Spot Bitcoin exchange-traded funds (ETFs) in the US registered $1.3 billion in inflows over the past two weeks, shared Bloomberg ETF analyst Eric Balchunas on X. This was enough to recover completely from April’s net outflows of over $343 million.

The Bitcoin ETFs traded in the US now hold more than $12.3 billion under management, which Balchunas considers a key number for considering inflows and outflows.

The bitcoin ETFs have put together a solid two weeks with $1.3b in inflows, which offsets the entirety of the negative flows in April- putting them back around high water mark of +$12.3b net since launch. This key number IMO bc it nets out inflows and outflows (which are normal) pic.twitter.com/tdnZOKEocM

— Eric Balchunas (@EricBalchunas) May 17, 2024

Moreover, Balchunas highlighted that those numbers make a point of not getting “emotional” over Bitcoin ETF flows, sharing his belief that the net flows will turn out as positive in the long term and that the flow amounts are relatively small when compared to the total under management.

As reported by Crypto Briefing, professional investment firms showed a high interest in Bitcoin ETFs in the first quarter, with 937 of them reporting exposure to those investment instruments in their 13F Forms.

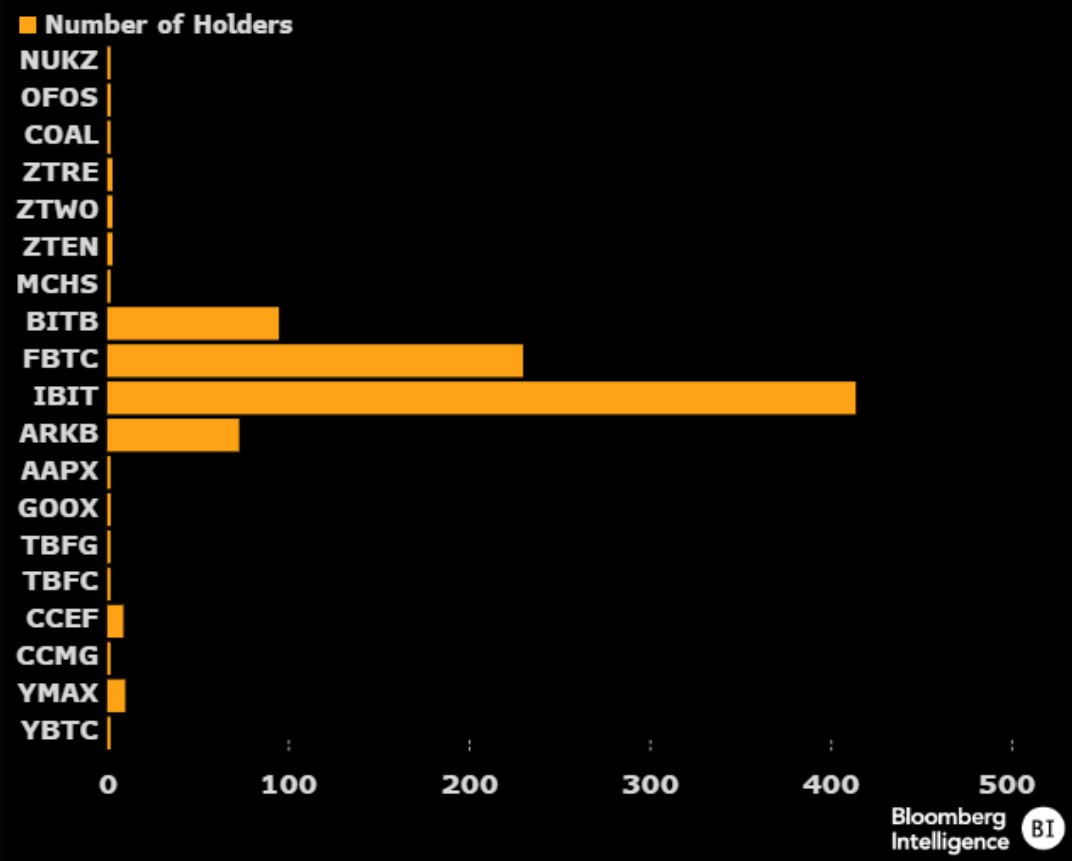

Balchunas doubled down on that, highlighting that BlackRock’s IBIT got 414 reported holders in Q1. He adds that having 20 holders for a recently launched ETF is “highly rare,” showing that at least four Bitcoin funds surpassed that mark with ease.

In the last 24 hours, nine Bitcoin ETFs in the US added 3,743 $BTC to their holdings, as reported by X user Lookonchain, which is equivalent to over $250 million. Grayscale’s GBTC added 397 $BTC, while BlackRock’s IBIT added 1,435 $BTC.

Galaxy’s BTCO was the only Bitcoin ETF showing daily net outflows, with 543 $BTC leaving their chest.

Regulatory movements

Furthermore, recent regulatory developments in the US could heat up even more the Bitcoin ETF landscape. Yesterday, the Senate passed a vote to overturn the SEC’s Staff Accounting Bulletin No. 121 (SAB 121), which makes it more expensive for banks to hold digital assets for their customers.

However, US President Joe Biden has already manifested himself contrary to the bill, and a presidential veto is very likely.

cryptobriefing.com

cryptobriefing.com