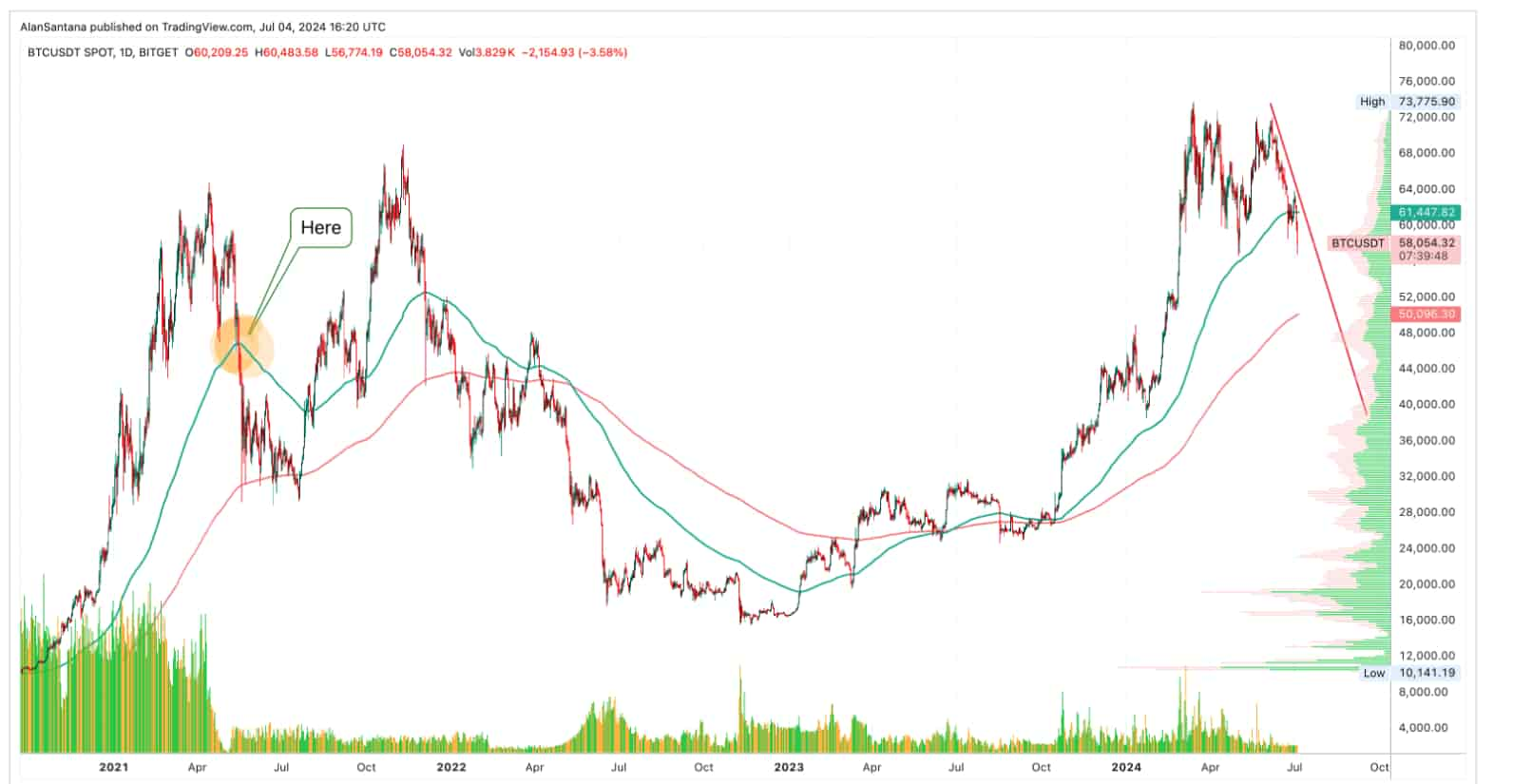

Trading expert Alan Santana has highlighted a critical technical breakdown on the daily timeframe. Bitcoin’s long-term exponential moving average (EMA) support, a significant level since May 2024, has been breached.

This EMA, around $57,500, acted as a crucial support level but failed to hold during the recent market movements.

The EMA was first tested as support in May 2024 and again in late June 2024 after a lower high. In May, the support level was around $58,500, while in late June, it was approximately $60,000.

The latest challenge in late June led to a minimal price bounce, followed by a resumed bearish trend.

The breach of this EMA signifies a pivotal moment in Bitcoin’s price trajectory, indicating that the support that previously helped maintain price stability has now failed.

Historical context and technical analysis

The long-term EMA has been a reliable support level until recently. The breach below this EMA indicates a confirmed bearish trend.

The analyst also projects a potential path for further price decline (red line), projecting Bitcoin could continue to drop significantly if this trend persists.

The last similar EMA breakdown occurred in May 2021, marking the top of the bull market and initiating the longest bear market in Bitcoin’s history.

This period also saw an irregular correction, with a higher high in November 2021 driven by the expansion of the money supply. The current conditions mirror those of 2021, with the potential for a major market correction.

Investors should brace for potentially lower Bitcoin prices as the market adjusts to these new conditions. The confirmed breach of this critical support level suggests that a major market correction is already underway.

While this does not necessarily predict another multi-year bear market, it does indicate that significant price declines could continue in the short to medium term.

Bitcoin price analysis

At press time, Bitcoin is trading at $54,482.91, down by 4% over the last 24 hours, with a 24-hour trading volume of $40.5 billion.

Bitcoin’s recent price movements and the breakdown of a key support level signal a potentially challenging period ahead for the cryptocurrency market.

The confirmed bearish trend, combined with external factors such as the Mt. Gox transfer and ETF outflows, indicates that the market could see further declines. Understanding these dynamics is essential for making informed investment decisions in the coming months.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com