According to the latest data, we are now less than 1,400 blocks away from the anticipated Bitcoin halving event, which will decrease the block reward from 6.25 bitcoin to 3.125 bitcoin. Bitcoin’s value soared to a new all-time high on March 14, reaching $73,794 per bitcoin, but has since seen a 6.5% decline. Observers are now eagerly awaiting the outcome of the upcoming reward halving, wondering what the future holds for bitcoin’s valuation.

Tik Tok – Next Block

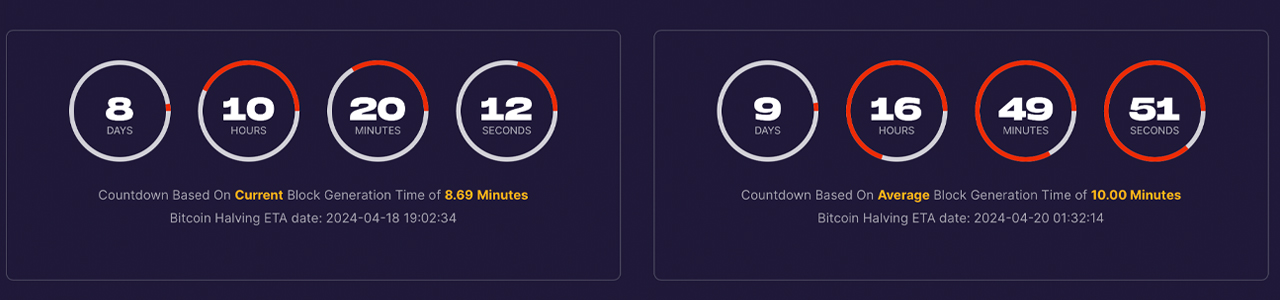

Lately, bitcoin’s (BTC) price has remained steady, fluctuating between $65,000 and $71,000. Impressively, 2024 has outdone the 2021 milestone by sustaining its value over the $60,000 mark for 42 straight days, eclipsing the earlier record of 40 non-consecutive days. Currently, at block height 838,601, there are precisely 1,399 blocks remaining until we reach block height 840,000, also known as the significant halving event. Upon reaching block 840,000, the fortunate miner that discovers that block will be rewarded with a total of 3.125 newly minted BTC.

The valuation of bitcoin has taken on a distinct narrative compared to its position in 2012, 2016, and even 2020. Typically, the exponential climbs in BTC’s value have been observed following previous halving events. Yet, over the last year, BTC has witnessed a 144% appreciation against the U.S. dollar. Contrary to the periods before the last two halvings, when Grayscale’s GBTC was the primary exchange-traded product absorbing the bitcoin supply, now there are ten additional products from major financial entities participating in the market. Beyond exchange-traded funds, BTC is now being accumulated by publicly traded companies like Microstrategy and Tesla, and even a Latin American nation.

In the lead-up to the previous halvings, BTC’s price levels were not hovering near record peaks. Even though BTC has seen a 6.5% decline from its recent peak, almost 90% of its holders are currently in a profitable position. This indicates that many investors who entered the market at the peak in 2021 have found opportunities to exit at or near breakeven, or even secure a profit. In contrast to previous halvings where bitcoin miners tended to sell off their BTC in anticipation of the event, this cycle shows miners retaining their bitcoin holdings. According to Cryptoquant data, miner reserves have remained fairly consistent over the past month as we approach the fourth halving.

As the fourth Bitcoin halving event draws near, the crypto community stands on the brink of a potential paradigm shift. With the market exhibiting unprecedented stability and a broader acceptance of BTC across diverse sectors, the forthcoming reduction in block rewards represents more than just a technical adjustment. It could catalyze a further maturation of bitcoin’s market dynamics, influencing not only the strategies of miners and institutional investors but also the overall perception and utility of BTC in the global financial landscape. Amidst this backdrop, the resilience and adaptability of the blockchain’s scaling will be crucial in determining its trajectory in the post-halving era.

What do you think about the upcoming Bitcoin halving? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com