As the Bitcoin (BTC) community anticipates the upcoming halving event, cryptocurrency whale behavior – investors holding large amounts of Bitcoin – has been intensely scrutinized.

Analysts and market observers are keen to understand how these major players are positioning themselves ahead of a milestone that historically impacts Bitcoin’s price and market dynamics.

Despite Bearish Conditions, Whales are Buying

Recent data from blockchain analytics platforms like CryptoQuant and Santiment reveals a notable shift in whale activity. According to a tweet from CryptoQuant, there has been an increase in Bitcoin accumulation by whales, suggesting a bullish outlook from those anticipating the supply squeeze post-halving.

Bitcoin inflows to accumulation addresses hit a new all-time high on April 18.

“Bitcoin inflows to the Accumulation Addresses hit a new all-time high of 27.7k BTC yesterday,” CryptoQuant noted.

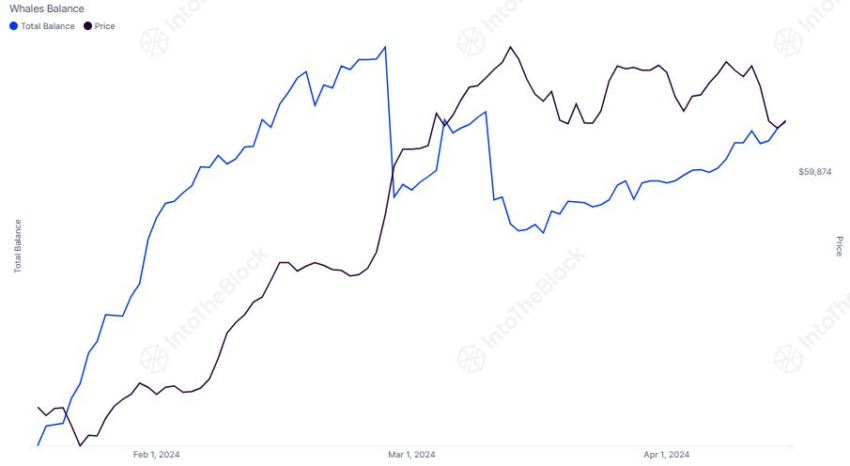

IntoTheBlock provides further insights, showing that large-scale holders (1,000 BTC+) have upped their holdings by 16,300 BTC in the last seven days – equating to $1 billion at the current price. However, the biggest whales are yet to start buying.

“The biggest whales, holding at least 0.1% of the supply, haven’t started accumulating and even decreased their holdings slightly yesterday,” IntoTheBlock noted.

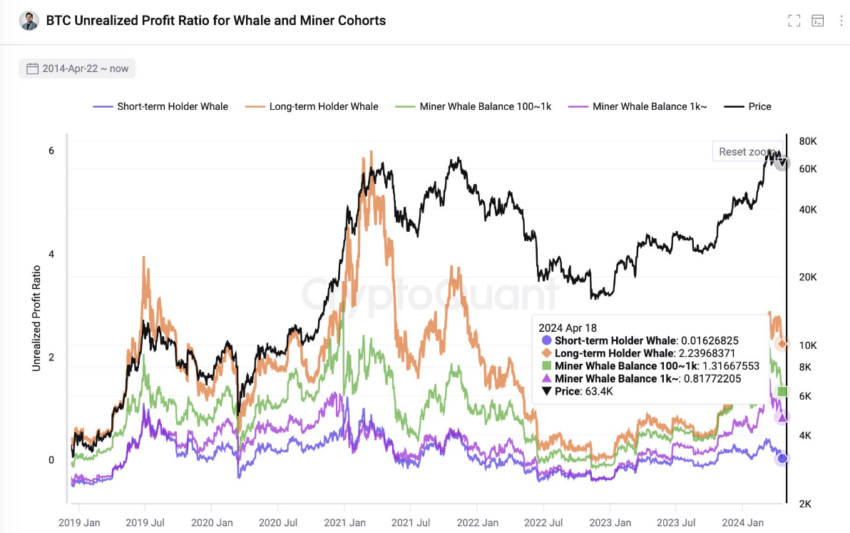

Ki Young Ju, CEO of CryptoQuant, tweeted that the historical pattern of increased holding periods around halvings suggests a strong holder sentiment. This behavior aligns with the general expectation that reduced supply, due to the halving and sustained or increased demand, will drive up prices. Ju notes that unrealized profits for on-chain cohorts, specifically miners and whales, remain positive.

“Not enough profit to end this cycle, imo.” Ju concluded.

Over-Skepticism by Bears Might Lead to Market Recovery Soon

Similarly, Santiment’s analysis indicates that the general consensus remains bearish despite Bitcoin reaching $63,800 as of April 18. However, Santiment notes this could be considered a sign of a potential recovery.

“The crowd has maintained a consistently bearish sentiment toward top caps, which strengthens the argument for more rising.” Santiment stated.

Observers view the Bitcoin halving event, which reduces the reward for mining new blocks by half, as a deflationary mechanism that decreases the available new supply of Bitcoin.

With past halvings, this event has led to considerable bullish runs in the months following the adjustment. Investors and analysts alike speculate that this year’s event may follow a similar pattern, although the extent of the impact remains to be seen.

Read More: What Happened at the Last Bitcoin Halving? Predictions for 2024

As the halving draws nearer, both seasoned traders and casual observers will continue to focus on the activities of Bitcoin whales. Their movements offer clues about potential market directions and sentiment. Which sets the tone for smaller investors looking to navigate the shifts in the cryptocurrency landscape.

beincrypto.com

beincrypto.com