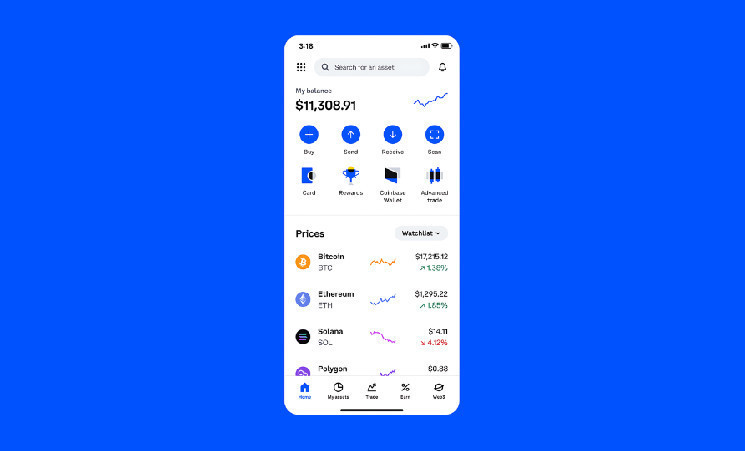

A digital asset wallet believed to be controlled by the United States government has recorded activity. On-chain data provided by Arkham Intelligence, a blockchain explorer, indicates that the U.S. government transferred 3,940 bitcoins worth roughly $241 million to Coinbase, a US-based digital asset exchange.

According to Arkham Intelligence, the government holds Bitcoin worth more than $13 billion. The reason for the transfer is still unknown, and no official communication has been made regarding the transaction. However, speculators in the industry believe this could be a plan for the government to offload some of its crypto holdings.

Also read: Coinbase Donates $25 Million Towards Voting Out Anti-Crypto Politicians

The bitcoins are alleged to have been seized from Silk Road, a popular Dark Web marketplace that facilitated the buying and selling of illegal weapons, drugs, and other substances. The marketplace sank in 2013 after federal agents arrested the owner, Ross William Ulbricht. Ross is currently serving jail time for developing and operating the illegal marketplace.

The U.S. government makes a series of transactions to Coinbase

The US government just sent $240 million dollars in Bitcoin (4,000 $BTC) to Coinbase

What happens next?

— borovik (@3orovik) June 26, 2024

The U.S. government has initiated many transactions recently. Earlier in April, the wallet transferred 30,175 $BTC, worth approximately $2 billion, to the same exchange, Coinbase. This transaction was divided into three transfers.

The first was seemingly a test transaction that only saw the movement of 0.001 $BTC (approximately $65) to the Coinbase Prime deposit address. The second transfer involved the main transaction worth 1,999 $BTC (around $130 million) to the same exchange. The final transaction saw 28,176 $BTC sent to another alleged government-controlled wallet, likely as part of a planned crypto offload.

Bitcoin to move in tandem with the U.S. stock market

In the past 30 days, $BTC has dropped by 9%. However, crypto pioneer and Token Bay Capital’s founder, Lucy Gazmararian, told CNBC in an interview that Bitcoin and the entire crypto market could begin moving in tandem with the stock market. Lucy emphasized that the crypto market is slowly gaining entanglement in traditional finance.

Also read: Bitcoin breaks $60,000 level while Memereum presale nears 25M tokens sold

These claims have also been reinforced by Bitcoin’s reaction to macroeconomic indicators as well as global monetary policies like interest rate decisions and employment data provided periodically by the Federal Reserve.

Historically, investors have treated Bitcoin as a long-term investment and a risky asset to hedge against the turbulent waves of inflation. However, Gazmararian highlighted that Bitcoin’s fundamentals differ from traditional assets like bonds and stocks in the current investment field. The difference could initiate a breakdown in the correlation between Bitcoin and these other assets. The Gazmararian stated that the Bitcoin bull run is only halfway through, and a primary surge to all-time highs is imminent.

Cryptopolitan reporting by Collins J. Okoth

cryptopolitan.com

cryptopolitan.com