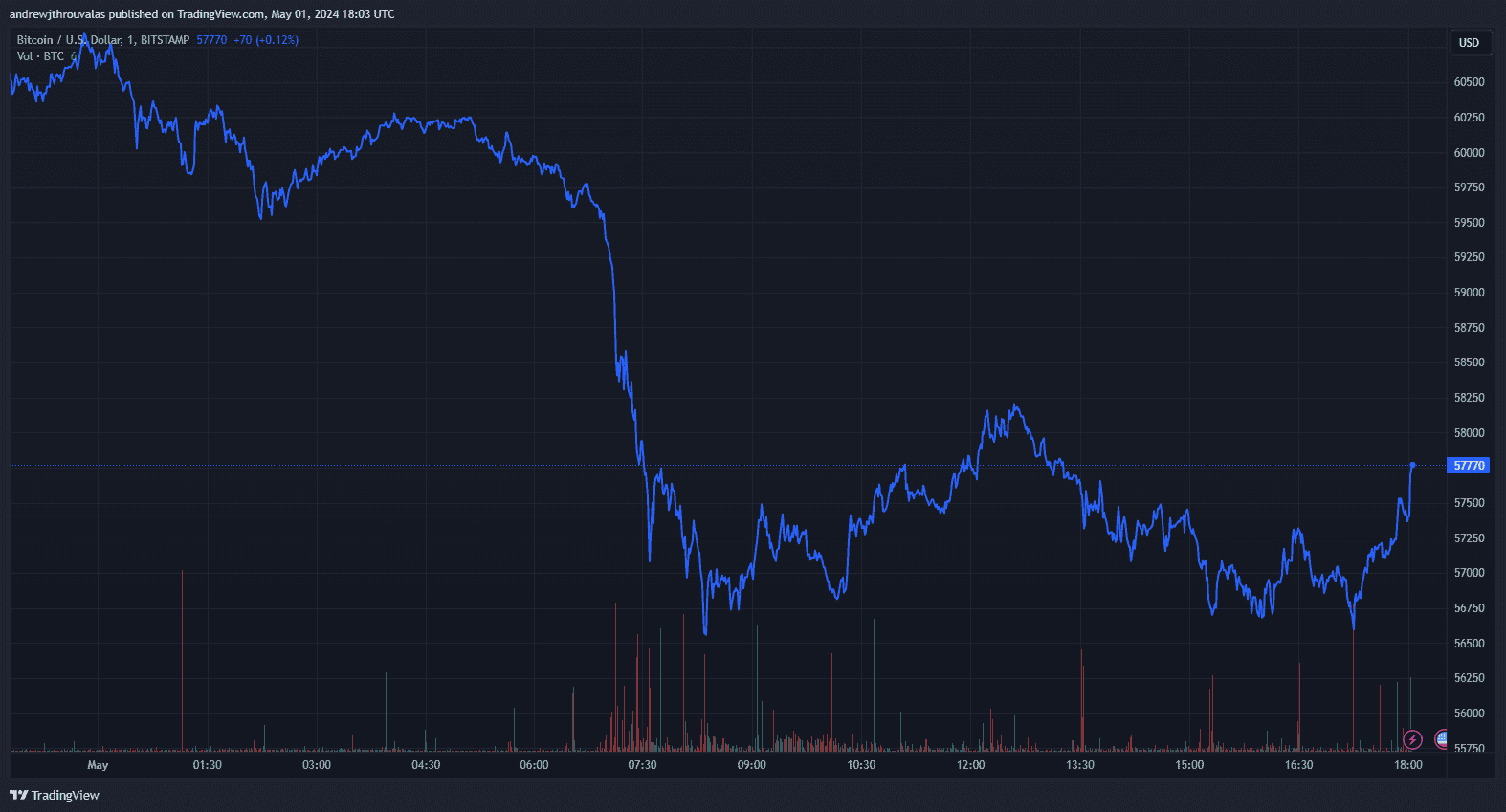

The Federal Reserve decided to maintain its benchmark interest rate of 5.25%% to 5.5% at the highly anticipated Federal Open Market Committee Meeting (FOMC) on Wednesday, following a fearsome 6% drawdown in Bitcoin’s price earlier that day.

Within five minutes of the announcement, Bitcoin’s price rose from $57,300 to $57,700

- Per a press release, the central bank said it also plans to slow down the rate at which it sells US Treasury securities starting in June, reducing its monthly redemption cap from $60 billion to $25 billion.

- Market participants overwhelmingly expected the Fed to maintain its interest rate at 5.25% heading into the meeting, expecting cuts to potentially take off in Q4.

- However, words from the central bank confirmed market fears that the central bank may have to keep rates higher for longer to quell nationwide price inflation, which remains stubbornly above 3%.

- “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” the Fed wrote.

- The economy also remains surprisingly resilient: data compiled by Bloomberg Intelligence suggests that 81% of S&P 500 companies that have filed their Q1 earnings have beaten their first-quarter expectations.

- Bitcoin’s price is known to be influenced by central bank policy and macroeconomic liquidity conditions.

Some analysts like BitMEX co-founder Arthur Hayes believe BTC will continue to surge past $100,000 as central bank balance sheets continue to expand.

cryptopotato.com

cryptopotato.com