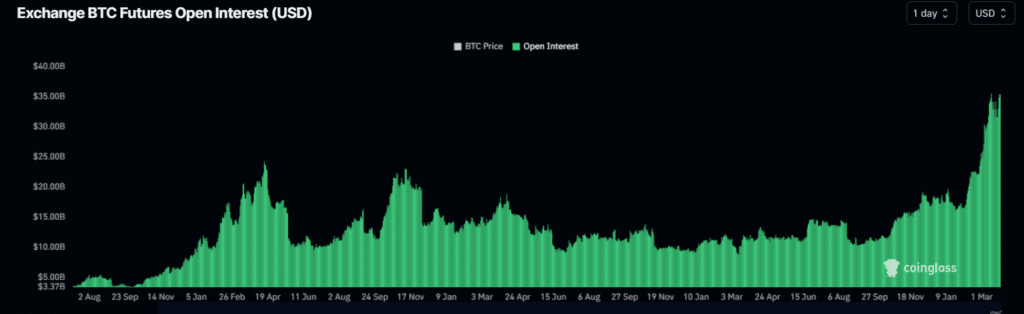

Bitcoin futures open interest surged to over $38 billion today, as BTC price increased 10% over the week.

The surge reflects growing investor interest and speculative activity around Bitcoin’s future price movements. Binance, the world’s leading cryptocurrency exchange, reported its highest BTC open interest to date, at $8.4 billion.

Record-setting open interest in Bitcoin futures comes as $15.1 billion worth of Bitcoin and Ethereum options are set to expire, potentially leading to increased volatility. Options expirations often trigger significant price movements as traders adjust their positions, and the large value of expiring contracts today suggests potential for notable market activity.

The rise in futures open interest coincides with the substantial options expiry, indicating heightened trading enthusiasm and speculation. Investors and traders are keenly watching the market’s reaction to these developments.

Significant open interest in futures contracts shows that many are betting on Bitcoin’s future price direction. The massive options expiry could lead to short-term price fluctuations as contracts settle, which is critical for both retail and institutional investors engaged in the cryptocurrency market.

Read more: Dogwifhat becomes 3rd largest meme coin in market capitalization