-

Bitcoin

(BTC) has powerfully reclaimed the $70,000 psychological barrier, signaling a potential bullish breakout. - The surge comes after BTC consolidated above $65,000, indicating strong underlying support.

- “This move could have significant implications for Bitcoin’s trajectory and might ignite further gains,” says market analyst Alican Çınarbaş.

Stay ahead of the crypto market curve with this in-depth analysis of Bitcoin’s price action, potential drivers, and what to expect next.

Bitcoin Price Analysis: Bulls Take Control

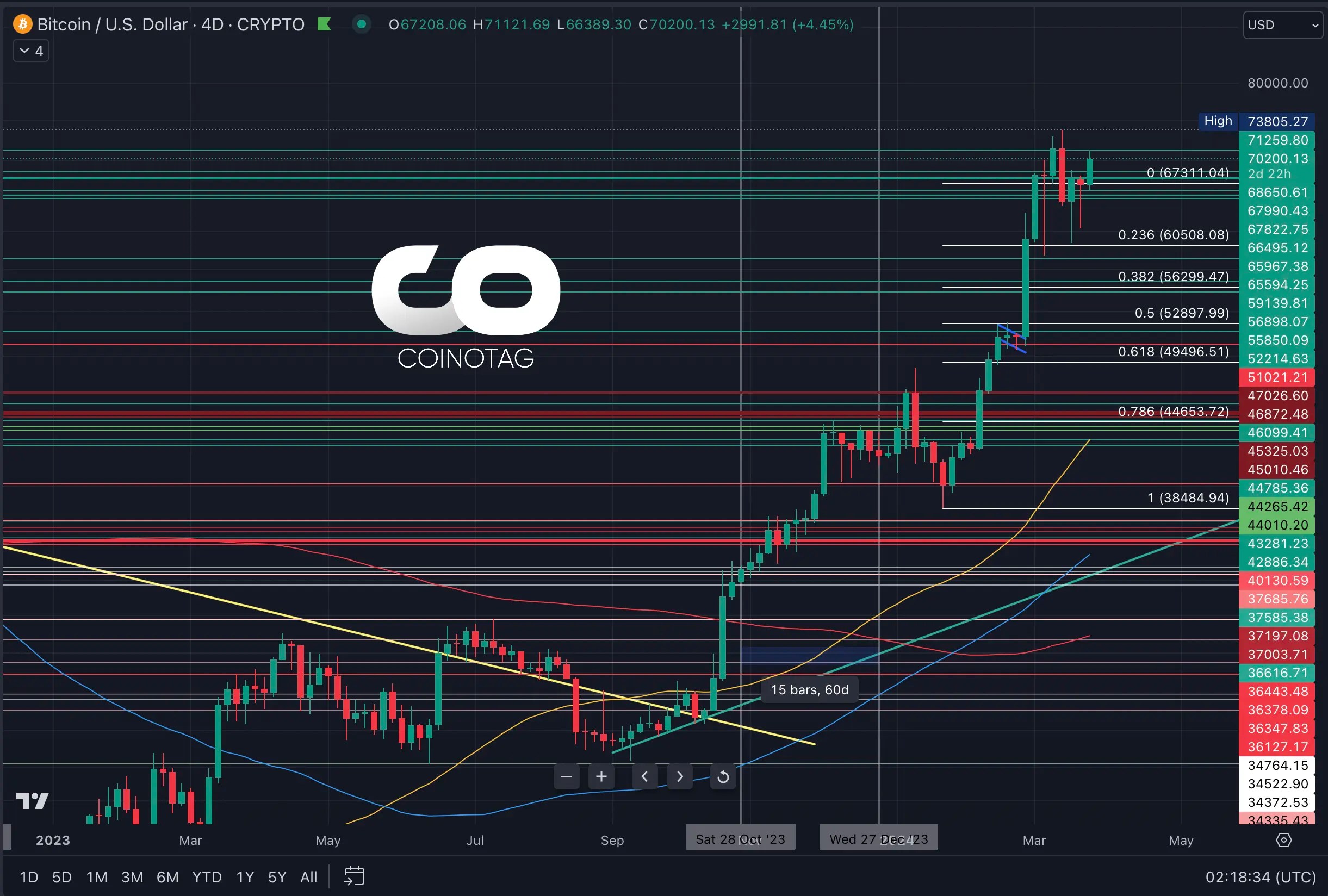

Bitcoin has decisively broken through the $70,000 resistance level, fueled by renewed bullish momentum. This follows a consolidation phase above $65,000, where BTC exhibited resilience and established a solid base for its upward trajectory. Technical indicators suggest that the rally could extend toward the $73,000 and $75,000 levels.

Key Technical Factors Behind the Surge

Several factors underpin Bitcoin’s bullish outlook:

* Moving Averages: BTC is trading comfortably above the 100-hour Simple Moving Average (SMA), a bullish sign.

* Trendline Support: A bullish trendline on the hourly chart near $67,500 offers immediate support.

* Fibonacci Retracement: The price has pulled back to the 23.6% Fibonacci retracement level, a potential launching pad for further gains.

Potential Upside and Downside Scenarios

Upside: A clear break above $71,200 could propel BTC to the next major resistance at $73,500, with a subsequent target of $75,000.

Downside: If BTC fails to hold above $70,000, it could slide towards support levels at $69,000 and $67,800 (trendline support). A breach of $67,800 might trigger further declines towards $66,800 and $65,500.

Conclusion

Bitcoin’s break above $70,000 strengthens its bullish narrative. While short-term volatility is expected, the overall market sentiment leans towards the upside. Investors should watch for key resistance levels and monitor technical indicators to gauge Bitcoin’s next move.