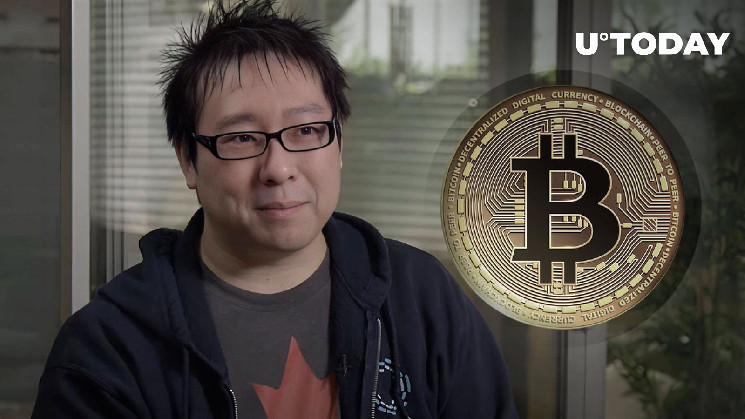

Vocal Bitcoin advocate and chief executive of BTC company JAN3 Samson Mow has made an important BTC call, addressing the governments of various countries. Mow warned them about the growing importance of the world’s flagship cryptocurrency.

Mow warns global governments

Samson Mow commented on the current state of economies in various countries, including, it seems, the United States. Mow once again touched on the subject of fiat money and its inability to support a healthy economy.

He tweeted that it is impossible to fix the economy “because the money is broken.” His recommendation is that they must “fix the money first” and added a Bitcoin hashtag.

Governments, you can’t fix the economy because the money is broken. You must fix the money first. #Bitcoin

— Samson Mow (@Excellion) July 3, 2024

Mow believes that Bitcoin is very much undervalued at the moment, despite the massive sell-offs that have been taking place across the market recently, according to his recent X post. Mow cited the “Omega law” when talking about this. He did not clarify what he meant exactly; however, this sounds like a clear reference to his earlier tweets, in which he shared his expectations of an “Omega candle,” which would take Bitcoin to massive new all-time highs and then to $1 million.

Mow believes that if BTC does not surge to this astronomic price high this year, it will happen in 2025 or very soon anyway.

Sell-offs will not harm Bitcoin, Mow says

Over the weekend, the JAN3 boss shared that he does not believe that current sales will harm Bitcoin. All BTC that is currently being sold, he tweeted, will eventually be consumed by the cryptocurrency market.

Crypto fans like comparing investors who sell quickly to “paper hands” and long term holders of crypto are referred to as “diamond hands.” Thus, Mow believes that investors with diamond hands will buy everything that “paper hands” are selling. In particular, the Bitcoin maxi reckons that Bitcoin will be consumed by spot ETF issuers – BlackRock, VanEck, Grayscale, Bitwise, etc.

They purchased Bitcoin actively on a daily basis between mid-January (when these ETFs were approved by the SEC) and April 20, when the BTC halving took place. After the halvening, the spot ETFs started seeing not only massive inflows but outflows as well – sometimes also daily ones.

Over the last 24 hours, the largest cryptocurrency on the market has plunged by 3.7%, losing the $62,800 level and dropping to the $60,500 zone.

u.today

u.today