Speculation about a potential U.S. recession in 2024 has been rampant, with several indicators pointing to this possibility.

In such a scenario, various financial assets, including Bitcoin (BTC), will likely be affected, considering the asset has shown susceptibility to events in traditional finance.

Notably, Bitcoin has yet to be tested in a recessionary environment, so its performance will be closely watched. Therefore, Finbold consulted OpenAI’s latest artificial intelligence (AI) tool, ChatGPT-4o, for insights on how Bitcoin might trade during a recession.

Factors affecting Bitcoin in a recession

The AI tool highlighted several factors that could impact Bitcoin’s price. ChatGPT-4o noted that some have historically perceived Bitcoin as “digital gold” or a safe-haven asset during economic uncertainty.

If this perception persists, demand for Bitcoin could increase during a recession, driving its price up. However, during extreme financial stress, the AI platform noted that investors might prefer liquidating assets, including Bitcoin, to cover losses or secure cash, potentially driving its price down.

Central banks might also implement quantitative easing or lower interest rates to counteract a recession, leading to higher liquidity in the market. This could boost Bitcoin’s price as more money enters the financial system. Bitcoin might attract investors seeking an inflation hedge if inflation is high, further pushing its price up.

The regulatory environment will also play a crucial role. Positive regulatory developments could enhance Bitcoin’s appeal as an investment, increasing its price, while negative regulatory actions could suppress its price, even amid a recession. Increased institutional adoption could also support Bitcoin’s price during economic downturns.

Lastly, market dynamics, such as Bitcoin’s supply and overall cryptocurrency market trends, will influence its price.

Bitcoin price prediction

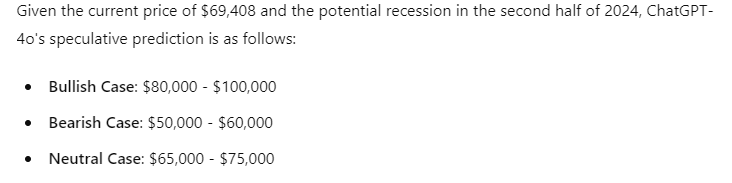

Based on the identified factors, ChatGPT-4o outlined three potential scenarios for Bitcoin’s price in the second half of 2024 in the event of a recession.

In a bullish scenario, if Bitcoin is perceived as a safe-haven asset, inflation is high, and monetary policy is accommodative, Bitcoin’s price could rise significantly, potentially reaching $80,000 to $100,000 or higher, depending on the recession’s severity and the reaction of traditional financial markets.

In a bearish scenario, if investors seek liquidity, face regulatory crackdowns, or if there’s a broad sell-off in risk assets, Bitcoin’s price could decline from $50,000 to $60,000 or lower, depending on the extent of the sell-off.

Elsewhere, in a neutral scenario, Bitcoin might trade within a range if the recession’s impact is moderate and the factors influencing Bitcoin’s price balance each other out. In this situation, Bitcoin could hover around $65,000 to $75,000.

Bitcoin untested during a recession

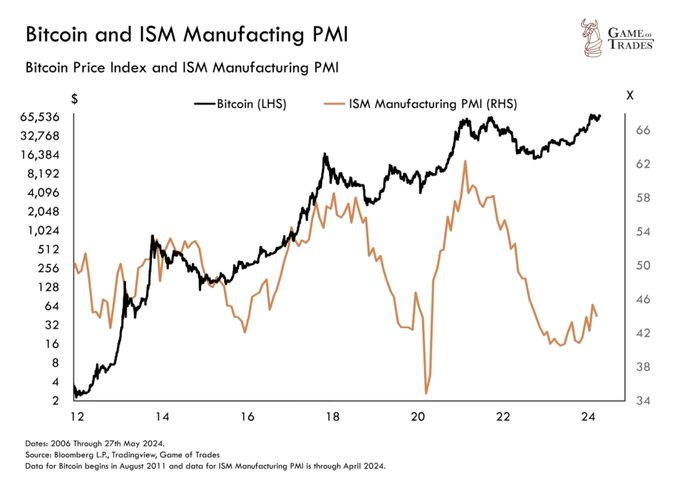

In line with Bitcoin’s possible reaction to a potential recession, investment research platform Game of Trades highlighted that Bitcoin remains heavily influenced by broader economic cycles, as evidenced by its close relationship with the ISM Manufacturing PMI.

In an X (formerly Twitter) post on June 7, the experts warned that a potential recession in the second half of 2024 could significantly impact Bitcoin’s price. This caution stems from the fact that Bitcoin has not yet been extensively tested in such an economic environment, leaving its future performance amid a recession uncertain.

Bitcoin price analysis

By press time, Bitcoin was trading at $69,350 with daily losses of about 2.6%. On the weekly chart, Bitcoin is up 2.61%.

In the meantime, Bitcoin continues to consolidate below the $70,000 mark, and breaching this level will be central to helping the crypto target new highs.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com