Four years ago, American citizens received stimulus checks from the government in the amount of $1,200 to help them recover from the financial losses incurred during the Covid pandemic, and investing this money was among the popular choices of the checks’ recipients.

Indeed, the United States Internal Revenue Service (IRS) had issued the stimulus checks, or Economic Impact Payments, under the Coronavirus Aid, relief and Economies Act (CARES Act), and the first round amounted to $1,200 (and $500 more per each child).

Investing in Bitcoin

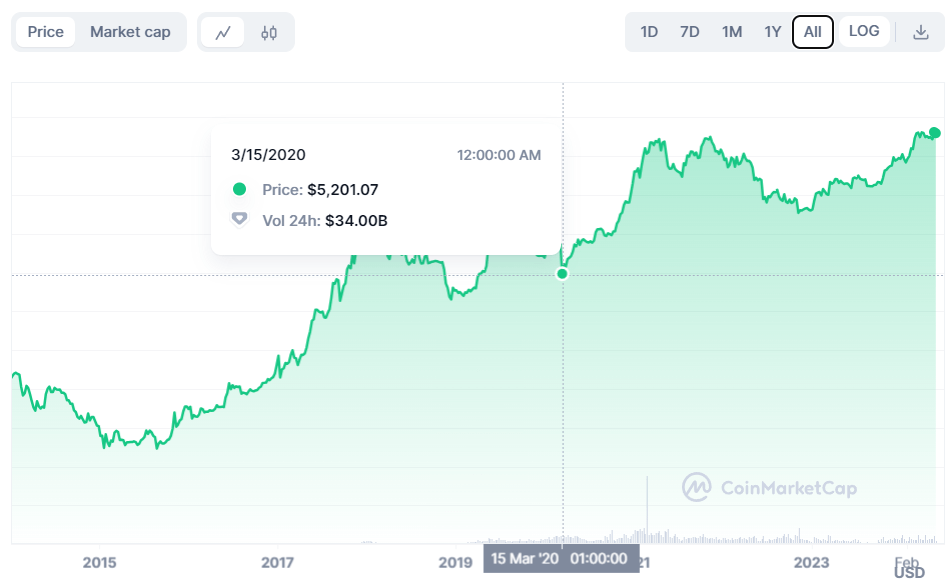

For those who chose to invest their $1,200 stimulus in Bitcoin (BTC) at the time, this would have been an exceptionally lucrative decision, considering that the price of the flagship decentralized finance (DeFi) asset had risen by nearly 1,218% since March 2020 when it stood at $5,201.07.

In other words, investing $1,200 in Bitcoin when its price was around $5,201 would mean that today, the investor in question would be holding close to $15,816 worth of the maiden cryptocurrency, providing them with significant profit if they chose to sell it at a current price.

Bitcoin price analysis

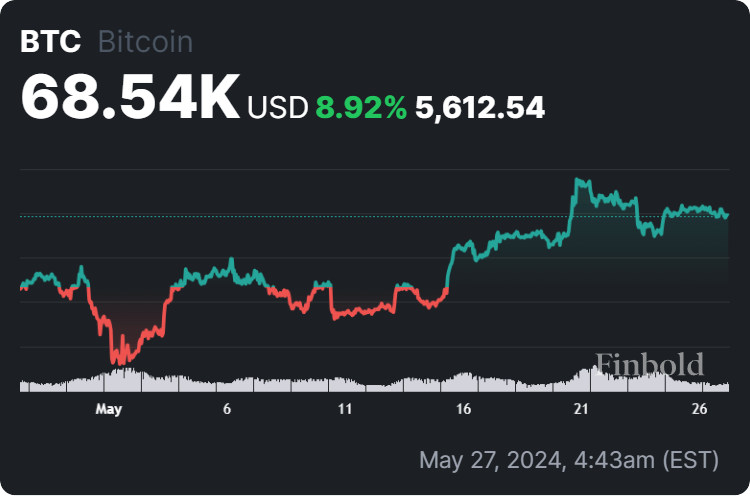

At the moment, Bitcoin is changing hands at the price of $68,540, which suggests a slight decline of 0.88% in the last 24 hours but still an increase of 2.52% across the previous seven days and an 8.92% advance over the past month, adding up to the 62.35% gain this year, as per data on May 27.

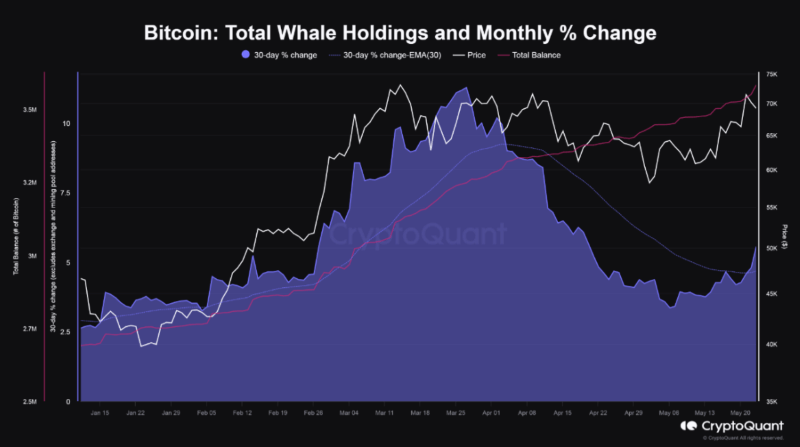

Meanwhile, Bitcoin whales seem to be back in the crypto sea, as they have recently started to show significant buying activity, reflecting the largest holders’ confidence in the crypto asset’s future price and signaling a resurgence of bullish sentiment in the sector, as Finbold reported on May 25.

All things considered, investing in Bitcoin when the government signed the stimulus checks into law back in March 2020 would have been exceptionally profitable, and certain indicators point to further price advances for the largest asset in the crypto market in the years to come.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com