There is a bloodbath in Bitcoin and altcoins. Activity in Mt.Gox wallets caused BTC to break important price support and fall to $53,400 for the first time since February 26.

At this point, the selloff in Bitcoin led to the collapse of the bankrupt exchange Mt. Gox moved a significant amount of BTC to a new wallet in preparation for their refund.

According to data from blockchain analytics firm Arkham Intelligence, the bankrupt Mt. Gox exchange moved 47,228 BTC worth $2.6 billion from the cold wallet to a new address.

After this transfer Mt. Gox-related address also made a BTCF transfer worth $85 million to Bitbank. Blockchain security firm PeckShield, in its post from the 'X' account, said that an address associated with Mt.Gox transferred 1,544 BTC worth approximately $85 million to the Bitbank exchange.

The upcoming refunds, which include 140,000 BTC ($7.73 billion at current prices), 143,000 BCH and Japanese Yen, were announced in recent weeks and it was stated that the refunds would take place at the beginning of July.

Since then, traders have been worried that creditors who have been patiently waiting for repayments for a decade would sell their BTC immediately after receiving it, creating mass selling pressure on the market.

$679 Million in Bitcoin and Altcoins Evaporated!

The selling pressure created by Mt.Gox refunds also affected altcoins other than Bitcoin.

Accordingly, Bitcoin dropped by 8% in the last 24 hours, falling below $ 54,000. Ethereum (ETH) fell more than 11% to $2,869, Solana (SOL) 7.4%; Cardano (ADA) 15.4%; BNB fell 12.1% and Dogecoin (DOGE) fell nearly 15%.

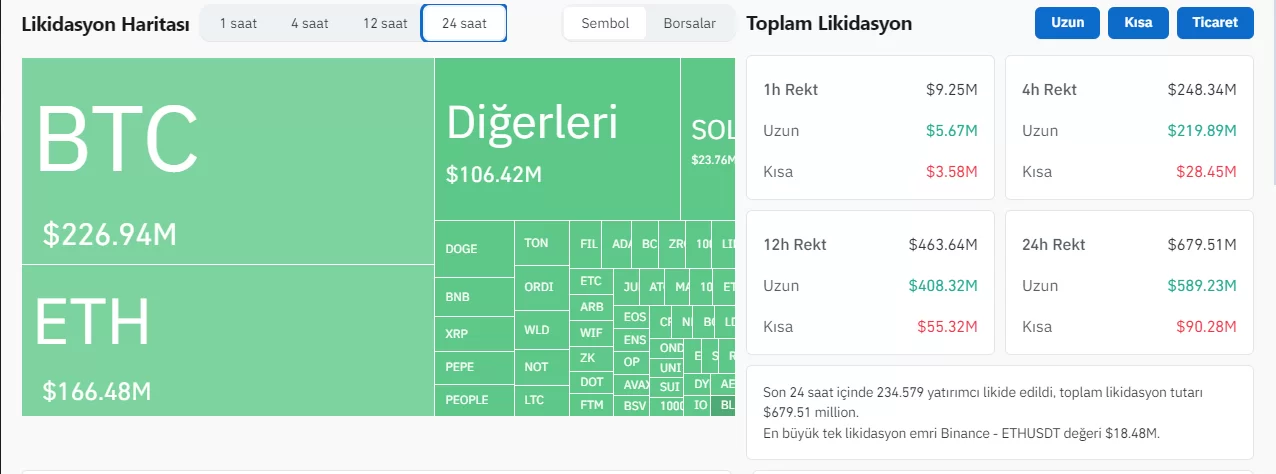

These declines caused many long positions to be liquidated. According to Coinglass data, $679 million in leveraged transactions were liquidated in the last 24 hours. Of these, $589 million consisted of long positions and $90 million consisted of short positions.

While 234,588 investors liquidated in the last 24 hours, the largest single liquidation order was in the ETH/USDT trading pair on Binance. The transaction was valued at $18.48 million.

Finally, experts stated that the sales wave in BTC may continue and added that the intense sales wave turned the horizontal support of $ 56,500 resulting from the bottoms in May into resistance.

*This is not investment advice.