As Glassnode observes, the robust macro trend, bullish for Bitcoin, has tapered volatility, helping maintain the uptrend. The increasingly shallow corrections, as the blockchain analytics platform notes, point to a more mature market backed by more institutions.

Whales Accumulating As Institutions Eye $BTC

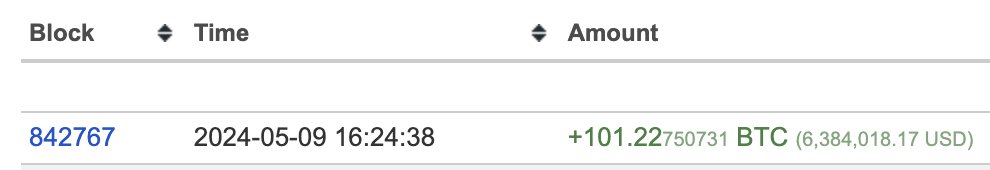

Confidence remains high. On-chain data reveals that one whale has taken advantage of the relatively low prices and the correction to stack coins.

In the last week, the whale bought over 100 $BTC, pushing the amount of coins bought this month to over 7,257 $BTC. This aggressive accumulation suggests that the whale, even at the current multi-year high, Bitcoin could be undervalued.

There could be more Bitcoin tailwinds incoming. For instance, this week, former United States president Donald Trump started accepting crypto donations in the ongoing campaign. This shift of stance has been bullish since Trump dismissed Bitcoin earlier.

While this happens, European regulators appear open to approving Bitcoin as an investable asset within Undertakings for Collective Investment in Transferable Securities (UCITS) funds. If this goes through, it could unlock more billions into Bitcoin from European institutions.

This move is massive, considering that banking giants like Morgan Stanley and BNP Paribas are already exploring ways for their clients to invest in $BTC.

Related Reading: Bitcoin Short Term NUPL Value Turns Negative, What This Means For Price

From a macro level, therising M2 money supply in the United States amid concerns from the United States Federal Reserve that inflation is high might further buoy Bitcoin demand. $BTC, like gold, is considered a safe haven, a hedge against inflation since its supply is designed to be deflationary.

newsbtc.com

newsbtc.com