-

Bitcoin rebound spurs demand for out-of-the-money calls at strikes from $70,000 to $100,000.

-

Analysts said the path of least resistance for bitcoin is on the higher side.

Bitcoin's (BTC) renewed price upswing has options traders reconsidering the possibility of the cryptocurrency reaching the $100,000 level at some point this year.

The leading cryptocurrency by market value has risen over 12% to $63,470 since Federal Reserve Chairman Jerome Powell ruled out additional tightening or rate hikes as the next policy move last Wednesday, CoinDesk data show. Friday's disappointing U.S. nonfarm payrolls (NFP) data validated Powell's stance, accelerating BTC's recovery.

As such, there has been a notable increase in demand for bitcoin call options on leading cryptocurrency exchange Deribit and over-the-counter (OTC) networks. These options are specifically targeting a rally to new highs, potentially surpassing $75,000 and even reaching $100,000.

"We are seeing some bullish follow-through in volatility and rates following the reversal bounce from Friday and into the weekend. BTC risk reversals have gone positive (calls more expensive than puts), and [there has been a] renewed demand for BTC Sep expiry $75,000 and $100,000 calls," QCP Capital said in a note on Monday.

A call option gives the right to purchase the underlying asset at a predetermined price on or before a specific date. A call buyer is implicitly bullish on the market and a put option buyer is bearish.

OTC institutional cryptocurrency trading network Paradigm made a similar observation Monday, stating increased demand for out-of-the-money (OTM) calls or those at strikes well above BTC's going market rate.

"The options market seemed to anticipate a short-term leg higher up earlier this morning with top BTC and ETH trades on Paradigm consisting of OTM calls bought in size. We noticed the previous March 25 [expiry] $200,000 call buyer closing his position to buy the July 2024 [expiry] $85,000 strike," Paradigm said in a Telegram broadcast.

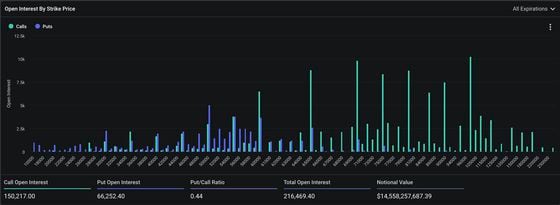

Data from Deribit show traders have locked in over $688 million in the $100,000 strike call options across different maturities. That's the highest notional open interest among all options listed on the exchange.

As of writing, more than 150,000 call option contracts worth $9.5 billion were active on Deribit. That's more than two times the open interest in put options, a sign of bullish market expectations.

Notional open interest refers to the dollar value locked in the number of active or open contracts. On Deribit, one options contract represents one BTC or one ether (ETH).

Analysts bullish on BTC

Both fundamental and technical analysts are again coalesced around on the idea that the path of least resistance for bitcoin is on the higher side.

"Bitcoin continues to be supported by the U.S. election cycle and ongoing deficit spending. This is why we have adjusted our 'line in the sand' from 68,300 to 62,000 in our report from May 3 — the market could trade (tactically) bullish above 62,000," 10X Research said.

Siwssblock Insights expects the dollar index (DXY) to remain defensive unless Powell's stance is challenged. A weaker DXY is usually good for risk assets, including cryptocurrencies.The DXY has declined by 1.2% to 105.20 since Wednesday's Federal Reserve meeting.

"The dollar's weaker position is likely to persist as long aseconomic data remains supportive of that direction and as long as Federal Reserve officials don't counter Powell's stance. The labor market is showing signs of loosening, but more hawkish Fed voices could still push for keeping rates higher for longer, which may impact the dollar's trajectory," Swissblock Insights latest newsletter said.

Meanwhile, Elliot wave analysis by John Glover, chief investment officer of Ledn, suggests bitcoin's could rise to 92,000.

‘The BTC price action continues to track my expected path for Wave 4 as can be seen in the chart below. Although the dip to $56.5k may have completed the correction, I still expect to see a price of $52-55k before Wave 4 completes, 2/ Once the 4th wave is completed I expect that the Wave 5 push to circa $92k will ensue," Glover said in an email to CoinDesk.

Ralph Nelson Elliott introduced the Elliot wave theory in 1938 in his book The Wave Principle. The theory assumes that asset price movements can be predicted by observing and identifying a repetitive wave pattern.

Trends unfold in five waves, of which 1,3 and 5 are impulse waves, representing the primary trend, while 2 and 4 show temporary retracements of the preceding impulse waves.

coindesk.com

coindesk.com