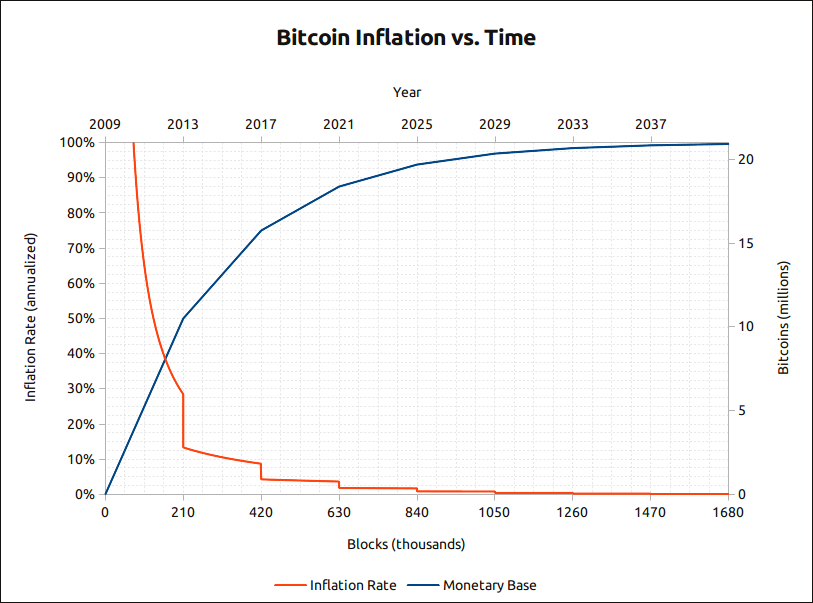

Per the most recent data, we are a month away, or precisely 30 days, from the fourth Bitcoin halving event. This significant milestone will cut the mining rewards from 6.25 bitcoins per block to 3.125 bitcoins per block after the halving. The summary below outlines the essentials to grasp the changes occurring during the halving, including the reduction of the inflation rate from an annual 1.69% to 0.84% subsequent to the event.

Bitcoin’s Reward Reduction Countdown

Within the Bitcoin network, miners embark on a quest to discover blocks, aiming to earn rewards and accumulate the fees linked to the transactions within those blocks. For their efforts, they are presently awarded 6.25 BTC in addition to transaction fees, which also serve to validate the transfers conducted across the decentralized network.

From 2009 to 2012, miners were awarded 50 BTC for every block they uncovered. Following this period, a halving event reduced the reward to 25 BTC per block. Embedded within the Bitcoin protocol is a halving mechanism, a core component of its mining ruleset.

Similarly, the network’s mining difficulty adjusts every 2,016 blocks, or approximately every two weeks, while the halving events are scheduled to occur every 210,000 blocks or roughly every four years. After the upcoming halving, this cycle will persist for each set of 210,000 blocks, gradually decreasing the reward to 0.00152587 BTC by 2068.

This year, the reward will drop from 6.25 BTC to 3.125 BTC per block, followed by reductions to 1.5625 BTC by 2028, and to 0.78125 BTC by 2032. Currently, miners are diligently and tirelessly working to mine as many blocks as possible in the lead-up to the halving event, aiming to maximize their returns from the higher rewards available now.

The forthcoming reduction in the issuance of new bitcoins will decrease the network’s inflation rate from the existing 1.69% to 0.84%, significantly lowering the rate at which new BTC enters circulation. Among those most eager for the price of bitcoin to increase are the miners themselves, as their extensive efforts will see an automatic reduction in rewards, regardless of the scale of their operations.

A unique aspect of Bitcoin’s protocol is its reliance on blocks to measure time, providing a remarkably accurate forecast of when halving events and adjustments in mining difficulty will happen. The spacing of blocks further allows for an assessment and measurement of the overall hashrate of the network.

The anticipated halving is set to take place at block 840,000, with the current count standing at 835,447 at the moment this editorial was drafted. Halving events have no direct impact on the average user, as their influence is strictly confined to altering the rewards received by bitcoin miners.

Additionally, these events adjust the rate at which new bitcoins are introduced into circulation. Beyond this, changes in the fee market are subject to the decisions of market participants, same with onchain scaling, adoption rates, and ultimately, the market will dictate the price. These fundamental elements will collectively shape the future value of both the subsidy and transaction fees for miners.

What do you think about Bitcoin’s upcoming fourth halving event? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com