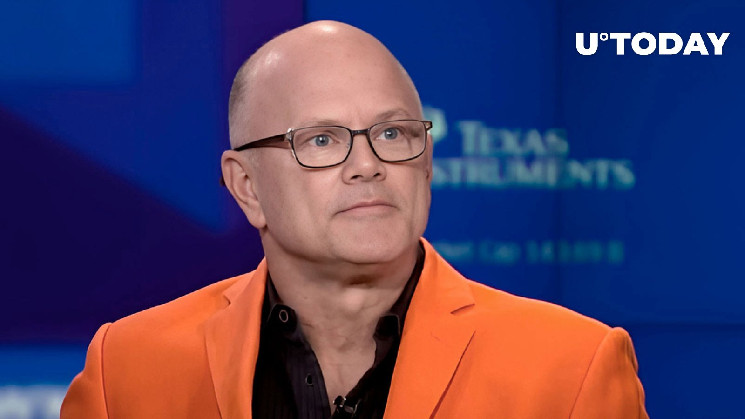

Mike Novogratz, the founder of Galaxy Digital Holdings, shares his insights into the crypto market, hinting that cryptocurrencies have entered a consolidation phase. This phase, often seen as a period of stabilization following market upswings, may indicate a cooling-off period.

Consolidation is characterized by assets moving sideways within a certain range, indicating equilibrium between buyers and sellers. Novogratz believes that this might be the current phase for cryptocurrencies such as Bitcoin, Ethereum and Solana, which have seen significant volatility in recent months. The consolidation phase could be a precursor to the next bull run, depending on various market factors.

Novogratz predicts that Bitcoin, the biggest cryptocurrency by market capitalization, may be stuck in the $55,000 to $75,000 range for the time being.

"We are in the consolidation phase in crypto. Bitcoin, Ethereum and everything else, Solana will consolidate, what does that mean? It means probably somewhere between $55,000 and $75,000 until the next set of circumstances, the next set of market events bring us higher," Novogratz said on a conference call, according to Bloomberg.

The cryptocurrency market has remained static since the record bull run in the previous two quarters, which was fueled by the launch of spot U.S. Bitcoin exchange-traded funds and the Bitcoin halving event.

Bitcoin, however, fell as confidence about the Federal Reserve's interest rate cuts faded due to continually strong economic readings.

Novogratz stated that the cryptocurrency market experienced many tailwinds in Q4 and Q1. A cool-off may be likely in the present quarter; however, this might change in the next quarter if certain factors, such as Fed rate reduction, come into play.

In the most recent indication of the U.S. economic outlook, Fed Chairman Jerome Powell stated that the U.S. economy is operating well and has a robust labor market. Inflation in the United States did not rise further in the first quarter.

Uncertain if inflation will continue, Powell hinted that raising interest rates might not be the next step, but they are likely to remain steady.

u.today

u.today