Metaplanet, a famous publicly traded investment company in Japan with a market capitalization of 3.7 billion dollars, revealed this morning that it has bought Bitcoin as a form of value reserve following market turbulence in the yen market.

By doing so, the Japanese giant, scared of an imminent fiscal crisis, followed in the footsteps of the American company Microstrategy, adding 117.7 Bitcoin to its balance sheet.

the company has also drafted and published a whitepaper explaining the reasons behind this move. All the details below.

Summary

Metaplanet, a publicly traded company in Japan, adopts Bitcoin as a store of value

In Japan, the adoption of the Bitcoin standard continues after Metaplanet Inc., a major publicly traded investment company with a market capitalization of 3.7 billion dollars, recently revealed that it has purchased cryptographic coins worth 7.2 million dollars.

The aim of Metaplanet is to protect its financial and tax situation with a reserve asset like Bitcoin from potential market turbulence related to the devaluation of the yen.

The Japanese company itself revealed it in a press release in which it explained its own position and investment strategy, releasing a sort of “whitepaper”.

NEW: 🇯🇵 Japanese public company Metaplanet released a white paper on their #Bitcoin corporate treasury strategy.

— Bitcoin Magazine (@BitcoinMagazine) May 13, 2024

Game theory has started playing out 🙌 pic.twitter.com/yb0oepHXhR

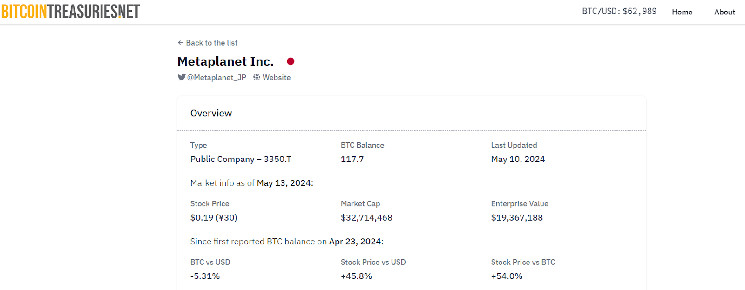

According to the data from Bitcointreasuries.net, Metaplanet started accumulating Bitcoin in April, reaching a total of 117.7 BTC as of May 10, 2024.

In this way, the investment giant in Japan has reached the 31st position in the ranking of listed companies with the most Bitcoin on their balance sheet worldwide, behind The Brooker Group and Banxa Holdings, with 122.3 and 126 BTC respectively.

At the top of the ranking we obviously find Microstrategy with 214,278 BTC for a value of over 24.4 billion dollars.

The strategic move by Metaplanet could gain momentum in the coming months if the internal situation in Japan becomes more concerning. In that case, we can expect a DCA plan from the company.

The same praised the cryptocurrency Bitcoin in its presentation to the group’s stakeholders, writing the following:

“Bitcoin’s monetary policy is rigidly set in stone until 2140, distinguishing it from both monetary metals and competing cryptographic projects managed at the whims of centralized developer teams. There will always and only be 21,000,000 bitcoins.”

Apparently, the characteristic of cryptocurrency that seems to interest society the most is its ability to act as a store of value asset, similar to what is done by physical gold.

It is also interesting the possibility of holding in the portfolio a solid currency that can act as a “tax loss asset“, potentially usable to realize future gains if necessary.

Basically, Metaplanet plans to hold bitcoin long term to ensure minimally realized taxable gains, thus being able to acquire more bitcoin over time by issuing yen liabilities when the opportunity arises.

The weakening of the yen leads many banks and investment companies to consider exposure to Bitcoin

The need to invest in a store of value asset like Bitcoin by Metaplanet is justified by a difficult economic situation in Japan, where we find high levels of public debt, prolonged periods of negative real interest rates and consequently a weak yen.

As reported by Reuters in a recent article published on April 26, Japan is facing one of the harshest financial crises of the last century, with a public debt to GDP ratio reaching 254.6% (International Monetary Fund data).

To make a comparison, the United States, also facing a difficult situation, has a debt/GDP ratio of 123%.

All this has helped push down the Japanese yen quotes to its lowest level in the last 34 years.

The last time the yen reached such levels against the dollar was in May 1990.

In January 2012, the Japanese currency had a value double compared to the current one, with the USD/JPY ratio showing 77.5 dollars while today it is around 155 dollars.

The USD-JPY exchange rate reached its multi-decade high after the Japanese central bank kept the treasury bond yields stable at the end of April, without hinting at possible cuts by the end of the year.

With inflation data showing no signs of easing, the Bank of Japan (BOJ) has been unable to raise interest rates given the extremely high levels of public debt.

In short, Japan is unable to stop the fall of the yen, nor to stop the rise in yields, as reiterated by Robin Brooks, former Chief FX Strategist at Goldman Sachs.

The Yen is in free-fall and markets wonder if there's a red line. There isn't. The red line that exists is on 10-year JGB yield, which can't rise as this would cause a fiscal crisis. Japan can't simultaneously stabilize Yen and cap yields. Japan's debt put it in a terrible place. pic.twitter.com/27FanuhCiF

— Robin Brooks (@robin_j_brooks) April 28, 2024

The situation, in addition to weakening the yen which is one of the top 5 world reserve currencies, increases the costs of debt maintenance leading to heavy fiscal issues.

As stated by Metaplanet in its press release announcing the investment in Bitcoin as a store of value:

“While the yen continues to weaken, Bitcoin offers a non-sovereign store of value that has and can continue to appreciate compared to traditional legal currencies. The BOJ’s strategy of keeping rates low by intervening in the FX markets represents an unsustainable monetary paradox.”

en.cryptonomist.ch

en.cryptonomist.ch