Since the start of June, investors have been watching Bitcoin ($BTC), the world’s premier cryptocurrency, with an increasingly wary eye.

Indeed, despite the long-standing hopes that the various positive developments of 2024 – such as the approval spot $BTC exchange-traded funds (ETFs) – will drive the coin’s price up toward $100,000 or even to $300,000 as some experts have predicted, the actual crypto market moves have been quite different.

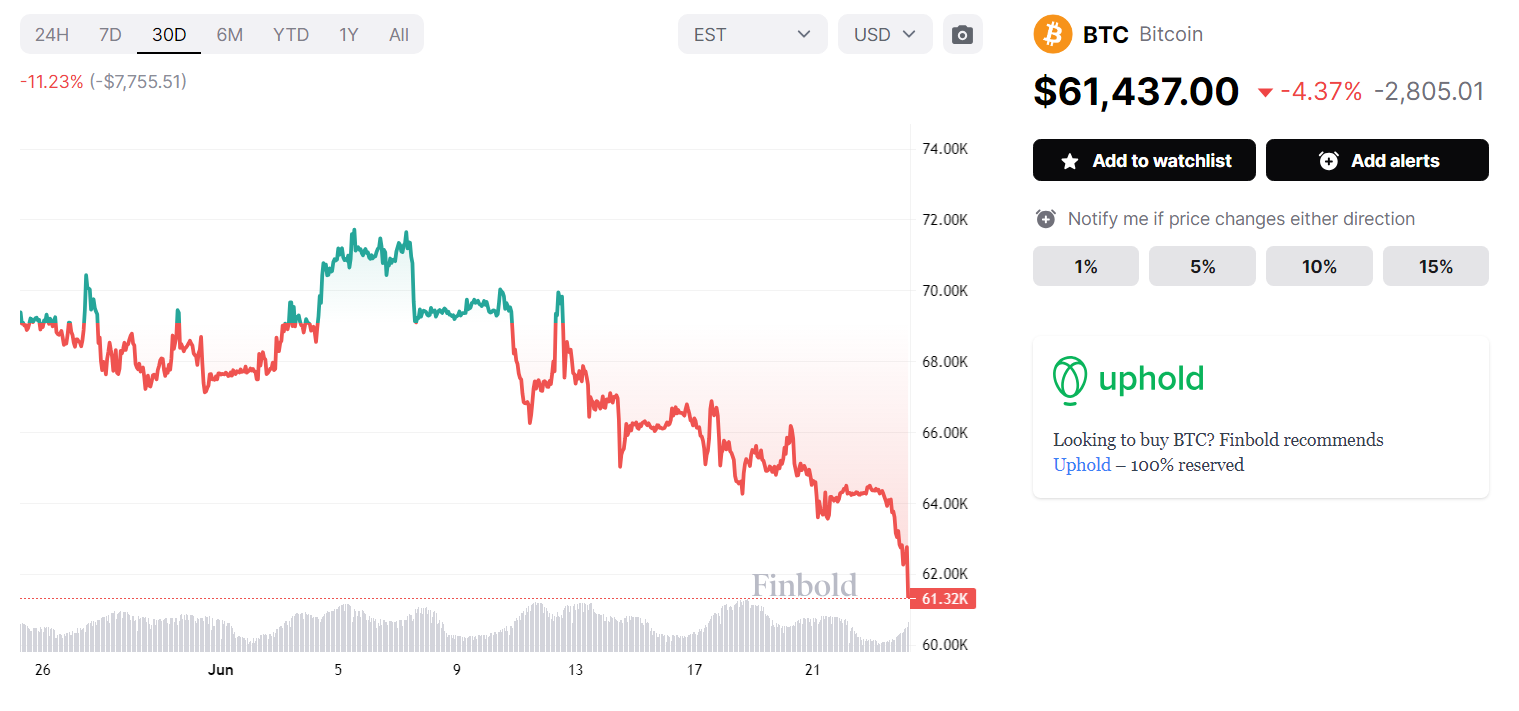

For much of the last 30 days, $BTC has been on a downtrend and fell as much as 11.23%. Bitcoin price today stands at $61,437 – well below its multi-month average between approximately $65,000 and $67,000.

While it is difficult to positively identify the source of the current selling pressure that caused $BTC to drop from just below $67,000 to just above $61,000, recent weeks have featured several events likely to have made traders ‘sell happy,’ leading to some $100 billion in losses in the time frame.

Why is Bitcoin crashing?

Around the middle of the month, the German government started depositing vast quantities of $BTC seized in January to several cryptocurrency exchanges, including Coinbase (NASDAQ: COIN), Kraken, and Bitstamp.

The move quickly caused some concerns among investors given the fact that the Central European country has as many as 50,000 Bitcoins to sell – an amount that could easily cause significant price disturbance.

Still, previous government sales of significant quantities of $BTC – best exemplified with United States’ sale of 50,000 Bitcoins seized from the dark web network Silk Road – show that law enforcement offloadings are unlikely to lead to price dumps.

Nonetheless, fears are likely to have only been fueled further by the May news that the bankrupt cryptocurrency exchange Mt. Gox is poised to begin redistributing assets to its creditors and fully ignited by a June 24 confirmation the payments will start in July.

Given that this includes approximately $9 billion worth of Bitcoin, there is a danger that it will cause substantial selling pressure and a near guarantee that the fears will lead to actual selling pressure.

Germany is dumping $3B and now MtGox is dumping $9B Bitcoin. pic.twitter.com/O5zWlzr6iG

— Charles Edwards (@caprioleio) June 24, 2024

Along with the major moves stemming from rather uncommon $BTC whales, the low volume reported at the start of June is likely to have amplified any price changes arising from the sales.

Additionally, the recent results of technical analysis (TA) conducted by several prominent cryptocurrency experts – results that hinted a substantial downtrend is incoming, may have further spooked investors.

Finally, the aforementioned optimistic price targets – particularly coming in the wake of the Bitcoin halving, but also more recently when Standard Chartered announced the setting up of a spot $BTC and Ethereum (ETH) trading desk – may have caused traders to lose patience and begin taking profits as the world’s foremost cryptocurrency stagnated near $67,000 for multiple months.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com