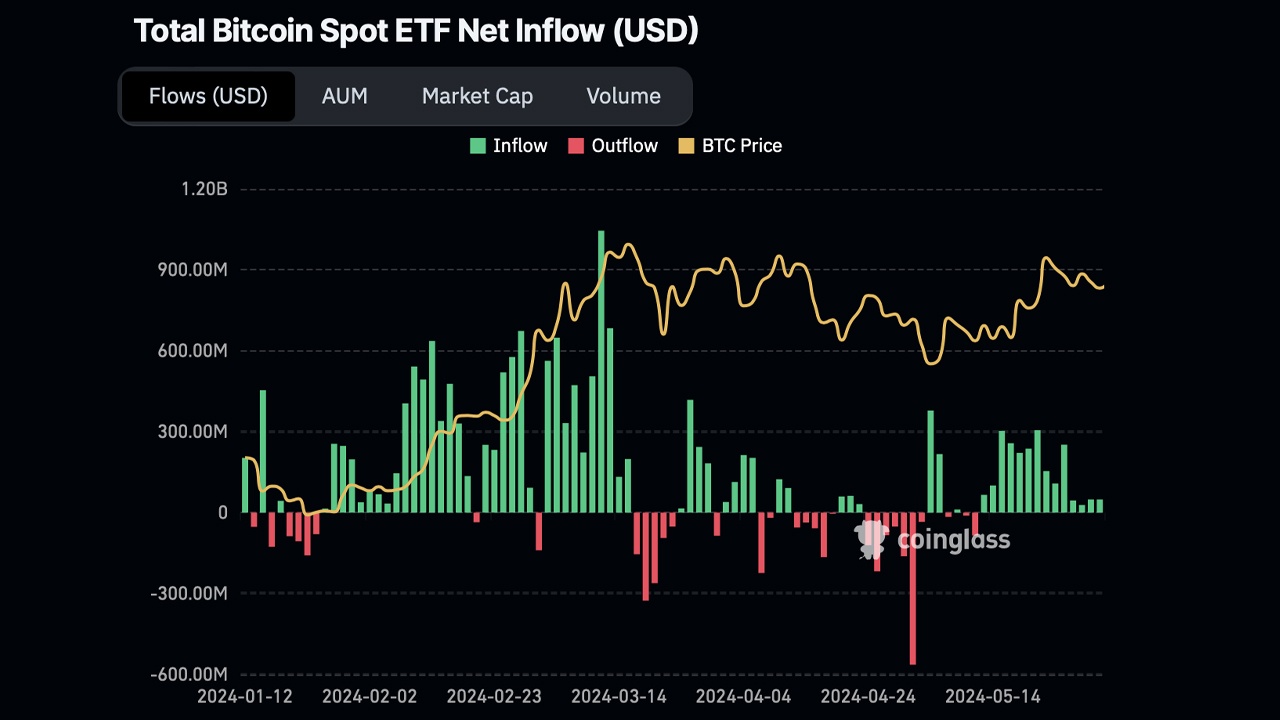

On Friday, U.S. spot bitcoin exchange-traded funds experienced their 14th consecutive day of inflows, totaling around $50 million. Leading the inflows once more was Blackrock’s IBIT, while Grayscale’s GBTC saw outflows.

$1.7B in Trade Volume and $50M in Inflows During Friday’s Bitcoin ETF Trading Sessions

Approximately $50 million in inflows were reported during Friday’s spot bitcoin exchange-traded fund (ETF) trading sessions. The day’s total trade volume amounted to about $1.73 billion. Both Grayscale’s GBTC and Vaneck’s HODL registered outflows, with HODL’s being significantly smaller than GBTC’s. Among the 11 funds, only IBIT and FBTC experienced gains, with Blackrock’s Bitcoin Trust (IBIT) capturing the majority of the inflows.

With GBTC experiencing further reductions, the trust now holds 286,957.14 BTC. Since Wednesday’s update, GBTC has divested a total of 485.89 BTC. On Wednesday, IBIT had an aggregate total of 289,035.25 BTC, and with the latest inflows on Thursday ($48M) and Friday, IBIT now holds 289,058.01 BTC. Mid-week, before FBTC’s latest inflows, Fidelity’s FBTC held 162,303.38 BTC. As of today, FBTC’s holdings have increased to 164,030.47 BTC.

Ark Invest’s and 21shares’ ARKB saw some divestment this week, holding 48,624 BTC on Wednesday. Currently, ARKB secures 47,175 BTC. Meanwhile, Bitwise’s BITB fund held 36,397.69 BTC on Wednesday, and today, the fund holds 36,770.61 BTC as of June 1, 2024. Combined, these five major BTC funds possess an aggregate of 823,991.23 BTC, valued at $55.82 billion.

The remaining funds experienced neutral activity with neither inflows nor outflows, except for Vaneck’s HODL, which witnessed a slight divestment during Friday’s trading session.

What do you think about the latest spot bitcoin ETF inflows? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com