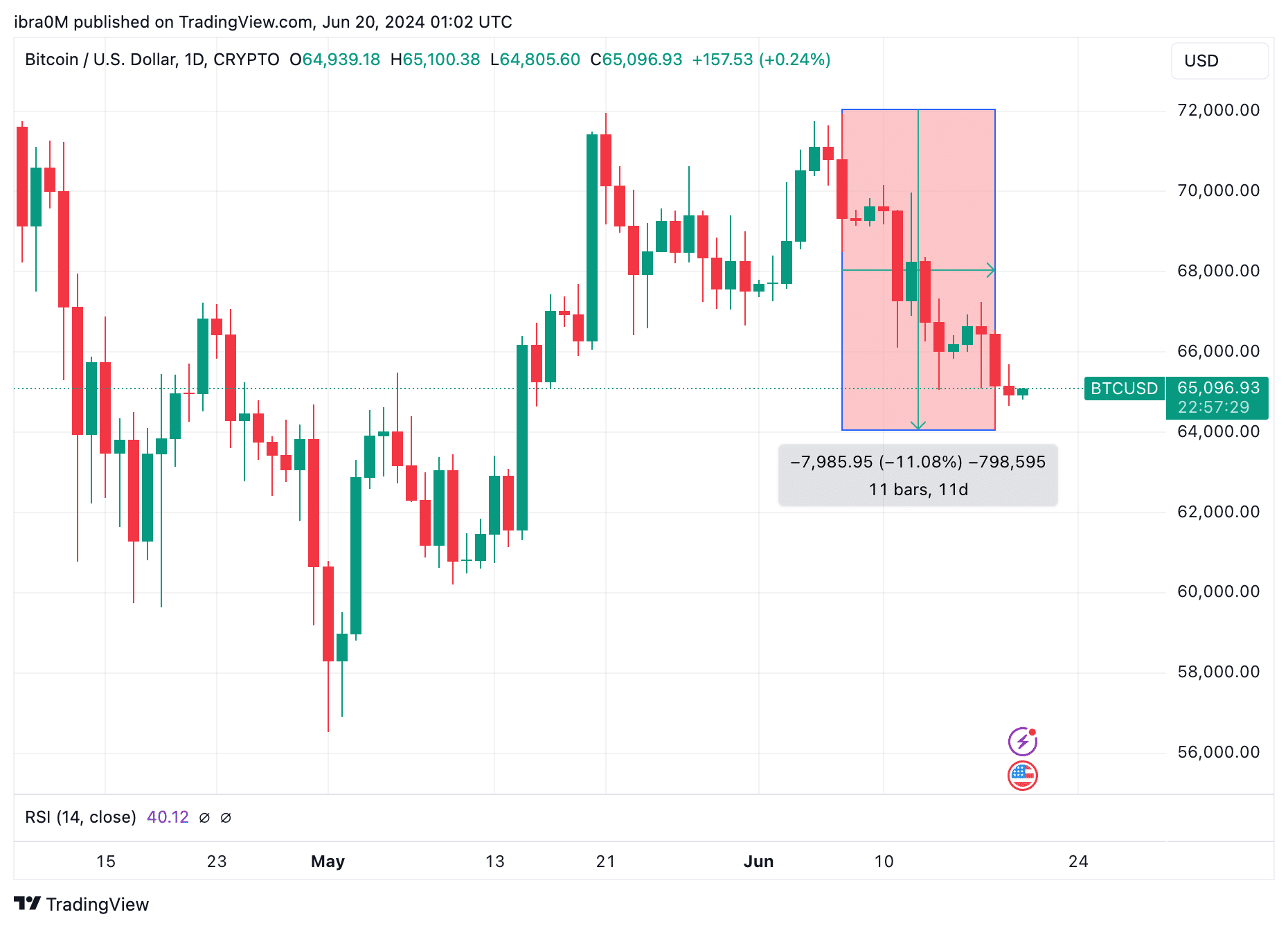

Bitcoin price tumbled below the $64,050 on June 18 2024, as bears forced the month-long BTC downtrend to a 35-day bottom, but the current dynamics in the derivatives markets signal bullish resilience among traders.

Bitcoin Price Dives to 35-Day Low

After a promising start to the month, Bitcoin price retested the $71,900 mark on June 6. But since the overheated labor market data release by the US authorities on June 7 which signalling unrelenting inflation, BTC has succumbed to bearish pressure.

On June 18, the Bitcoin downtrend reached a record low unseen in over 30 days, dating back to May 15, sparking massive liquidations across the rest of the crypto markets.

Looking at the TradingView Chart above, Bitcoin’s retraction towards $64,047 brings its monthly timeframe losses to 11%. But over the last 48 hours, bulls traders have made frantic covering purchases to halt the downtrend.

Consequently, at the time of writing on June 19, Bitcoin price has managed to stage an instant rebound above the $65,000 mark.

Bulls Traders Showing Resilience Despite Market FUD

Curiously, the BTC rebound phase has been subdued by retail traders exiting the market to ape into stock markets as the S&P 500 hit a new all-time high on June 19.

However, a rare market data trend observed in the derivatives markets signals hopes for a more pronounced upside in the days ahead.

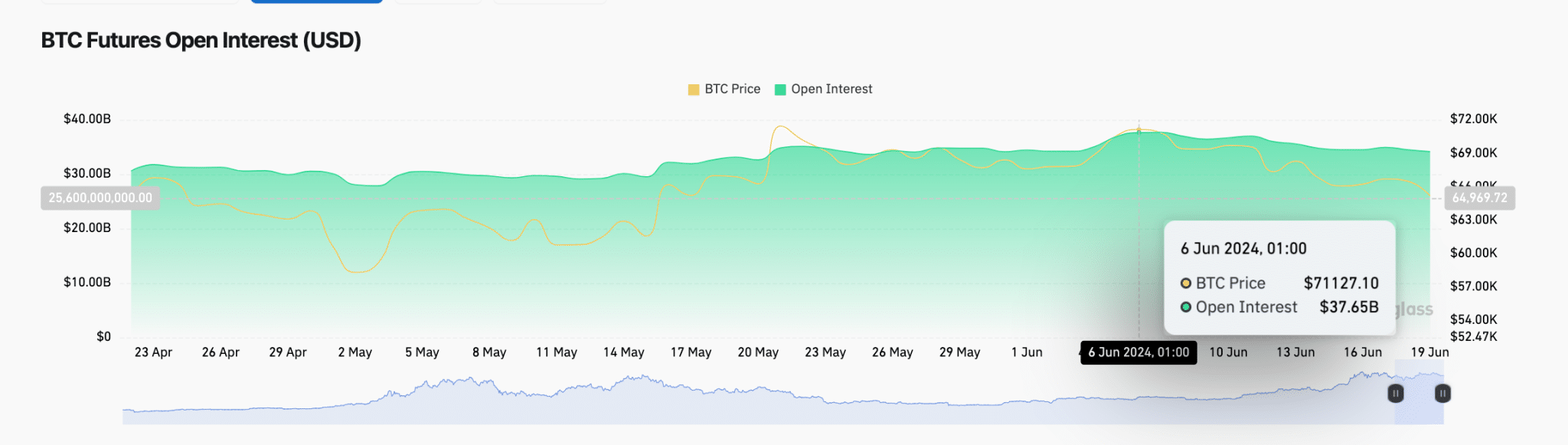

Coinglass’ Open Interest chart shows the total dollar value of all active derivatives BTC futures contracts listed across recognized exchanges and trading platforms.

When compared to the prevailing price trends, the open interest chart provides key insights into speculative traders’ dominant sentiment around the assets’ short-term prospects.

As seen above, Bitcoin open interest stood at $37.65 billion on June 6, just before the the price dip began. But while BTC price has now retraced 11% since then, the open interest has only reduced by $3.51 billion, reflecting 9% decline as it dropped to $34.14 billion at the time of writing on June 19.

This means that Bitcoin’s price has declined by 2% faster than open interest over the last 14 trading days.

When the price of an asset declines faster than open interest during a market dip, it suggests that traders are reluctant to close out their positions.

This can indicate that there is still significant interest and engagement in the market despite the falling prices, potentially highlighting the strong conviction among Bitcoin traders that current price dip is temporary and are holding onto their positions in anticipation of a rebound.

If this scenario plays out, Bitcoin price could be set for a major breakout towards $70,000 when the market sentiment flips bullish again.

thecryptobasic.com

thecryptobasic.com