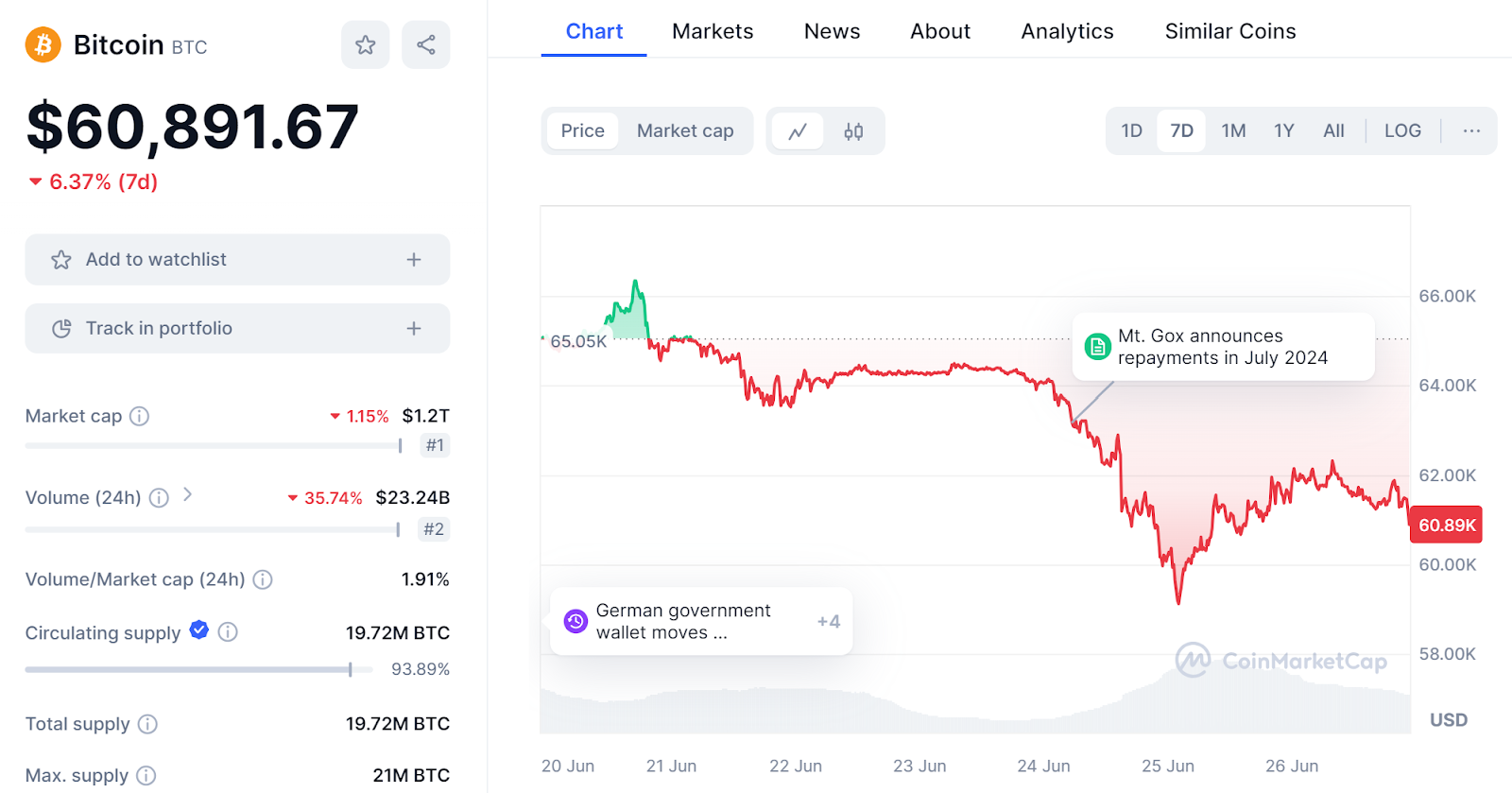

The Bitcoin price is facing a crucial test in the coming days, which will decide whether or not the bottom is in for $BTC and other large-cap cryptocurrencies.

$BTC appears poised to re-test the $60k support, a level it held in the crypto crash earlier this week. Experts believe that a successful test paves the way for new all-time highs while a breakdown below it could result in $BTC falling to as low as $48k.

This week’s key macroeconomic data – including the GDP and PCE figures – are expected to play a crucial role in Bitcoin’s price action.

What’s Next For The Bitcoin Price – Sell or Buy The Dips?

The Bitcoin price currently hangs on a knife’s edge, with the bears and the bulls equally in control.

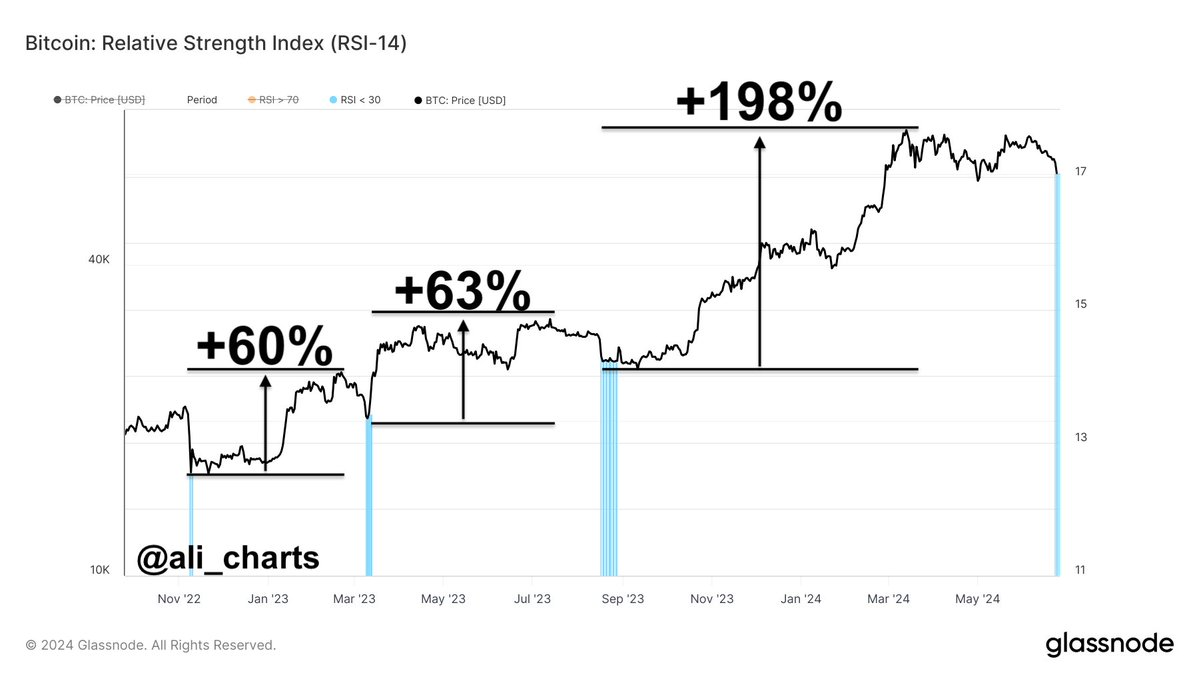

Several historic indicators seem to favour the bulls. For instance, the Bitcoin RSI dipped to the oversold territory earlier this week, which is typically followed by a significant $BTC price rally. The last time $BTC’s RSI became oversold, the largest cryptocurrency skyrocketed by nearly 200%.

Similarly, Bitcoin’s MVRV ratio – which fell to -8.90% earlier this week – is signalling a significant bounce in $BTC.

Since February 2023, the #Bitcoin MVRV Ratio has dipped below -8.40% on four occasions, triggering $BTC price jumps of 63%, 100%, 92%, and 28%.

— Ali (@ali_charts) June 24, 2024

Currently, with #$BTC priced under $60,000 and the MVRV Ratio at -8.96%, this might be an ideal time to buy the dip! pic.twitter.com/mn9EzXdD5s

However, several fundamental factors seem to be favouring the bears. Dr Martin Hiesboeck – the Head of Research at Uphold – signalled a potential crash to $48k, owing to the ongoing miner capitulation and the disinterest amongst ETF holders.

Technical analysts believe that Bitcoin’s price action in the coming week will likely be decided by its test of the $60k support. As long as the bulls avoid a daily or weekly close below the level, they remain in control. In fact, a successful retest of the support could kickstart a bullish divergence to new all-time highs.

$BTC longs favored for me down here at support

— HornHairs 🌊 (@CryptoHornHairs) June 26, 2024

Retest of $60k sets up a potential bull div to keep us range bound and chopping into next month-August.

Invalidation clear at $58.5k and low of the week, don't want to see us trade below that, which makes for a clear trade setup. pic.twitter.com/SK9ta0e5XH

Key Macroeconomic Data This Week Could Be The Decider For $BTC

Amidst a slew of economic data set to be released this week, two are of key importance.

Firstly, all eyes will be on the Final GDP data for Q1 2024, considering the concerns regarding stagflation – a phenomenon which describes slow growth and high inflation. A worse-than-expected GDP could negatively impact market sentiment and adversely affect Bitcoin.

Secondly and more importantly, the Bureau of Economic Affairs is set to release the Personal Consumption Expenditure, which is the Fed’s favoured inflation index. The PCE will play a key role in the Federal Reserve’s monetary policy for the rest of the year.

The upcoming PCE holds such key importance that Matthew Dixon – the CEO of Evai – believes that a better-than-expected report on Friday could lead to a new all-time high for Bitcoin.

Evidence is mounting that bottom MAY be in on #Crypto for now.$BTC shown here has been contained within a parallel price channel in this current EW wave cycle.

— Matthew Dixon – CEO Evai (@mdtrade) June 26, 2024

The move down from the $ATH looks corrective and so IMO we will see a new $ATH soon perhaps following better #PCE Friday pic.twitter.com/FKvkFBfTnl

New Presale Cryptos Surge In Demand

The uncertainty in Bitcoin and other large-cap cryptocurrencies has turned investors to crypto presales.

The broader market sentiment has no impact on presale tokens, which allows traders to invest in assets with strong fundamentals without any concern about short-term price action.

For instance, a new Solana meme coin – Sealana (SEAL) – concluded its highly successful presale yesterday after raising over $6 million. According to its X account, the meme coin will go live on July 2nd, following which the presale buyers will receive their SEAL tokens.

🦭 #Sealana brings news for all the Loyal $SEAL Comrades out there! 🏎️💸🇺🇸 Are you prepared to get your #Tokens with absolute ease! 🚀 #Airdrop and Trading kicks off July 2nd at 1 PM UTC! 🕙🦭

— Sealana (@Sealana_Token) June 26, 2024

Get ready to trade $SEAL on #DEX using our @RaydiumProtocol or @Uniswap pools that… pic.twitter.com/7Nv9Xdofyw

Meanwhile, investors continue to stack Sealana at its discounted presale price, an offer which will no longer be available after its IEO.

Owing to the popularity of its comical mascot – a chubby and patriotic seal – experts believe that Sealana could be the next big Solana meme coin.

Similarly, a new learn-to-earn cryptocurrency – 99Bitcoins (99BTC) – has raised over $2.2 million in its ICO. Being a BRC-20 crypto, 99BTC is expected to show a strong correlation to Bitcoin after its launch and could therefore deliver outsized returns, potentially up to 10x.

As such, this new cryptocurrency is enjoying significant support during its presale, thanks to the popularity of the 99Bitcoins’ crypto education platform. Indeed, the company has close to 3 million subscribers across its website and YouTube, which could provide a substantial boost to the new crypto after launch.

Furthermore, its learn-to-earn incentives, community-centric tokenomics and high staking rewards have attracted the attention of deep-pocketed investors, most of whom are bullish on its upside potential.

finbold.com

finbold.com