- 1 The failed Bitcoin exchange, Mt. Gox, announced it would distribute Bitcoin and Bitcoin Cash cryptocurrencies to hack victims in early July 2024.

- 2 The Mt. Gox repayment news may have made BTC holders nervous because its market dominance fell by 1.8%.

- 3 Altcoins showed strength after BTC dominance fell amid the defunct Mt. Gox 140K reimbursement drama.

Once managing up to 80% of Bitcoin (BTC) trading volume, Mt. Gox was a Tokyo-based Bitcoin exchange. It served BTC traders between 2010 and 2014 and unexpectedly ceased operations due to the theft/loss of 850,000 bitcoins.

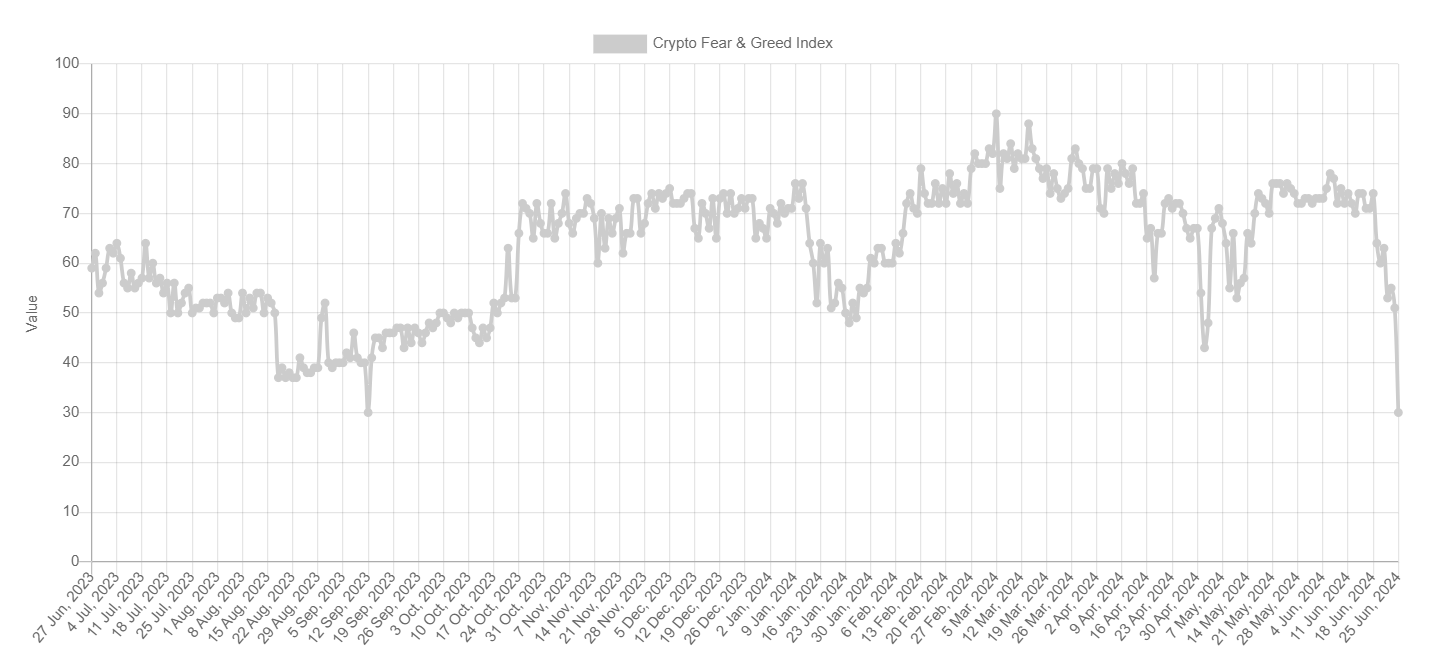

Now, defunct Mt. Gox 140K redemption news has caused turmoil in the crypto market. The Fear was at its peak when Mt. Gox went down, and now, the Fear and Greed index shows heavy fear in the market at press time.

Reports reveal that the defunct Bitcoin exchange has planned to distribute 140,000 Bitcoins to the victims of the hack. The exchange had lost hundreds of thousands of BTC in 2014. It affected many of its users, who will receive the lost Bitcoins in July.

This news had a negative impact on the Bitcoin price. Its market dominance fell by 1.8%, a substantial single-day percentage drop for a long time.

The BTC crypto price fell almost 5% in speculation of supply overhang in the cryptocurrency market. Continue reading to learn more about Mt. Gox redemption and its effects on Bitcoin and Bitcoin Cash (BCH) prices.

How Will Mt. Gox Repayments Affect Bitcoin Price?

Defunct Mt. Gox BTC exchange is preparing to repay the hack victims after over a decade of filing for bankruptcy. As reported, the exchange will repay affected customers $9 billion worth of BTC cryptos. It will also redistribute Bitcoin Cash (BCH) worth $50.8 million to the creditors.

The official repayment announcement from Mt. Gox reveals that the repayments will begin in the first week of July 2024. Creditors have waited for more than a decade and might not hold reimbursed BTCs and BCHs for much longer.

Source: Official Mt. Gox Website

Mt. Gox is finally repaying victims who lost funds due to multiple hack attempts, but BTC Investors seem nervous about it. The failed exchange might plan to distribute 140,000 Bitcoins, valued at around $9 billion. Several BTC holders and crypto experts worry that recipients might offload their crypto assets quickly after receiving them.

It could cause a supply overhang in the crypto market and has caused sell-side pressure on Monday. The Bitcoin price fell below $61,000, breaking the major support level of $60,000. It is now trying to bounce back by taking support of the 200-day EMA.

Why Mt. Gox Declared Bankruptcy?

Many crypto investors lost their funds due to a sudden market fall on Monday. Bitcoin, the world’s leading crypto asset, was affected more severely than altcoins. Many experts associate the drop in Bitcoin’s dominance with the impending MT Gox payouts.

What went wrong with Mt. Gox, which was once the world’s leading Bitcoin exchange? Why did this crypto exchange become the prime target of hackers? Let’s find out.

Jed McCaleb created the Mt. Gox and introduced it as a platform for trading Bitcoin and other currencies. The Failed Mt. Gox exchange claimed that it detected suspicious activity in digital wallets in February 2014. Therefore, it suspended withdrawals after discovering the loss of hundreds of thousands of Bitcoins. It was reported that the exchange lost 650,000 to 850,000 Bitcoins, valuing hundreds of millions.

Since the value of lost/stolen Bitcoins was hundreds of millions, Mt. Gox went into solvency. Once, a thriving Bitcoin exchange filed for bankruptcy on 28 February 2014. The failed crypto exchange was ordered to repay creditors and liquidate in April 2014.

Defunct Mt. Gox Redemption Effects on the BCH Price

Mt. Gox reimbursements could also affect the Bitcoin Cash price as the failed BTC exchange will also make repayments in BCH tokens. Reports show it can distribute Bitcoin Cash cryptos worth over $50 million. Victims may quickly offload those tokens, negatively affecting the BCH crypto price.

How the Crypto Community Has Reacted to Mt. Gox Repayment News?

Crypto experts believe the concerns of 140,000 Bitcoins distributed by Mt. Gox spooked the market. However, the influx would be less than Fidelity’s Spot Bitcoin ETF’s total holdings of 167,375 BTC.

Gumshoe (@0xGumshoe), a researcher, has tweeted that the recently tested support by Bitcoin could be the very bottom.

pay attention because yesterday was a pretty telling day

— gumshoe (@0xGumshoe) June 25, 2024

– insiders knew about Mt Gox, reason why market was weak

– mt gox news came after it got priced in

– bitcoin finally retested $60K on very high volume

– altcoins showed relative strength

– ETH ETF is coming and no one… pic.twitter.com/VGe1xFXiYR

Disclaimer

This article is for informational purposes only and provides no financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your research before making any financial decisions.

thecoinrepublic.com

thecoinrepublic.com