- 1 The German govt. is offloading BTC, while Mt. Gox is also about to distribute a considerable amount of Bitcoin.

- 2 In seven days, the total BTC moved from the German govt. related accounts to CEXs (including Coinbase, BITSTAMP, and Kraken) was 3900 BTC, worth $250.85 Million.

- 3 The German government still holds a whopping quantity of $46.359 K BTC, worth around $2.82 Billion.

Bitcoin price has been under consistent downward pressure, as most participants seem to be offloading the crypto. Around the time of writing, 900 BTC worth $54.76 Million have been transferred in the last 24 hours.

Let us see how the German government offloading Bitcoin and the Mt. Gox Bitcoin getting back in supply could affect the crypto market.

Bitcoin Selling Pressure on the Rise

The Bitcoin sell-side pressure was increasing as BTC retested the range-low price level of $61000, threatening to drop lower. If the sell-side pressure continues to grow, the price could decline toward its next crucial support level, currently at $56,653, as seen below.

Bitcoin price 1-day | Source: TradingView

Moreover, the cause of this decline for now has been indirectly pinned on the Mt. Gox BTC and BCH coming back to circulation soon. However, the German government also has a role to play in the current BTC price downfall as it has been seen offloading Bitcoin in large amounts.

Bitcoin price has been stable, but sell-side pressure from the German Govt and Mt Gox can lead to further downfall.

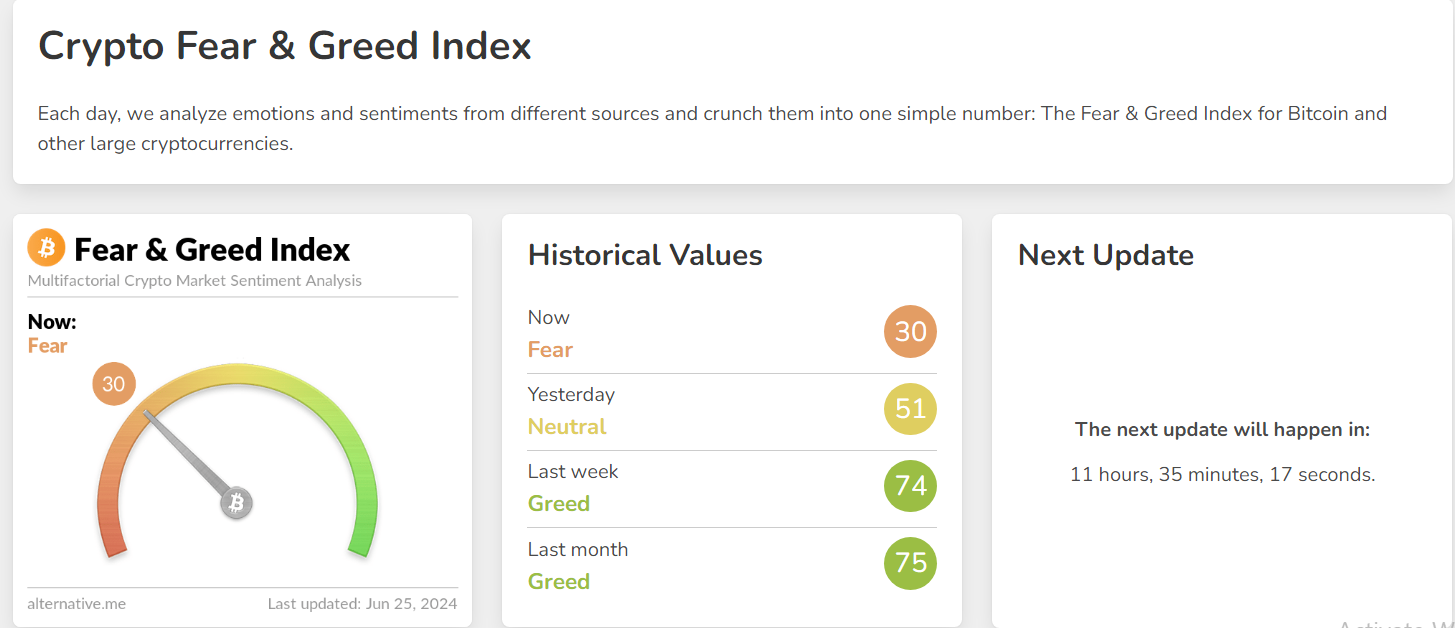

After the update that Mt Gox was ready to repay victims at the beginning of July under the rehabilitation plan, there has been some fear in the market, as it is at 30.

Fear and Greed Index| Source: alternative.me

Charles Edwards, the founder of Capriole Fund, highlighted that Mt. Gox would be dumping $9 Billion in Bitcoin.

Germany is dumping $3B and now MtGox is dumping $9B Bitcoin. pic.twitter.com/O5zWlzr6iG

— Charles Edwards (@caprioleio) June 24, 2024

Overall, this intense pressure could lead BTC’s price towards the next major support.

What’s happening in Germany with Bitcoin

Astekz, a renowned crypto trader, highlighted in a Tweet that the German government is showing themselves to be busy with the Euro 2024 football tournament to distract the public from their Bitcoin mass dumping.

German government are hosting the euros to distract us from the fact they’re mass dumping btc 💀

— Astekz ⚽️ (@astekz) June 19, 2024

In fact, according to updates from Arkham Intelligence, the German Government (BKA) transferred a total of 400 quantities of BTC to Coinbase and Kraken (200 BTC each) on June 25th, 2024, worth about $24.34 Million.

#PeckShieldAlert The #Bitcoin address bc1qq0…738z (labeled as German Gov.?) has transferred 400 $BTC (worth ~$24M) to CEXs (#Coinbase & #Kraken)

— PeckShieldAlert (@PeckShieldAlert) June 25, 2024

Balance: 500 $BTC pic.twitter.com/mh4bSVgtWf

About 1.5 hours later, on June 25th, the BKA transferred another 500 quantity worth $30.42 Million from their holding to address ending -7ybVu.

Overall, 900 BTC worth $54.76 Million have been transferred in the last 24 hours. Moreover, previously, on Thursday, more transfers happened with Coinbase, and the address ended -7ybVu.

In the span of seven days, the total BTC moved from BKA to others (including Coinbase, BITSTAMP, and Kraken) was 3900 BTC worth $250.85 Million.

Overall, after 24 hours of transfer, the German government still holds a whopping quantity of $46.359 K BTC, worth around $2.82 Billion from the current market price of BTC.

Inflow And Outflow Observation

The graph below shows the exchange’s combined outflows and inflows, which is the number of BTC deposits and withdrawals daily.

The graph shows that the inflows or BTC getting transferred on exchanges were 18.9K, while BTC withdrawal into wallets was around $19.7K.

While the current inflows and outflows show that the market is mostly linear, we can also see a rise in flows to exchanges amid the recent market sell-offs.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com