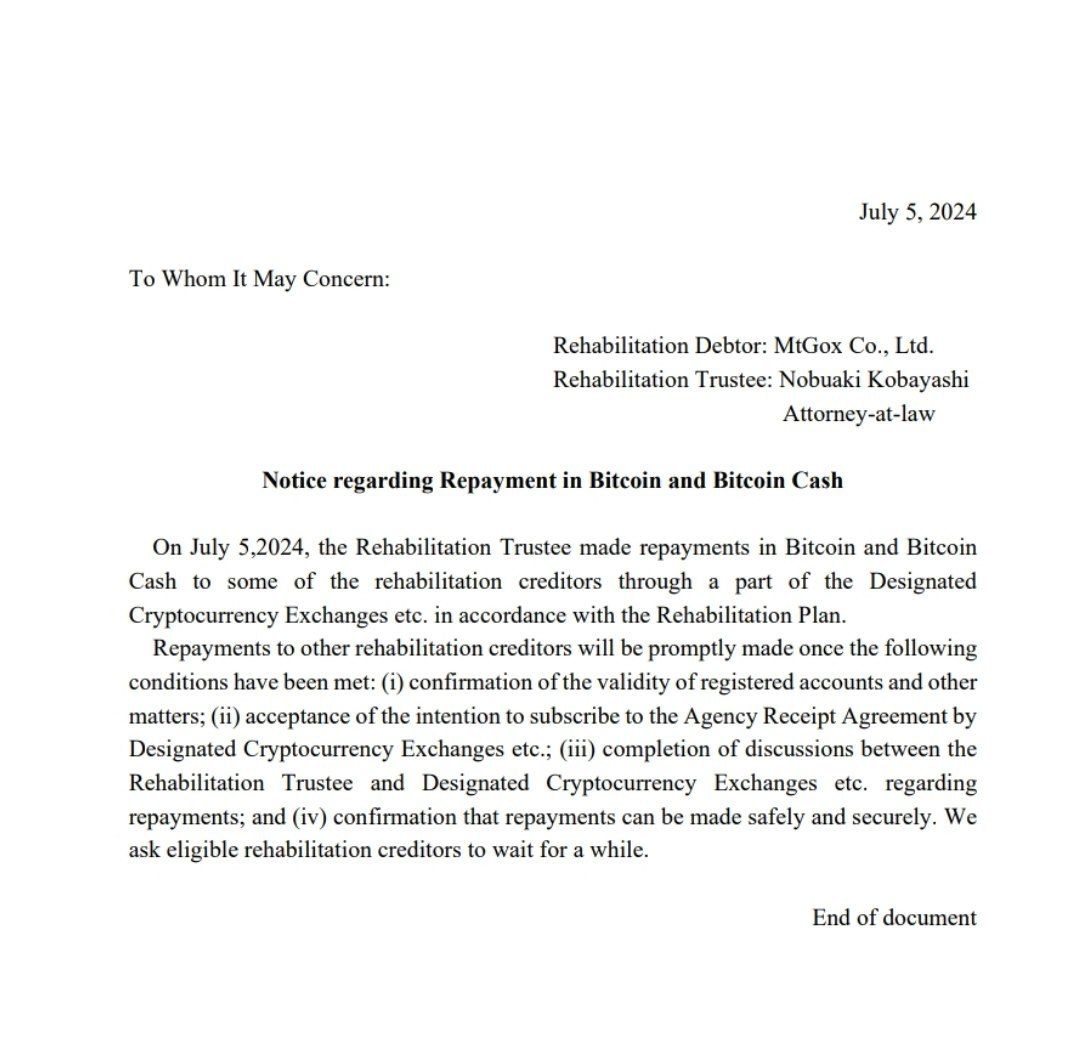

Mt. Gox, the infamous crypto exchange that collapsed in 2014, has begun repaying its creditors in Bitcoin (BTC) and Bitcoin Cash (BCH). This long-awaited move raises questions about the potential market impact of these repayments.

However, repayments to other creditors will only proceed after several conditions are met, including account validation, agreement subscriptions, and secure transaction confirmations.

The rehabilitation plan aims to repay a total of $8.5 billion worth of Bitcoin, sparking concerns and speculation within the crypto community.

Recent Transactions and Market Response

Recently, Mt. Gox transferred 47,229 Bitcoin, valued at $2.71 billion, to a new wallet. Additionally, 1,545 BTC ($84.87M) were sent to Bitbank. This activity coincided with Bitcoin hitting a four-month low of $53,499 on Coinbase, indicating market sensitivity to Mt. Gox's movements.

The main concern is the sheer volume of Bitcoin that could potentially flood the market as creditors receive their repayments.

However, analysts suggest that the impact may not be as severe as feared. Galaxy Digital's head of research, Alex Thorn, pointed out that many creditors might hold onto their Bitcoin due to significant capital gains tax implications if they sell immediately.

Creditors' Options and Early Settlements

Creditors had until March 10, 2023, to decide whether to take an early lump sum of about 90% or to wait until the end of the civil litigation.

According to a recent Coinshares report, approximately 75% of creditors chose the early settlement, reducing the amount of Bitcoin likely to hit the market in July to around 95,000 BTC. Notably, Bitcoinica and MtGox Investment Funds (MGIF), which opted for early settlements, account for about 30,000 BTC of this total.

Potential Market Impact

With about 75,000 BTC potentially entering the market, the impact will depend on various factors.

The distribution will occur across multiple exchanges (Bitstamp, Kraken, Bitbank, BitGo, SBI VC Trade, and others) and different dates, mitigating the risk of a massive, simultaneous sell-off.

Worth noting, the average daily exchange inflow of Bitcoin has been around 32,000 BTC over the last 12 months, with spikes exceeding 100,000 BTC. This suggests that the market can handle significant inflows without drastic price drops, according to Luke Nolan, analyst at CoinShares

Given the historical offers from claims buyers and the tax implications, many creditors might sell only a portion of their holdings or hold them longer.

Worst-Case Scenario

Even under aggressive selling conditions, where up to 75,000 Bitcoin could enter the market, the distributed nature of transactions minimizes the impact on any single platform or day. Analysts suggest that such controlled distribution could actually bolster market resilience rather than undermine it.

“Assuming our estimate of US$8.74bn of daily traded volume on trusted bitcoin exchanges, in the worst case scenario US$2.8bn could be sold,” Luke Nolan stated.

However, Bitcoin Cash (BCH), with an $8 billion market cap, might face more pressure. Analysts estimate that 80% of the distributed BCH could be sold by creditors, given its lower popularity compared to Bitcoin.

bsc.news

bsc.news