As the majority of assets in the cryptocurrency market are resuming their bullish move, the sector’s representative and its largest asset by market capitalization, Bitcoin (BTC), is no exception, and its advance could soon culminate with a new all-time high (ATH) peaking at $100,000.

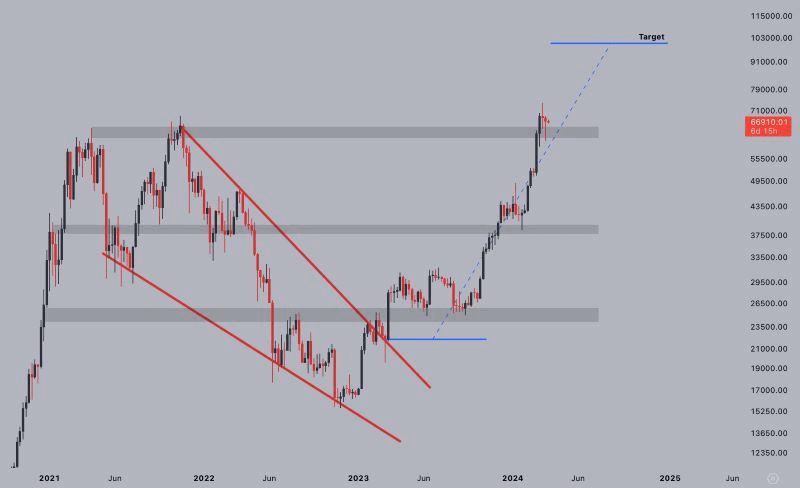

Specifically, Bitcoin closed last week above $65,000, which the maiden crypto asset has confirmed as support, and there are not many obstacles left on its way toward reaching the high target of $100,000, according to the analysis shared by pseudonymous crypto trading expert CryptoJelleNL on March 25.

Bitcoin price prediction 2024

Indeed, if the crypto expert’s observations are correct, it means that Bitcoin could enter the predicted range in the next few months, possibly in July or August 2024, aided by the anticipation of the upcoming halving, as well as the continued optimistic sentiment beyond it.

As the analyst added:

“Patience remains the name of the game.”

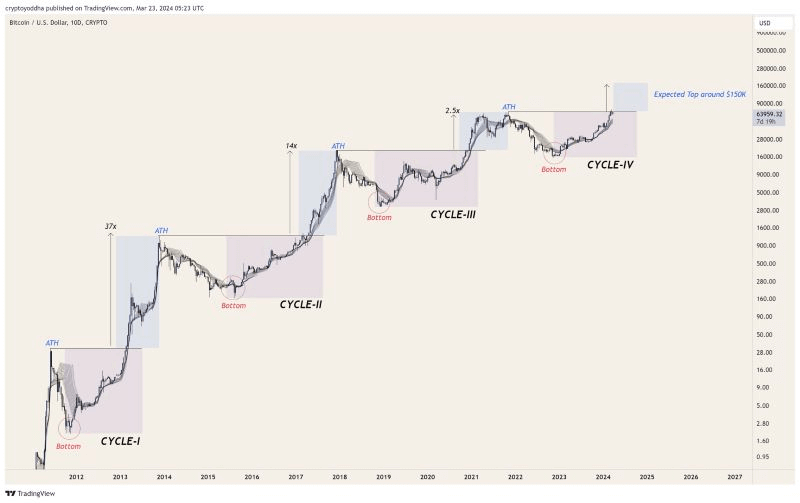

Earlier, another pseudonymous crypto analyst CryptoYoddha shared the Bitcoin price prediction that sees the “real pump” for Bitcoin to “start after the halving next month,” also attaching a chart pattern analysis that demonstrates its movements in each halving cycle, expecting it to hit $150,000 by 2025.

Furthermore, spot Bitcoin exchange-traded funds (BTC ETFs) have recorded the largest weekly negative net flows since inception, with Bitcoin outflows exceeding $800 million, whereas strategic whales took the opportunity to ‘buy the dip’ during the weekend, helping the bullish momentum.

Bitcoin price today

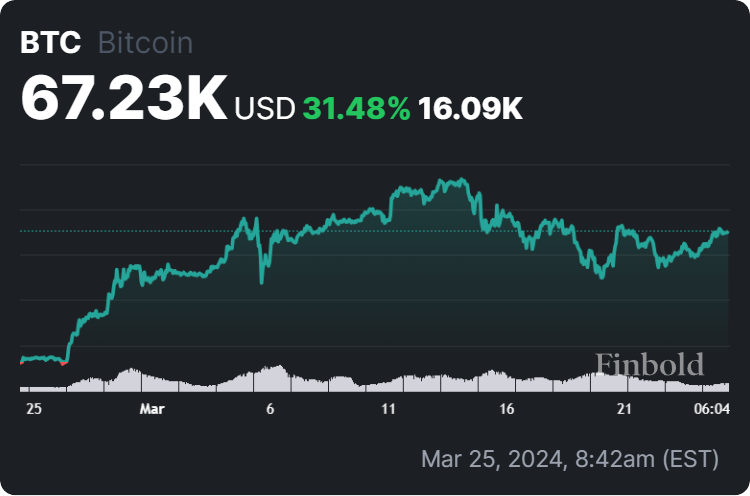

For now, Bitcoin is trading at the price of $67,230, suggesting a growth of 3.54% in the last 24 hours, having declined 0.29% across the previous seven days, and accumulating a gain of 31.48% on its monthly chart, according to the latest information retrieved on March 25.

It is also worth noting that this means that the flagship decentralized finance (DeFi) asset is in the clear after no longer trading below the critical $65,000 level, which crypto analyst Alan Santana previously noted would spell trouble and extended losses for Bitcoin.

All things considered, the experts’ Bitcoin price predictions may or may not materialize, although the fundamentals are looking exceptionally optimistic. Hence, it is important to do one’s own due diligence and research the asset before investing instead of relying exclusively on BTC price prediction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com