Bitcoin whales are always continuing several major corrections of the asset’s price. As the price continues to plunge, whales are continuing to purchase the dip. Ultimately, these investors are the centre of attention this week as the price actions plit its BTC’s narrative. When it comes about bullish bets in the BTC market, deliver the data from show derivatives investors leading the way. Notably, a classic bullish rally forecasting the metric has shown bullish signals while the whales are looking into exposure to the US FED this week.

BTC price indicators shows bullish signals

Analysts have noted that in the second half of the last month, BTC had witnessed a marked uptick in the buy/sell ratio on major crypto assets exchange platforms. Following the scenario, Cole Gamer, a contributing analyst noted that the actions are a pure sign that Bitcoin price would react positively in the small time-frame. According to the analyst, the ratio on Deribit derivatives exchange seems a sick leading indicator.

The researchers have also noted that the signal shows a 30-day WMA. Indeed, strong signals towards a bull rally have preceded each of the positive sentiments of this bull, hence ultimately they have printed a monster bull move.

Bitcoin whales have missed no opportunities

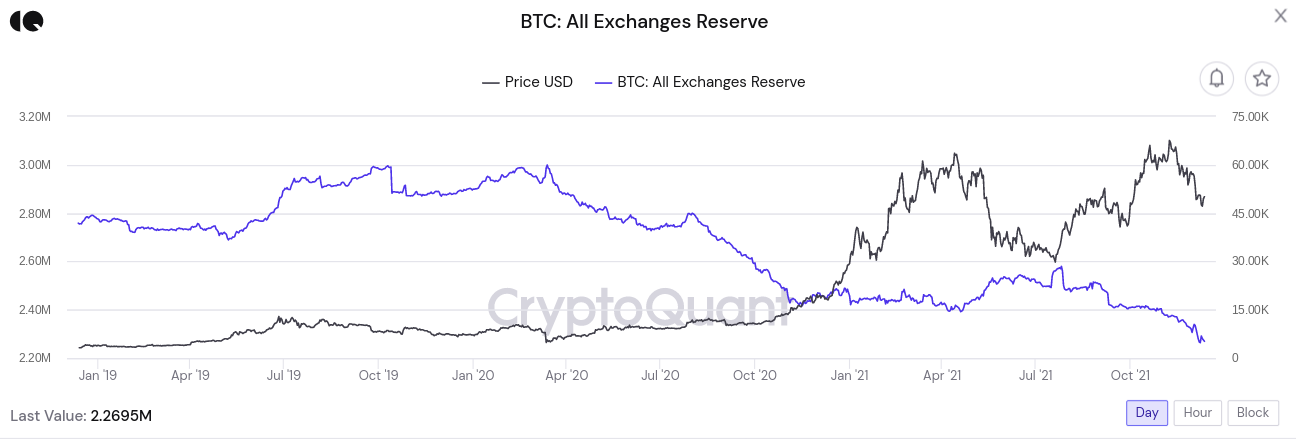

Besides the trends and signals, we have recently observed that Bitcoin whales are continuing to show interest throughout the price correction from the new ATH. According to researchers in the cryptosphere, digital asset’s exchange reserves are now more widely at their four-year low levels. Hence, the factor indicates that the crypto platform has less coins on their books in comparison to the last bull run of 2017.

Financial markets waits US FED’s signal

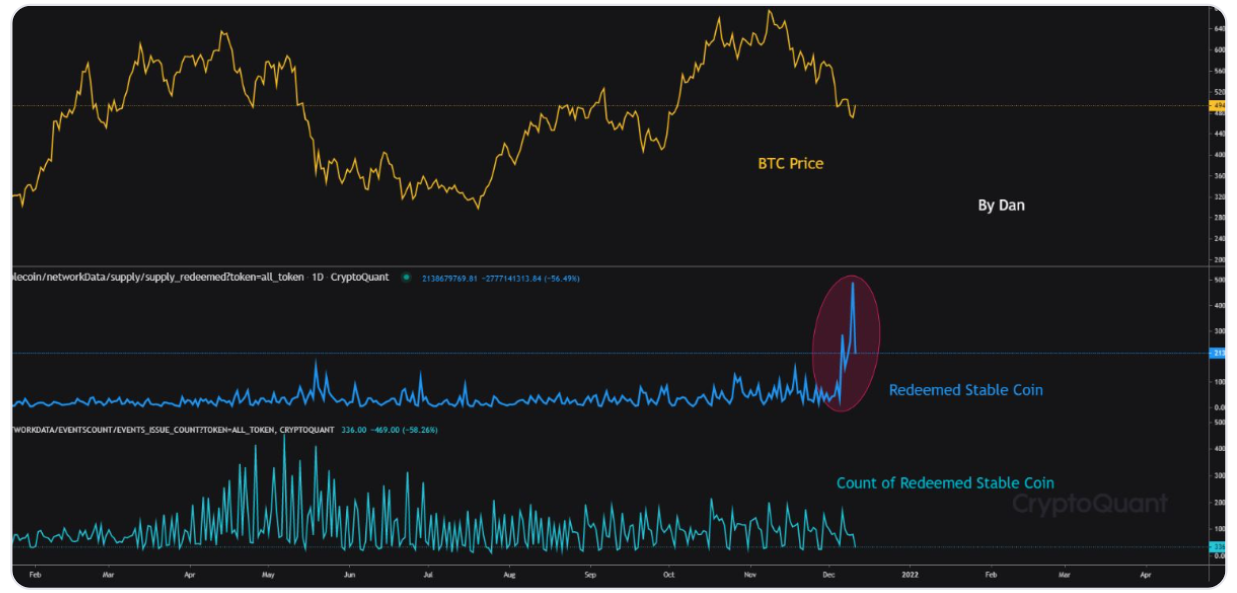

It has been observed that the flipside lies with the fiat-pegged stable crypto tokens. This week the US Federal Reserve will provide signals on the future of quantitative easing in the form of asset purchases. According to analysts, the signals would have consequences for traditional and cryptocurrency markets alike.

Furthermore, the researchers have highlighted that the Redeemed Stablecoin Index indicates a new ATH. However, it is not sure whether the Bitcoin whales are cashing out following the price volatility due to upcoming market FOMO. Although there is an uncertainty, analysts explained that so far Bitcoiners are still careful until some uncertainties would be resolved.

thecoinrepublic.com

thecoinrepublic.com