Bitcoin surpasses $66K, overcoming major resistance levels and indicating strong market confidence and the potential for a new all-time high.

Bitcoin recently surpassed a significant resistance level at $66,000, marking a notable milestone in its price journey. According to data shared by IntoTheBlock on X, the premier cryptocurrency demonstrated resilience by overcoming substantial on-chain resistance levels.

This move has sparked discussions about the potential of Bitcoin to reach substantial price levels, particularly a new all-time high (ATH), according to IntoTheBlock.

Bitcoin overcame some massive on-chain resistance levels with its move past $66k.

The lack of selling during this move up shows the market's confidence in $BTC. Is a new ATH coming next? pic.twitter.com/0IvJz5uxfR

— IntoTheBlock (@intotheblock) May 16, 2024

Bitcoin Price Distribution

A snapshot shared by IntoTheBlock shows a high volume of addresses in profit within the range of $56,115.72 to $66,048.34. This volume indicates strong market confidence and support, as these holders are likely to retain their positions rather than sell at a loss. Particularly, the range from $64,090.82 to $66,048.34 shows numerous addresses holding profit, suggesting a strong support level just below the current price.

Conversely, resistance levels are identified in the ranges of $67,353.36 to $72,500.92. These addresses, currently at a loss, may sell to break even as the price rises, creating potential selling pressure. This range includes addresses that bought at higher prices and are now out of the money, marking a possible resistance point.

The volume of addresses in the $69,890.89 to $72,500.92 range presents a stronger resistance level. As Bitcoin approaches these levels, the market may experience increased selling pressure from holders seeking to recoup their investments.

Market Confidence and Post-Halving Analysis

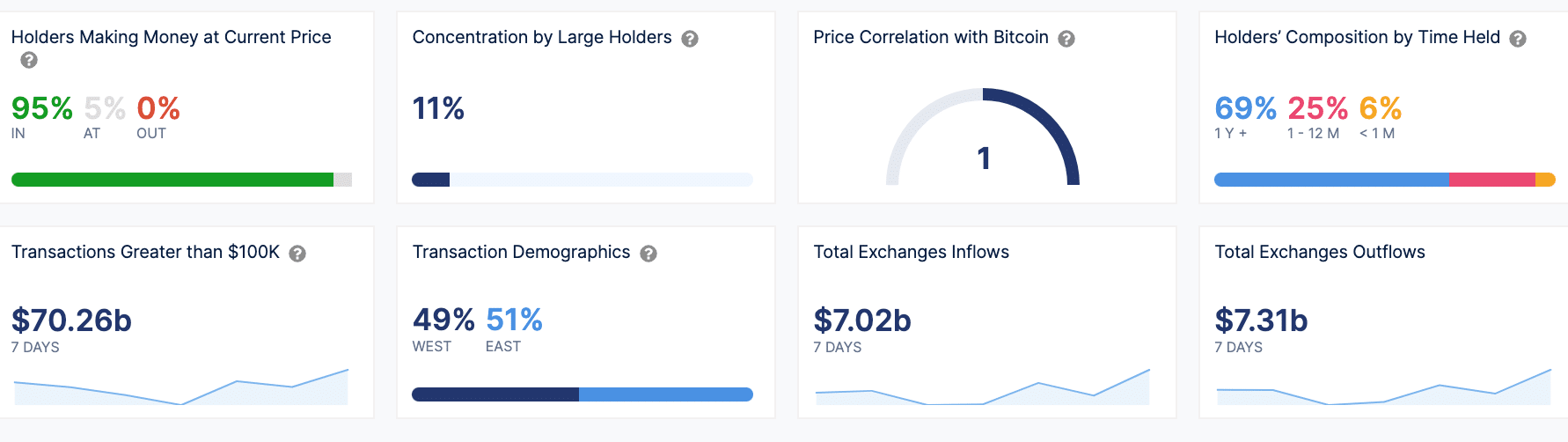

The transaction volume of $70.26 billion for transactions over $100,000 in the past week points to steady market activity, often driven by institutional investors. Moreover, exchange flows reveal higher outflows ($7.31 billion) compared to inflows ($7.02 billion), suggesting that more Bitcoin is being moved to storage, a bullish indicator.

With balanced global transaction demographics and positive exchange signals, the overall sentiment is largely bullish, though mixed on-chain signals indicate some areas of caution.

Recent analysis from The Crypto Basic highlights Bitcoin’s exit from its post-halving “danger zone,” with predictions of decreased volatility and a stable growth path through 2024. Rekt Capital’s analysis suggested an end to the precarious phase following the Bitcoin halving, pointing to a period of price stabilization and potential growth.

Historical data from 2016 show similar patterns in price movements, with a volume spike of approximately 603,000 BTC coinciding with notable price actions. This included a critical drop of 17.87% around July 11, 2016, followed by a recovery phase leading to a parabolic increase in Bitcoin’s price.

thecryptobasic.com

thecryptobasic.com