Over the past 158 days, starting from the beginning of the year, the quantity of bitcoin held by exchanges and miners has decreased by 183,253 BTC, valued at nearly $13 billion. Roughly 90.95% of this bitcoin withdrawal originated from cryptocurrency exchange reserves.

Exchanges and Miners See Massive Reductions

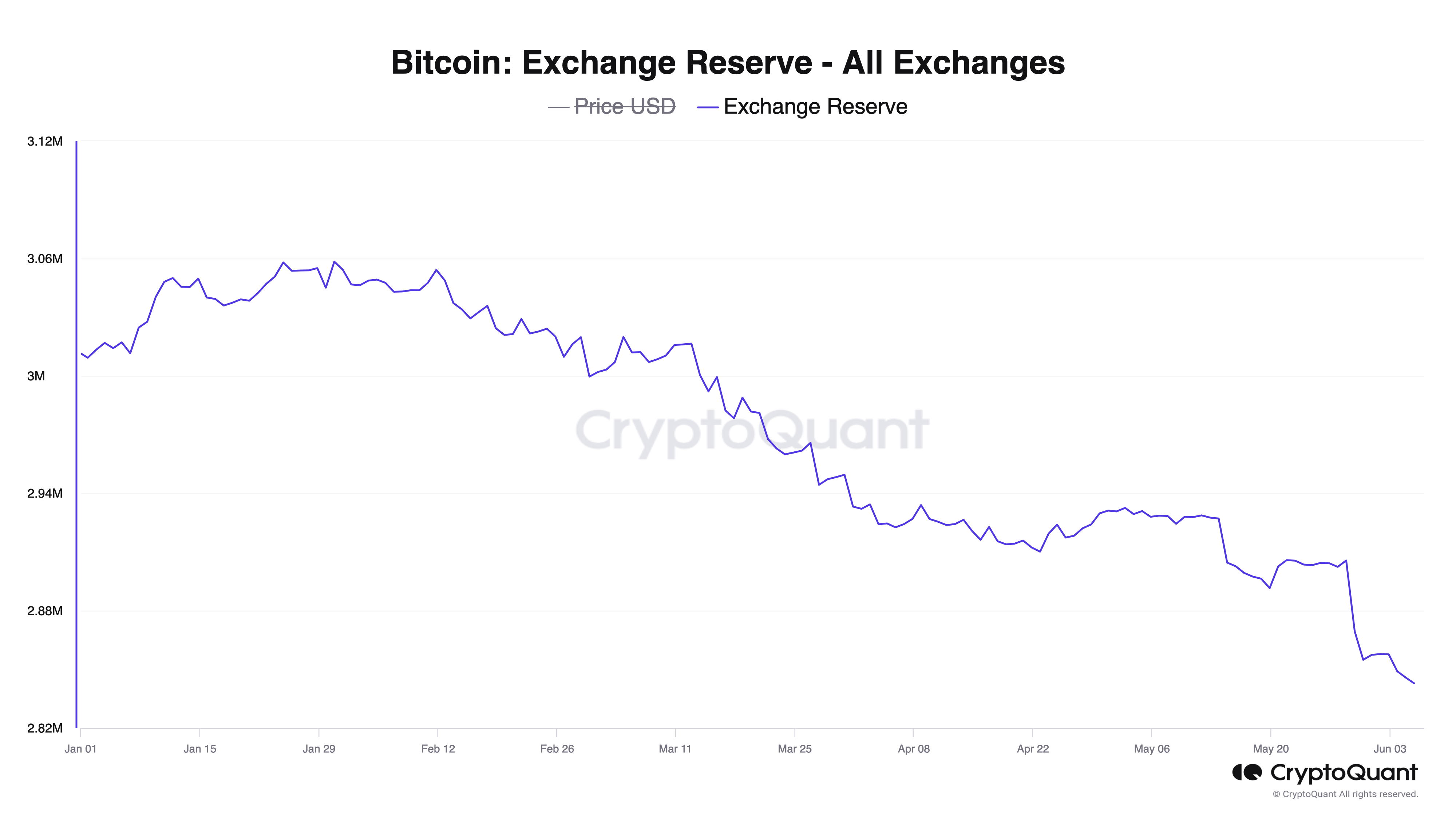

From Jan. 1 to June 7, 2024, a substantial amount of bitcoin (BTC) has exited the reserves of bitcoin miners and exchanges. Although less than 10% of the total originated from BTC miners, their combined holdings are steadily decreasing. According to data from cryptoquant.com, around 183,253 BTC, valued at $12.9 billion, has been withdrawn from the combined wallets of miners and exchanges.

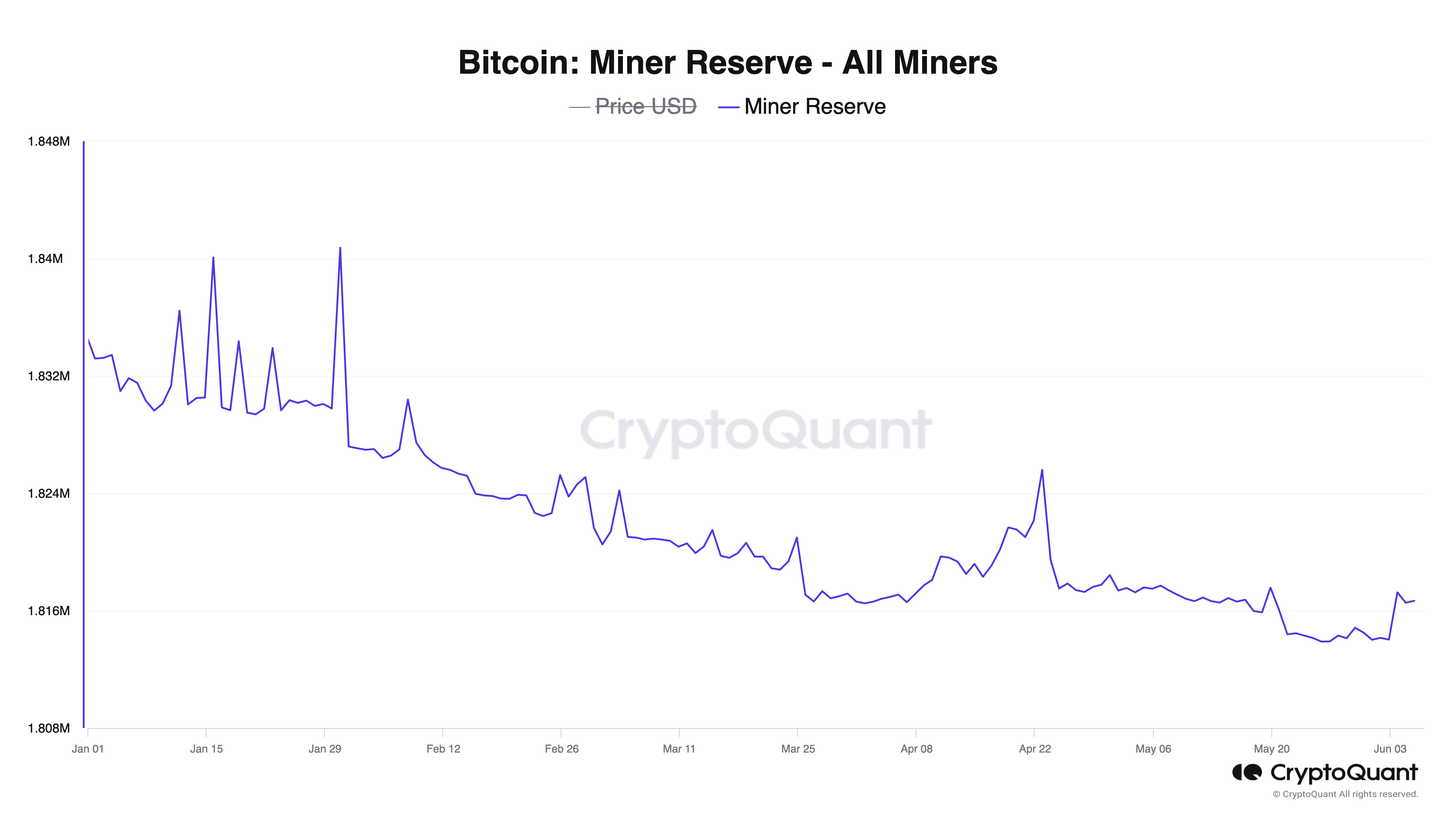

Approximately 9.05%, or 16,578 BTC valued at $1.17 billion, has departed from the collective addresses of current BTC miners. At the year’s outset, miners held 1,833,179 BTC, which has now decreased to 1,816,601 BTC. However, reserves have seen a slight increase since June 3, when they hit a low of 1.814 million. Crypto trading platforms experienced a significant loss, with 90.95%, or 166,675 BTC, withdrawn since Jan. 1.

At the beginning of the year, exchanges held 3,009,239 BTC, which has since dropped to 2,842,564 BTC. A lot has changed this year, especially with the launch of spot bitcoin exchange-traded funds (ETFs) on Jan. 11, 2024. Data from sosovalue.xyz shows that these ETFs have seen cumulative net inflows of around $15.34 billion since their inception. Meanwhile, Grayscale’s GBTC has shed more than 333,000 BTC since Jan. 11.

As of now, it has been 48 days since the fourth bitcoin halving, which occurred at block height 840,000. Since then, and moving forward, the number of BTC issued has significantly decreased, making it challenging for miners to maintain reserves amid operating costs and overhead. An increase in hashprice, which has been rising since BTC surpassed the $70,000 mark, will help bolster reserves.

After hitting a low of $45 per petahash per second per day, the expected value of a petahash has now stabilized at $62. This continuous depletion of bitcoin from exchanges and miners not only underscores a trend toward greater individual holding but also amplifies bitcoin’s inherent value through increased scarcity. As more BTC exits public trading venues, its rarity could further propel its market worth, suggesting a potential for even higher valuation in a landscape where supply increasingly lags behind demand.

What do you think about the number of bitcoins that left the wallets of miners and exchanges? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com