Bitcoin’s recent surge above the key $60,000 mark, driven by substantial buying activity, is signaling a potentially bullish July for the cryptocurrency. On-chain data reveals strong demand, with 237,000 addresses accumulating Bitcoin in the $61,000-$62,600 range, aligning with historical trends of positive July returns.

Historically, July has been a favorable month for Bitcoin, averaging a 7.42% return. Investors and traders are now keenly observing whether Bitcoin can maintain this upward momentum.

Source Bitcoin News X (formerly Twitter)

This price range, bolstered by substantial buying activity, serves as a strong foundation for potential further gains. The influx of buyers at these levels signals confidence in Bitcoin’s upward trajectory.

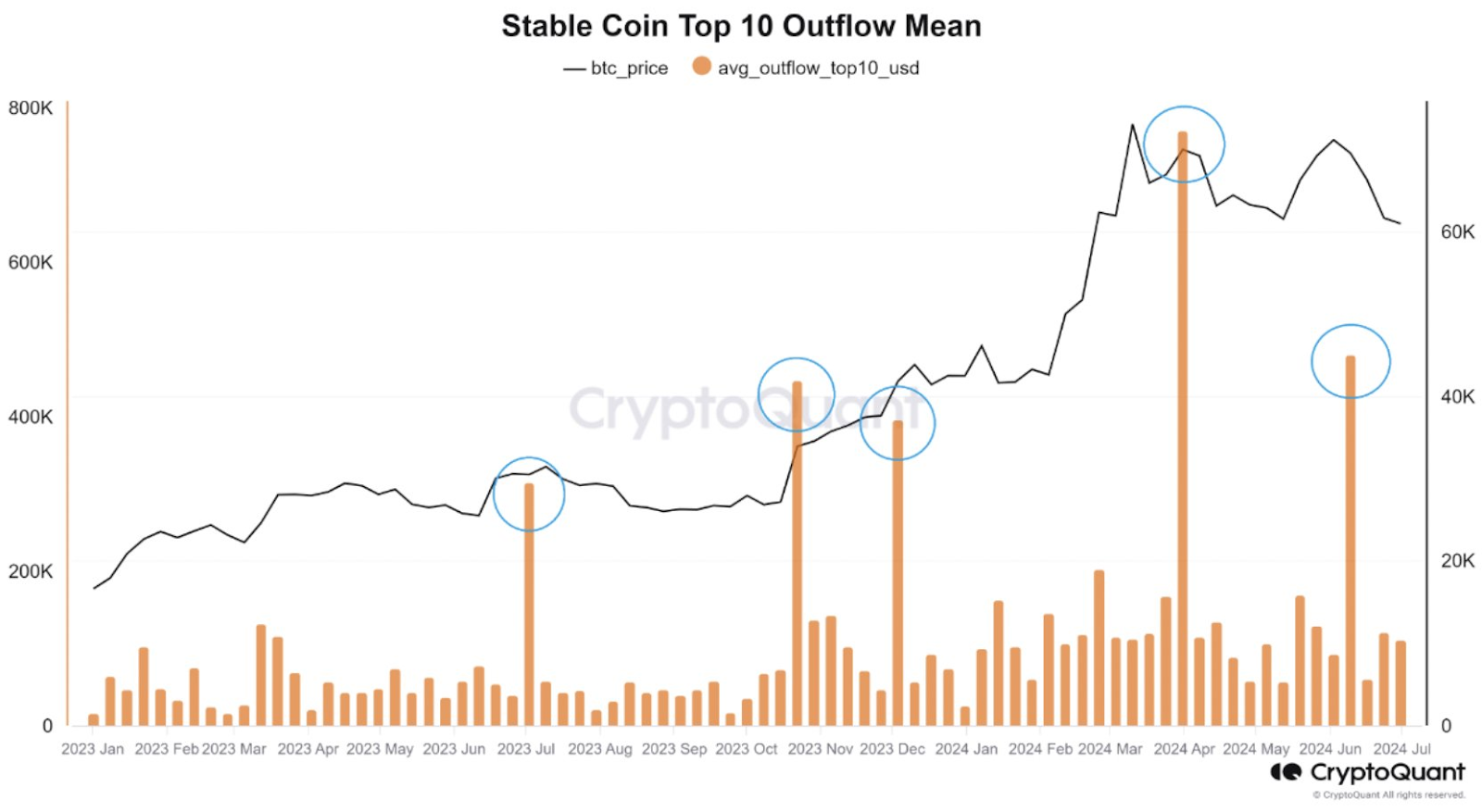

Recent analysis by CryptoQuant reveals that sellers are showing signs of exhaustion, a development that could further stabilize Bitcoin’s price. Reduced selling pressure often correlates with a more stable or upward price trend, indicating a potential decrease in downward pressure on Bitcoin.

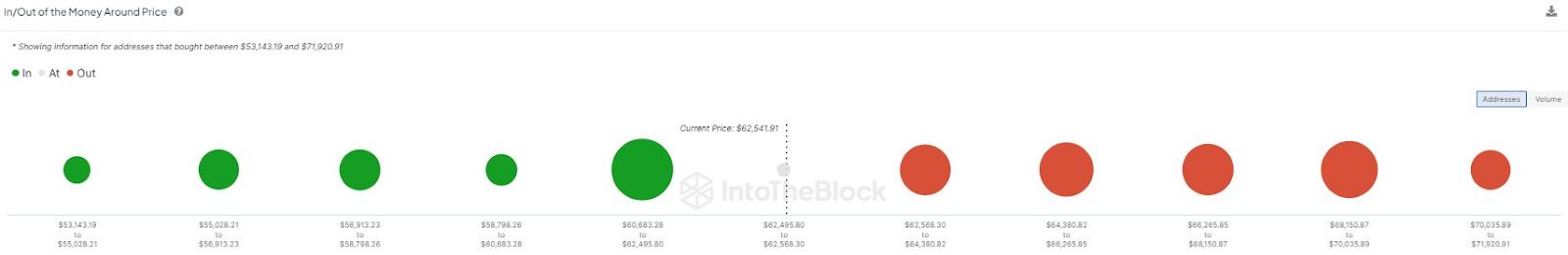

Data from IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) analysis further supports this bullish outlook. The analysis reveals substantial support levels within the current price range, where large volumes of Bitcoin were previously purchased. This suggests that many holders are currently “in the money” (profitable), which could incentivize holding behavior, reduce the likelihood of a sell-off, and potentially pave the way for additional price increases.

Source Into the blocks X

Overall, Bitcoin’s recent performance above the $60,000 support level, combined with strong buying activity, historical trends, and decreasing selling pressure, paints a positive picture for the cryptocurrency’s potential in July.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com