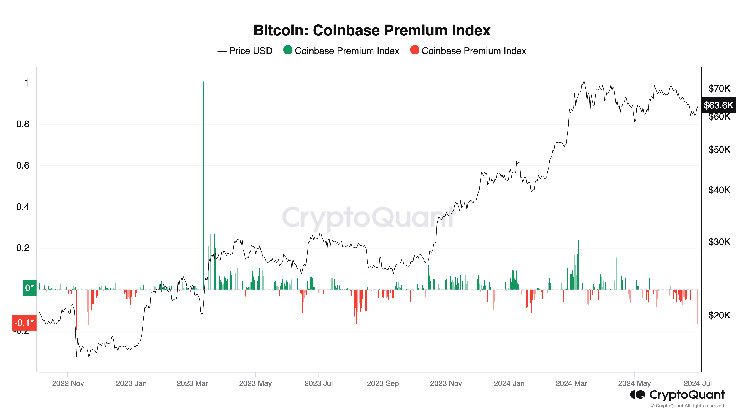

Bitcoin's price premium on Coinbase has plummeted to negative levels rarely seen, CryptoQuant data showed.

Similar readings in November 2022 and August 2023 foreshadowed imminent local price bottoms and subsequent rallies.

Bitcoin (BTC) is trading at a deep discount on crypto exchange Coinbase, which could be a sign that the largest crypto asset's price is bottoming foreshadowing the next leg higher.

"Always darkest before the dawn," asked David Lawant, head of research at institutional crypto trading platform FalconX, in an X post. "The last time the Coinbase premium was this negative was a couple of months before the massive rally from Oct '23 to March '24," he added.

The so-called "Coinbase Premium Index" measures the price difference for bitcoin on Coinbase, widely used by U.S. users and many institutional market participants, compared to the off-shore Binance, the leading exchange by trading volume and popular among retail users.

The metric has been negative for an extended period during June and most of May, echoing last year's market lull in August and September, according to data from analytics firm CryptoQuant. On Friday, it slid to nearly -0.19, its lowest reading on the daily timeframe since the November 2022 collapse of crypto exchange FTX.

Such negative readings suggest weak demand and selling pressure from U.S. investors, as bitcoin has been consolidating range-bound since March's all-time highs. Investors have also grown concerned about outflows from the U.S.-listed spot BTC exchange-traded funds – many of which use Coinbase for settlements – and the U.S. government selling seized assets through Coinbase, which might have contributed to the price discount on Coinbase.

Read more: Bitcoin and Crypto Closing Out Lame Quarter and One Analyst Believes More Pain Could Be in Store

However, such a deeply negative Coinbase Premium previously appeared near to local bottoms in price, followed by significant rallies in the coming months.

The early November 2022 reading coincided with the bear market low for BTC at below $16,000, with prices later surging to nearly $25,000 by February. That was a more than 50% rally.

The August 2023 low in the premium occurred a couple weeks before bitcoin hit a local bottom around $25,000. Then, BTC traded range-bound until October to almost double in price by January driven by anticipation for the upcoming U.S. bitcoin ETFs, and later to new all-time highs.

Most recently, the metric spiked to similarly low levels (-0.17) during the May 1 capitulation to $56,000, from where BTC rallied about 27% to near $72,000 in June before faltering.

"At least recently, the Coinbase premium has become a reliable, confirming, and sometimes even leading indicator of overall market trends," Lawant told CoinDesk in a direct message. "This underscores the significant influence of the U.S. market in determining market price formation."

Given that several upcoming catalysts are U.S.-centric – such as ETF flows, U.S. monetary policy and the presidential election, he said he expects this trend to continue.

"Something tells me the next 6-12 months will be splendid—and probably volatile," Lawant predicted.

coindesk.com

coindesk.com