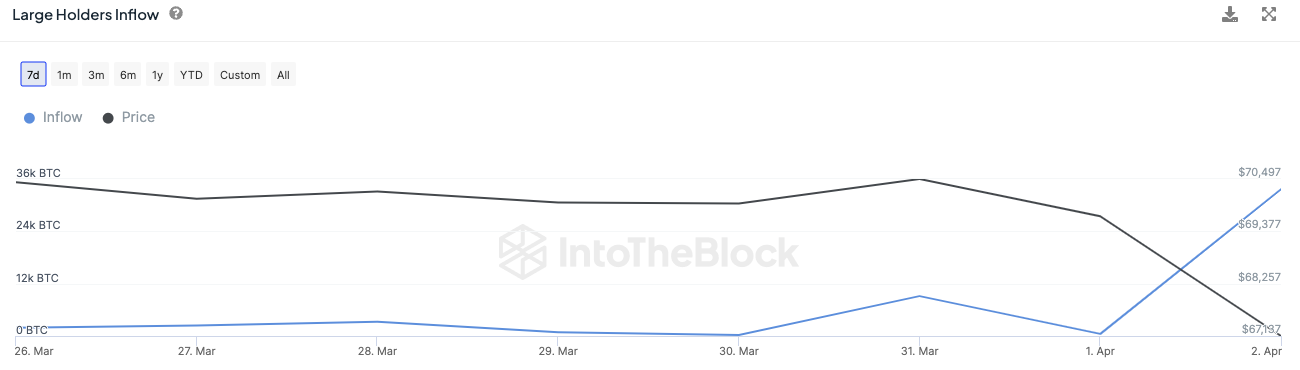

Data from IntoTheBlock's Large Holders Netflow metric has revealed a staggering surge in Bitcoin accumulation by whales during the recent market downturn. Wallets holding at least 0.1% of the total Bitcoin supply seized the opportunity to bolster their holdings by adding nearly 33,000 BTC to their stacks in a single day, translating to a whopping $2 billion investment.

Delving into the figures, the net flow of Bitcoin into the wallets of these large holders witnessed a remarkable turnaround. On April 1, outflows exceeded inflows by 3,530 BTC. However, by April 2, the tide had shifted dramatically, with a net inflow of 32,750 BTC into these whale addresses.

This surge marked a staggering 6,900% increase in Bitcoin flow, indicating what may be a significant shift in accumulation patterns among major investors.

Silk Road's Bitcoin on move

While some attributed this surge to market optimism and strategic accumulation, others offered a contrasting perspective. Thus, it was suggested that the sudden spike in Bitcoin movements could be linked to the U.S. government's actions regarding confiscated assets.

The Silk Road BTC address (linked to the US government) moved 2K $BTC ($131M) to Coinbase Prime and 29.8K $BTC ($1.95B) to a new address 1 hour ago.

— Spot On Chain (@spotonchain) April 2, 2024

This is likely an OTC deal and does not directly affect the BTC spot price, but BTC has dropped 4.6% in 24 hours.

They still hold… pic.twitter.com/XxZ5r9SYvP

Specifically, attention was drawn to the Silk Road BTC address, associated with U.S. authorities, which recently executed substantial transfers. Notably, 2,000 BTC, valued at $131 million, were sent to Coinbase Prime, while a significant sum of 29,800 BTC, worth $1.95 billion, was relocated to a new address.

Although these transactions are likely part of an over-the-counter (OTC) deal and may not directly influence spot prices, they coincide with a decline in BTC value over the past 24 hours.

u.today

u.today